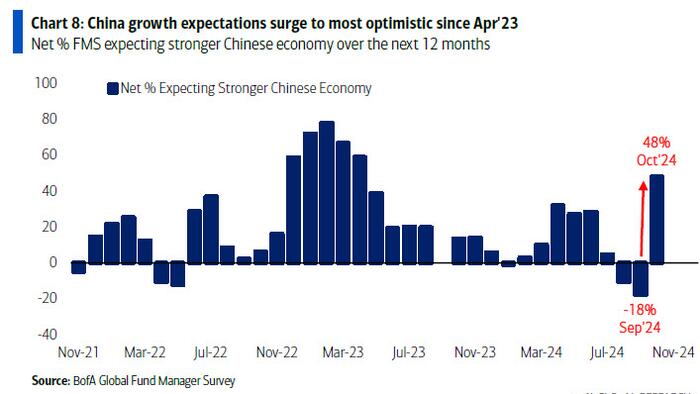

In the ever-evolving landscape of global investments, the sentiment surrounding Chinese stocks has undergone a remarkable transformation. Just a month ago, shorting Chinese equities was regarded as one of the most favored trades, leading many investors to position themselves bearish on the market. However, following a significant stimulus effort from the Chinese government and a temporary market rally, this sentiment has rapidly shifted. According to Bank of America Corp.’s recent survey of global fund managers, bullish bets on Chinese stocks have emerged as some of the most crowded positions in the current investment climate. This sudden pivot highlights the volatility and unpredictability that characterize market perceptions, revealing how quickly the tide can turn based on geopolitical and economic developments.

The Bank of America survey conducted for the week ending October 10 offers critical insights into this shift in investment sentiment. It indicates that approximately 14% of investors now view bullish positions on Chinese equities as among the most crowded trade options globally. This places these investments in line with other popular trades, such as long positions in the “Magnificent Seven” stocks—comprising major tech companies—and gold holdings, which are historically seen as a safe haven during times of uncertainty. This dramatic shift underscores a growing confidence among investors that the bearish outlook that previously dominated sentiment toward Chinese equities may be dissipating, albeit temporarily.

Historically, short selling Chinese stocks had been a prevalent strategy due to concerns over economic weakness, regulatory crackdowns, and geopolitical tensions. Reports from leading financial firms indicated that a significant portion of market participants believed that additional downside existed for these equities. However, the recent implementation of various stimulus measures by the Chinese government, aimed at stabilizing the economy, has revitalized investor interest and sparked optimism regarding future growth. This illustrates the delicate interplay between policy actions and market perceptions; a well-timed stimulus can significantly alter the trajectory of investor sentiment.

Moreover, this intriguing reversal raises questions about the sustainability of the current bullish sentiment. The excitement surrounding short-covering rallies suggests that many investors are scrambling to reposition themselves in light of collective optimism. Yet, there remain underlying uncertainties pertaining to China’s economic recovery, including lingering concerns around property market stability, consumer confidence, and potential further regulatory interventions. As such, while the immediate reaction to stimulus efforts has been positive, investors must tread carefully, as the fundamentals may not yet fully support the optimistic outlook that currently seems pervasive in the market.

While many investors have shifted toward bullish positions, the rapid change in sentiment emphasizes the need for caution. Bank of America’s findings are a reminder that market sentiment can pivot swiftly, particularly in more volatile environments. Furthermore, the perception of crowded trades can lead to increased volatility, especially if a significant number of investors are compelled to reverse their positions. A shift back to bearish sentiment, especially if triggered by disappointing economic data or policy missteps, could lead to sharp corrections, creating potential pitfalls for investors who may have jumped on the bullish bandwagon too hastily.

Ultimately, the current climate surrounding Chinese equities exemplifies the complexities faced by investors navigating global markets. The juxtaposition of light bullish sentiment against potential headwinds raises the stakes for all market participants. Those looking to capitalize on this newfound optimism must remain vigilant, continually assessing the relationship between monetary policy, economic indicators, and broader geopolitical dynamics. In such a rapidly evolving environment, adaptability and informed decision-making will be paramount for successfully negotiating future investment opportunities in China.