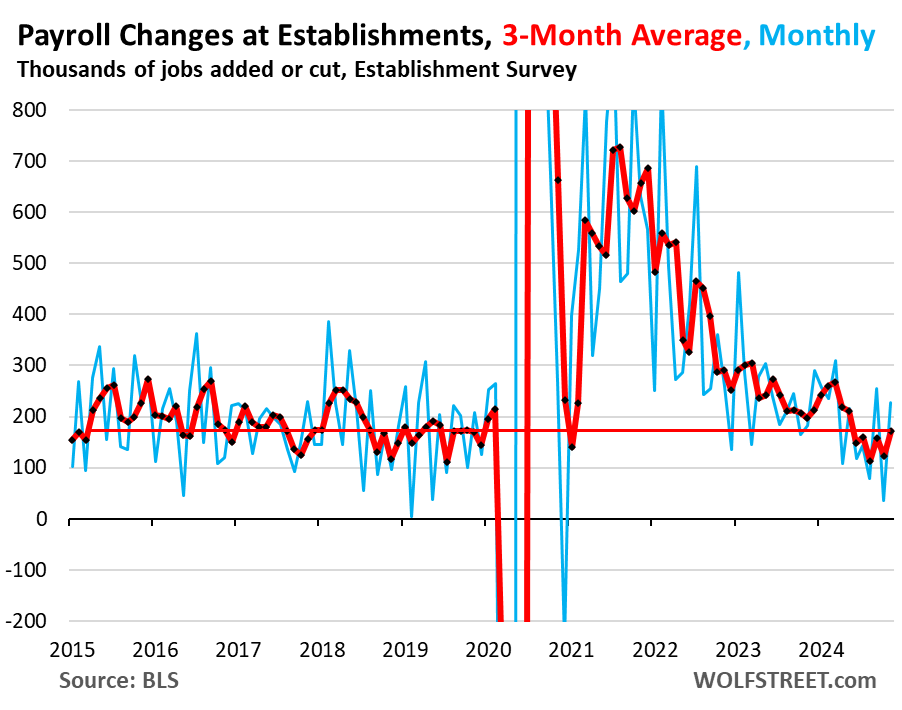

In November, the U.S. job market demonstrated significant recovery, adding 227,000 jobs compared to October, with previous months’ reports also adjusted upward. This led to a total uplift of 283,000 jobs when considering revisions from prior months. The three-month average for job creation stands at a solid 173,000, underscoring a robust rebound amid disturbances caused by recent hurricanes and the Boeing strike. The report highlights a strong recovery, particularly in sectors impacted by the aforementioned events, showing a return to stability across various industries. Notably, the end of the Boeing strike on November 5 contributed to a significant rise in employment in Transportation Equipment Manufacturing, which saw a rebound of 30,000 jobs after a loss of 44,000 in October. Further employment figures are expected to improve in December as workers returning post-strike continue to contribute to payroll numbers.

The economic landscape also reflects a notable uptick in wages, with average hourly earnings rising by 4.5% year-over-year in November, equating to the most significant annual increase since January. The revisions for October also pointed to a positive trend, with wage growth uplifted from 4.5% to 5.2% annualized, demonstrating robust earnings enhancement. Overall, the three-month average wage increment rose to 4.5% annualized, signifying positive wage trends monthly and on an annual basis. These wage increases are significant as they surpass even the pre-pandemic gains, contributing to inflationary concerns as increased spending potential can lead to sharp price increases in goods and services.

In assessing the unemployment rate, it marginally increased from 4.1% in October to 4.2% in November; however, it has remained steady in a historically low range for several months. This stability is notable given the forecasts from the Federal Reserve, which had projected an uptick to 4.4% by the close of 2024. Unemployment figures are derived from the household survey, which may not fully account for the recent spikes in labor supply caused by a wave of new migrants, complicating the analysis. Worker participation rates could be influenced by this influx, yet the current job creation data suggests sustained hiring despite the growing labor pool.

The ongoing migration trends pose additional challenges for employment data accuracy. The Congressional Budget Office estimates around 6 million migrants have entered the workforce in 2022 and 2023, but the household surveys may not fully capture these changes due to lower response rates among these populations. The Bureau of Labor Statistics is expected to release revised household survey data in January, which should more accurately reflect labor market dynamics and include the growing migrant workforce. This re-evaluation could lead to substantial upward adjustments in reported employment figures and labor force participation, aligning the household data with consistent job growth reported by nonfarm payroll statistics.

Notably, the rising number of unemployed individuals now approximates 7.1 million, reflecting a stable trend in unemployment numbers rather than job losses. This dynamic suggests that the uptick in the unemployment rate may be attributed more to an expanding labor force linked to new immigrants rather than diminishing job opportunities, as job creation remains strong. The three-month average of unemployed individuals indicates a stabilization around the 7 million mark, a metric that highlights ongoing growth within the labor market rather than impending job reductions, differing from typical recession patterns where unemployment rises due to demand declines.

As the Federal Reserve contemplates monetary policy adjustments in light of these employment indicators, the prevailing theme expresses caution against rapid rate cuts. With substantial economic data reinforcing a moderate yet stable labor market and rising inflation rates, the Fed is inclined to take a more conservative approach amid uncertainty regarding the optimal neutral rates for interest. Current economic indicators suggest the possibility of entering a more balanced fiscal phase; however, ensuring inflation does not resurge remains critical. The Fed can adjust its tactics if inflation trends up as it has in the past. Overall, the resiliency in job creation and wage growth suggests a potential for further economic strength that policymakers will have to navigate carefully.