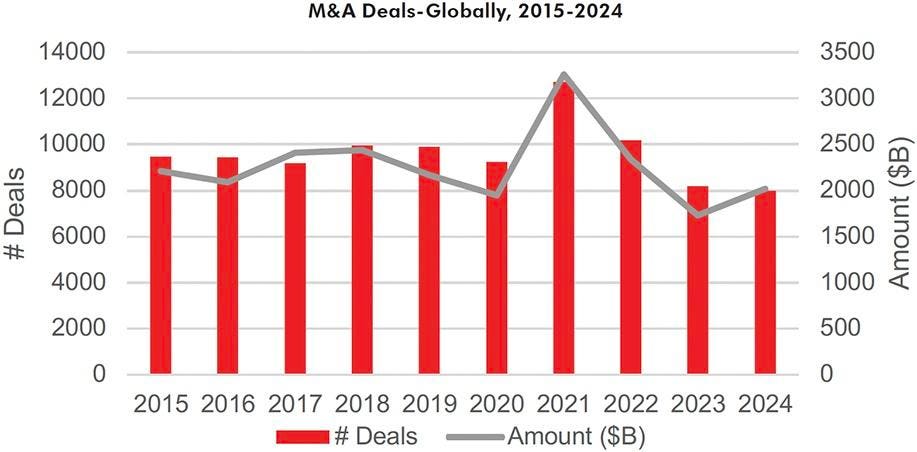

The November elections marked a pivotal shift in the U.S. political landscape as a Republican administration gained control over the White House, House of Representatives, and Senate. This transition has been interpreted by investors, investment bankers, and private equity (PE) firms as a potential turning point for an uptick in mergers and acquisitions (M&A) activity, as well as public equity issuances. The belief is that the change in governance will alleviate some of the stringent regulatory measures that have characterized the past few years, particularly under the Biden Administration, which was led by Gary Gensler and Lina Khan. These leaders have imposed heavier regulatory burdens on public offerings and have challenged a higher number of mergers, leading to a chilling effect on the deal-making environment.

After experiencing a sluggish period, the initial public offerings (IPOs) market has shown signs of recovery in the U.S., albeit still significantly below the peak levels reached in 2021. The decline in public companies, from a high of 8,090 in 1996 to about 4,300 currently, has been accompanied by a remarkable growth in PE-backed firms, which have surged from 1,900 to 11,200 over the last two decades. Analysts, including those from William O’Neil, suggest that there is an underlying pent-up demand from investors seeking new offerings and companies that are waiting to go public. However, despite the recent revival, the number of IPOs in the last three years has remained consistent with the low numbers seen over the past decade.

In a sector-specific breakdown, the health care industry has led the pack in IPOs year-to-date, followed by capital equipment and technology. The technology sector, in particular, has struggled, with many companies opting for private funding sources or acquisitions rather than public listings. Should the IPO market continue to gain momentum in the next four years, there is a reasonable expectation for a spike in technology offerings, especially those related to artificial intelligence (AI), which is poised to be a significant growth area.

Positive trends have also emerged in IPO-related exchange-traded funds (ETFs), which have demonstrated strong price performance and are trading above key moving averages. This upward trajectory signals a potentially improved deal environment, which could further contribute to the resurgence of IPO activities. Additionally, forecasts suggest that a rise in IPOs and secondary offerings may coincide with better performance among small-cap companies, which have underperformed relative to large-cap peers over the last four years. Encouragingly, recent data show an uptick in primary and secondary equity offerings since the lows of the past two years, although these numbers still fall short of the activity seen in 2020 and 2021.

As M&A and equity offerings are expected to gain traction, U.S. investment banks are likely to be significant beneficiaries of this uptrend. Investment banks’ stock performance has demonstrated strength, making them leading market players in the latter half of the year. The weekly data from the O’Neil Industry Group suggests these institutions are in a period of price leadership. Although some stocks may be considered extended in the short term, those with high relative strength, such as Jefferies Financial Group, PJT Partners, Raymond James Financial, Lazard, Piper Sandler, Evercore, Houlihan Lokey, and Perella Weinberg Partners, warrant further investigation for potential inclusion in investment portfolios.

In conclusion, the recent political shift in Washington is being closely watched by the financial community, as it may precipitate a more favorable regulatory environment for M&A and public equity activities. The data indicates that IPOs are on the rise, albeit from historically low levels, with sectors like health care and potentially AI technology leading the charge. Moreover, the surge in PE-backed companies emphasizes a growing divide between private and public equity landscapes. Should the favorable trends continue, investment banks could see a resurgence in activities, potentially creating lucrative opportunities for investors willing to adapt to the evolving market dynamics. Overall, the financial and investment sectors are primed for potential growth as they navigate through changes influenced by the new Republican administration.