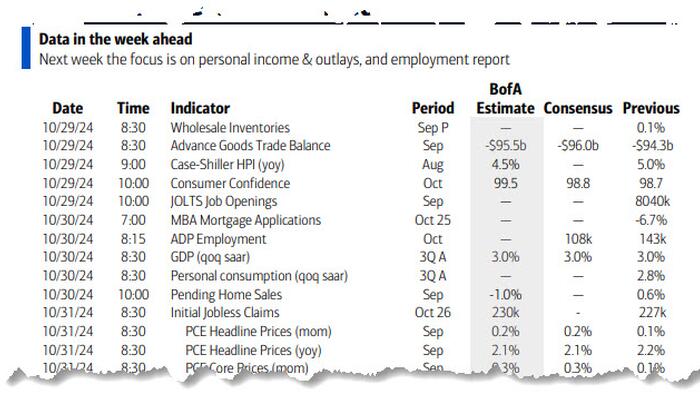

The upcoming two-week period is marked by an intense flurry of economic indicators and events, including earnings reports, payroll data, and pivotal elections, which could heavily influence market dynamics. Recent market activity has shown a slight hiccup, notably with the S&P 500 index experiencing a dip after six consecutive weeks of growth. This downturn was coupled with a persistent sell-off in the bond market, where the yield on 10-year Treasury notes reaches notable highs, driven by ongoing concerns about U.S. fiscal deficits and hesitance regarding swift rate cuts from the Federal Reserve. With upcoming reports on U.S. payrolls, GDP, and PCE inflation, market participants are bracing for potential volatility as investors navigate these critical indicators along with a contentious election campaign.

Geopolitical tensions in the Middle East are easing following targeted Israeli airstrikes on Iranian military facilities, removing some of the risk premiums previously factored into energy markets. As a result, Brent crude oil prices have dropped significantly, and U.S. equity futures show positive movements. The bond market remains under pressure, yet yields have started to reverse slightly after peaking. Despite these fluctuations, the overall market sentiment appears more optimistic in light of reduced geopolitical tensions, which is reflected by declining gold prices and rising stock futures.

In the realm of labor reports, significant attention is anticipated around the upcoming payroll data, with projections pointing to a notable slowdown. Economists forecast the addition of approximately 110,000 jobs in October, a stark decrease from the previous month’s figures. This anticipated decline is partly attributed to the impact of strikes—particularly from Boeing—as well as adverse weather events. In contrast, the average hourly earnings are expected to show slight growth, while unemployment rates are likely to remain stable. The release of the JOLTS report and the Employment Cost Index will also shed light on the labor market’s dynamics, providing further context for employment trends and wage pressures.

Beyond the U.S., other significant economic data releases are set to be unveiled, including figures regarding inflation in the euro area and GDP growth therein. The European Central Bank will also be closely watched as it navigates its monetary policy in this context. Observers anticipate a modest increase in headline inflation in the eurozone, while core inflation is expected to show signs of slowing. In the U.K., the first major budget under the Labour Government in nearly 15 years is drawing attention, particularly concerning policies aimed to redefine national debt metrics.

Asia will see its own set of important events, including the Bank of Japan’s anticipated monetary policy decisions and key PMI readings from China. These figures will be scrutinized for indications of how effective recent stimulus measures have been in stabilizing economic growth. With ongoing global economic uncertainties and shifting fiscal policies in key regions, these developments will be pivotal in shaping market sentiment and forecasts for future growth.

Finally, the U.S. presidential election looms, with early voting already surpassing 40 million ballots cast. Polling indicates a highly competitive race, with a narrow lead for Kamala Harris in national polls, while Donald Trump appears to have an edge in swing states. The upcoming election outcome is seen as a significant variable that could add to market volatility. All of the aforementioned factors, combined with a busy calendar of earnings for major tech companies, underscore the importance of the next two weeks for financial markets as they react to both domestic and international economic signals.