Chinese lawmakers are convening this week for a crucial session of the Standing Committee of the National People’s Congress, with significant implications for the nation’s economic future. Scheduled from November 4-8, this meeting is poised to finalize a substantial fiscal package aimed at stimulating growth amid ongoing economic challenges heightened by the global economic landscape and the upcoming U.S. elections. Analysts from leading financial institutions, including Goldman Sachs and HSBC, anticipate that this legislative assembly will approve a range of measures designed to alleviate financial strain on local governments and bolster major state-owned banks.

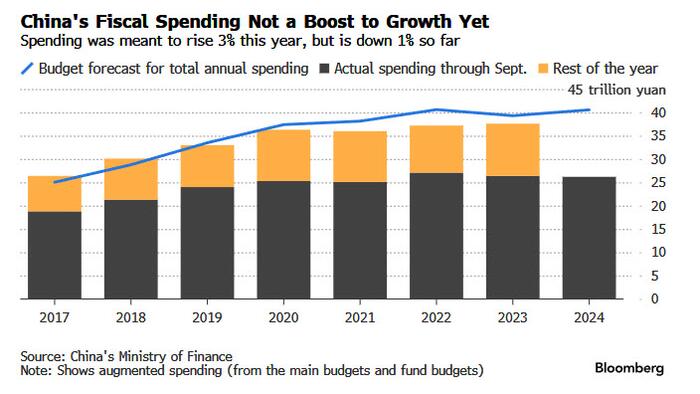

The fiscal package, projected to involve trillions of yuan, reflects the Chinese government’s commitment to navigating the aftereffects of the pandemic while addressing persistent economic headwinds. Local governments, often burdened with debt and diminishing revenues, are a focal point of this strategy as the central government seeks to enhance their fiscal capacities. This move is particularly critical as regional authorities play a vital role in implementing national policies and fostering economic development. The support from the central government is intended to provide localities with the resources they need to maintain essential public services and invest in growth initiatives.

Given the geopolitical backdrop, especially with the impending U.S. elections, the urgency of this fiscal stimulus cannot be understated. The increasing uncertainty in global markets, influenced by both domestic policies in the United States and shifts in China’s economic landscape, creates a precarious environment for investors. Chinese lawmakers must carefully consider both the domestic implications of their financial strategies and the international repercussions as they navigate through these turbulent waters. Therefore, the upcoming conclave is not merely a domestic affair; it operates within a broader context of global economic interactions.

While the package is extensive, analysts caution that it may not entirely reassure markets immediately. The anticipated measures, while significant, might fall short of completely countering the various economic challenges faced by China, including sluggish consumer spending and wavering foreign investment. Investors and market participants will be scrutinizing the details of the package closely to gauge its effectiveness and potential impact on stabilizing the economy. Thus, the forthcoming discussions and resolutions from the National People’s Congress are critical in shaping market sentiment and influencing investor confidence.

Moreover, the fiscal measures are expected to be accompanied by an evaluation of existing economic policies and a reorientation towards more sustainable growth strategies. This includes a shift from short-term fixes to long-term structural reforms that could enhance the resilience of the Chinese economy. Such reforms might involve improving the efficiency of local finance management, fostering innovation in key sectors, and broadening the tax base to create more sustainable revenue sources for local governments. The balancing act of stimulating growth while implementing reforms will need careful navigation to avoid exacerbating existing economic vulnerabilities.

In summary, the upcoming meeting of China’s legislative body represents a pivotal moment for the nation’s economic strategy in a complex global environment. With the expected fiscal package intended to alleviate pressure on local governments and provide critical support to major banks, the stakes are high. However, the effectiveness of these measures in restoring market confidence and stimulating sustained economic growth remains to be seen. As the unfolding political and economic dynamics continue to reshape the landscape, all eyes are on Beijing’s decisions and their broader implications for both domestic and global economic stability.