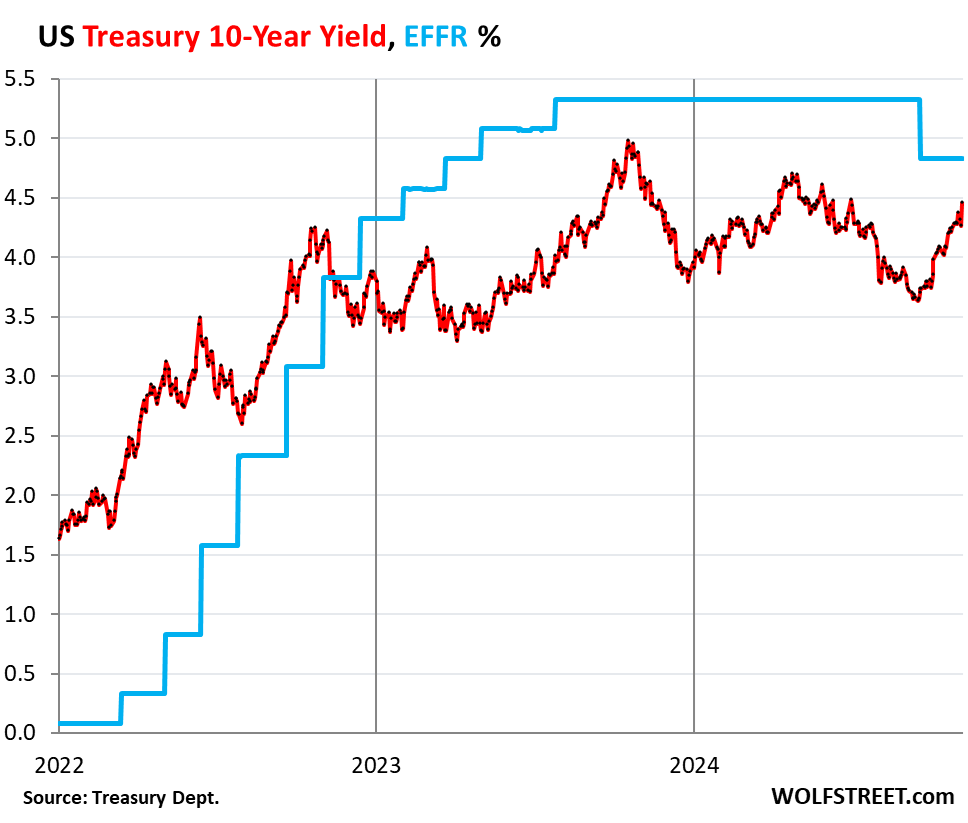

In a recent analysis by Wolf Richter on WOLF STREET, the author delves into the tumultuous state of the bond market following a significant spike in long-term Treasury yields. This surge in yields presents a stark contrast to the prevailing expectation that interest rates would decline after the Federal Reserve’s decision to cut rates on September 18. The immediate result has been a sharp decline in bond prices and substantial pain for bondholders, as the 10-year Treasury yield has jumped dramatically to 4.46%, marking an increase of 81 basis points since the Fed’s cut. Similarly, the 30-year Treasury yield surged to 4.64%. The rising yields, influenced by shifting market sentiments and the wrong-footed expectations surrounding interest rates, signal an impending tighter monetary climate that is impacting the nation’s housing market as well.

The dynamics at play reveal a critical shift in the yield curve, which has been un-inverting dramatically. Typically, longer-term yields sit above short-term yields in a healthy economy, but this inversion had taken hold since July 2022. The recent uptick in longer-term yields, juxtaposed with a decrease in short-term yields, indicates a normalization process. The author notes that the yield curve has now flipped, with the 30-year yield surpassing all others, signaling a potential return to a more typical interest-rate environment, though not in the manner that the real estate sector had anticipated. This divergence has led to increased volatility within the Treasury market, creating uncertainty that resonates throughout various financial sectors.

As the bond market grapples with these changes, the implications for the housing market are significant. Mortgage rates, which closely follow the 10-year Treasury yield, have risen aggressively, now standing at approximately 7.13%. This spike has resulted in dwindling mortgage applications, exacerbating the decline in demand for existing homes. The author points out that this trend could see home demand hit its lowest levels since 1995, leaving sellers and stakeholders in the housing market reeling. The sharp uptick in mortgage rates is a stark reminder of the delicate interdependence of the bond and real estate markets and underscores the challenges faced by prospective homebuyers navigating rising costs.

The real estate industry, which had been hoping for a more favorable interest rate environment, has faced a harsh shift in sentiment. Initially buoyed by early decreases in mortgage rates—from nearly 8% to about 6.1%—this optimism quickly evaporated as rates surged following the Federal Reserve’s intervention. The expectation was that the Fed’s cuts would facilitate lower short-term rates, ultimately pulling down long-term rates and mortgage rates in tandem. Instead, the opposite has unfolded. The industry had built expectations for rates around 5.x% by this time of year, especially with hopes for 4.x% rates by spring, only to be confronted with mortgage rates exceeding 7%.

This unexpected reversal leaves home sellers in a precarious position as the market dynamics shift beneath them. The anticipated influx of buyers that typically characterizes the spring selling season may not materialize due to higher borrowing costs. With demand stifled and higher rates serving as a deterrent, the real estate sector faces profound challenges. Homeowners looking to sell may find that their properties remain on the market longer, with fewer interested buyers willing or able to navigate the elevated rates. This not only impacts individual sellers but also casts a long shadow over the housing market’s recovery as a whole.

In conclusion, the current state of the bond market, driven by rising Treasury yields, is creating significant repercussions for the housing industry and broader economy. As yields spike and mortgage rates climb, bondholders are experiencing substantial losses, while home demand faces severe contraction. The anticipated recovery scenario for housing has quickly transformed into a sobering reality where higher costs deter buyers and stall market momentum. The interrelated nature of these financial sectors illustrates the fragility of markets in response to policy decisions and economic indicators, underscoring the need for stakeholders to remain vigilant and adaptive in an uncertain financial landscape. As the situation continues to develop, both bondholders and housing market participants will have to navigate the complexities of a rapidly changing economic environment.