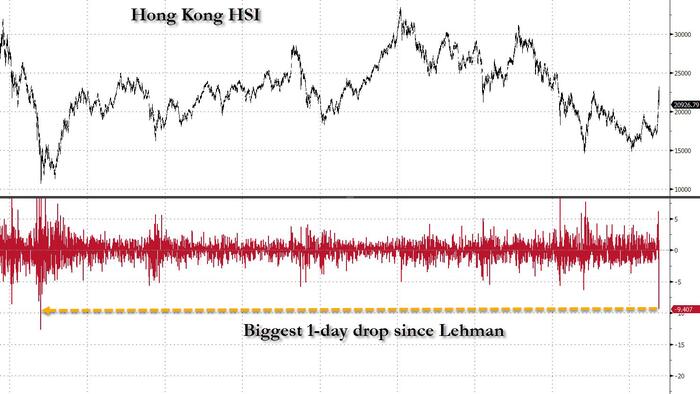

In recent commentary regarding Goldman Sachs’ upgrade of China’s market to “Overweight,” it was pointed out that such a move followed a significant 30% rally, leading to speculation that China’s upward momentum may have peaked. This alignment with Goldman Sachs’ trading desk reflects a broader analysis suggesting that without immediate quantitative easing (QE) from Beijing, the market could face a more severe downturn in the coming year. The reopening of China’s A-shares from a week-long holiday highlighted this scenario, as gains were quickly reversed, with Hong Kong markets experiencing sharp declines—the worst performance since the Lehman Brothers collapse in 2008. The adverse market response can be attributed to investor disappointment following an NDRC press conference that failed to provide substantial details regarding anticipated stimulus measures.

As trading resumed in A-shares, there was an observable split between markets—while A-shares initially surged, they later cooled down, closing with modest gains. In stark contrast, Hong Kong markets saw their most significant sell-off in over a decade, with major indices suffering double-digit losses. This disconnection signifies a potential rotation of capital from Hong Kong shares into A-shares, as mainland investors may have begun perceiving value amid the aggressive sell-off. Despite the broad swath of losses in Hong Kong, the A-share market recorded record trading volume and substantial turnover, indicating immense investor activity, arguably driven by profit-taking and strategic repositioning.

The NDRC conference, which many anticipated would unveil substantial stimulus measures, fell short, focusing instead on reiterating previous pledges without offering actionable fiscal details. The modest announcements, including front-loading a limited amount of strategic investment projects, left investors wanting more substantial commitments in light of high expectations for stimulus to bolster the economy. Goldman Sachs conveyed a perspective that any significant stimulus initiatives would require collaboration among various ministries and may rely heavily on fiscal resources. The trading behavior reflected this sentiment, as investors shifted their focus towards sectors that could benefit from policy support, attempting to capitalize on the government’s evolving rhetoric regarding economic stabilization.

Additionally, there are broader implications regarding retail investor behavior and its influence on market momentum. Reports indicate that authorities are growing wary of speculative behavior among retail investors, reminiscent of the frenzied market conditions experienced in 2014 and 2015. Such caution could impact how forthcoming stimulus measures are rolled out, as the government may consider the potential volatility linked to rising retail activity within the stock market. The shift in the tone from policymakers could indicate a more measured approach moving forward, particularly as retail traders who opened new accounts during the National Day holidays were still awaiting their first trading opportunities.

In the immediate landscape, market participants now look toward upcoming events and discussions that may catalyze renewed interest in stimulus. Attention is particularly focused on potential joint meetings among key ministries and the National People’s Congress (NPC) standing committee meeting scheduled for late October or early November, which could finalize the fiscal budget. Goldman’s traders, particularly William Chan, acknowledge the need for caution amid profit-taking but also indicate that while the sharp rally could have concluded, it is premature to abandon the China trade entirely.

In conclusion, while Goldman Sachs’ recent upgrade positions China’s market favorably, it comes with an acknowledgment of a ‘bubble’ dynamic that hasn’t fully matured, as widespread retail involvement is still on the horizon. The current situation highlights a market characterized by both exuberance and trepidation, with investors anxiously awaiting further clarity on government interventions and fiscal policies. As the economic landscape evolves, stakeholders remain watchful for indicators of sustained recovery or the onset of deeper financial challenges, particularly in light of recent trading activity and government stances.