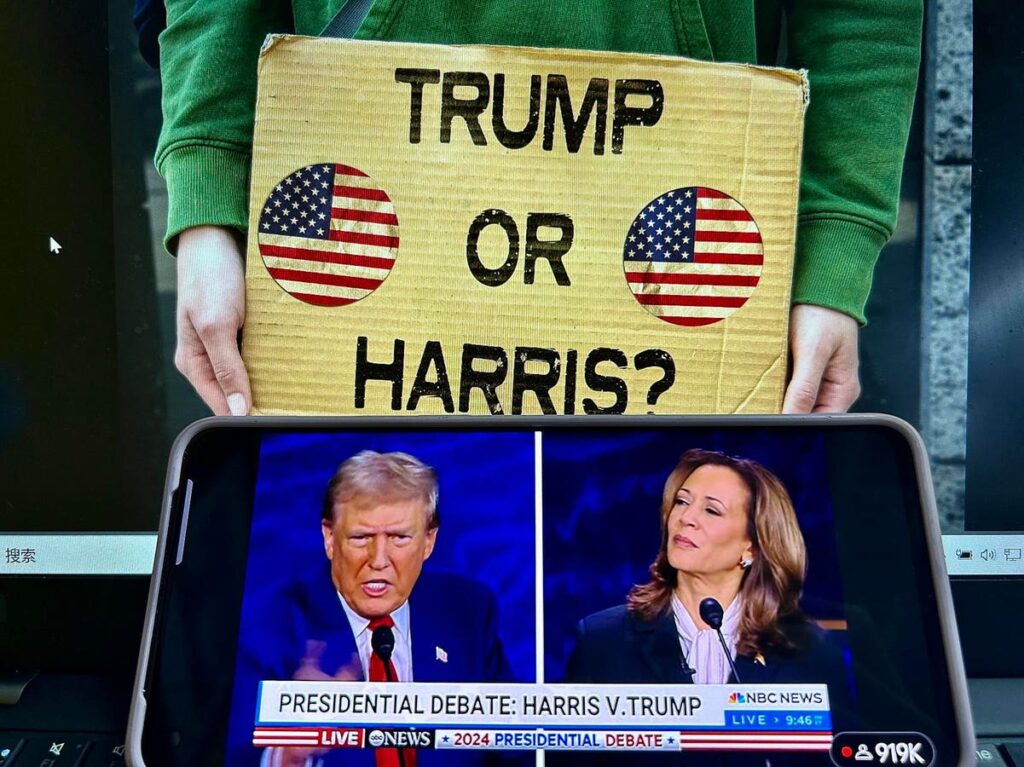

The ongoing presidential campaign has highlighted the critical need for government intervention to support frail older adults, younger people with disabilities, and their families. Historically, this demographic has been largely overlooked by lawmakers, but Vice President Kamala Harris and former President Donald Trump have introduced their proposals to address long-term care issues. Harris has suggested a significant expansion of traditional Medicare, aiming to include long-term support services for home care, while Trump has proposed a caregiver tax credit as his countermeasure. The mere focus on long-term care by both candidates signifies a pivotal change in political discourse, pushing the issue to the forefront of national discussions.

Harris’s Medicare-inspired plan has its advantages, primarily its connection to a well-established and popular program. However, Medicare’s design is inherently focused on health insurance rather than personal care and social support services. This poses limitations, especially on the type and range of care beneficiaries can access due to complex regulations. Funding for Harris’s proposal is expected to come from general tax revenues, a strategy that may obscure the overall cost. Still, this approach leaves the program vulnerable to potential budget cuts or repeal in the future. Furthermore, introducing a Medicare long-term care benefit raises intricate questions about interactions with existing Medicaid programs and private insurance, creating a complex web of coverage challenges.

On the other side, Medicaid already provides a foundation for long-term care but is limited to low-income individuals with financial constraints. Although it has established benefits and eligibility protocols, the variability across states leads to disparities in care quality and accessibility. As such, Medicaid’s reach does not extend to middle-income individuals who may struggle to cover care costs yet possess too many resources to qualify for Medicaid support. The narrowing focus of Medicaid’s benefits highlights a critical gap in coverage that neither healthcare program sufficiently serves.

Other approaches to reforming long-term care include front-end public insurance and catastrophic public insurance models. Front-end coverage, where individuals would have more flexibility with purchasing services, has been enacted in Washington State, which is collecting payroll taxes to fund benefits starting in 2026. While this broadens access for many older adults, individuals facing prolonged care needs may exhaust their benefits before they pass, often leading them to rely on Medicaid. Conversely, catastrophic insurance is designed for individuals requiring long-term care, reducing the financial burden on Medicaid by covering severe cases such as dementia. However, since fewer individuals would qualify for these benefits, such plans often face legislative resistance.

Trump’s caregiver tax credit serves as one potential solution, although it raises questions about its efficacy and the administrative feasibility of implementation. Families studying their finances might find a $1,000 credit negligible in the face of long-term care expenses that can easily pile into the tens of thousands or more annually. Furthermore, the credit would apply to caregivers rather than recipients, complicating its impact on families juggling care responsibilities and financial constraints. The administrative complexities become even more pronounced when multiple family members are involved in caregiving, raising questions of eligibility and proof for credit claimants.

The background of these discussions reveals a long history of half-measures and legislative failures. The Affordable Care Act initially included a voluntary public long-term care insurance program, but it was repealed before launching. The recent Washington State law exemplifies a progressive attempt at reform, yet it faces challenges amid potential repeal initiatives. Previous federal attempts, such as the WISH Act introduced by Representative Suozzi and President Biden’s proposal for increased Medicaid funding, also demonstrate lawmakers’ growing awareness of these issues, albeit with limited success. The growing discourse on long-term care reform reflects an urgent political and societal need that the next presidential administration must confront head-on. This evolving landscape may signify a potential inflection point in addressing the long-standing challenges of long-term care in America.