The DividendRank formula utilized by Dividend Channel classifies a vast assortment of dividend stocks, ranking them through a proprietary algorithm that highlights two critical features: strong fundamentals and low valuations. Johnson & Johnson (JNJ) stands out in this analysis, currently ranking within the top 25% of the coverage universe. Such a high ranking indicates that JNJ is a compelling option for investors looking to research promising dividend-paying stocks further. The combination of strong financial performance and favorable valuation makes JNJ an attractive candidate for those interested in making informed investment decisions.

This attractiveness of Johnson & Johnson is amplified by a recent trading development where its shares descended into oversold territory, with prices dipping as low as $148.95. Oversold territory is defined through the Relative Strength Index (RSI), a momentum indicator that provides insights on stock price movements within a scale from zero to 100. When the RSI falls below 30, it signifies that a stock may be undervalued, posing a potential opportunity for investors. Currently, JNJ’s RSI reading is marked at 29.0, a stark contrast to the average RSI of 52.5 for other dividend stocks monitored by Dividend Channel. This oversold condition suggests that JNJ might be poised for a rebound.

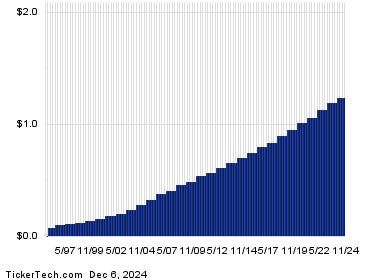

The implications of a stock entering oversold territory can be significant for dividend investors, as a declining price can enhance the yield on dividends. Johnson & Johnson’s annualized dividend, set at $4.96 per share and dispensed quarterly, translates to an attractive annual yield of about 3.32% at the recent trading price of approximately $149.52. An appealing yield is often a crucial factor for investors, particularly in the current climate where income generated from investments is highly sought after. The combination of JNJ’s strong dividend yield and its current price dip presents an enticing opportunity for those seeking income-generating investments.

For bullish investors, the low RSI reading may signal that the recent selling pressure is easing, providing a ripe moment to consider entry points for purchasing JNJ shares. It’s essential for investors to gather further insights on JNJ’s fundamental performance and dividend history before committing capital. An examination of JNJ’s dividend history can reveal important trends and the likelihood of sustaining dividends at the current rate. Understanding the stability and growth of dividend payouts contributes to forming a more comprehensive view of the stock’s potential for future performance.

Furthermore, while dividends can often be unpredictable, analyzing historical trends can provide insight into whether JNJ can maintain or grow its dividend payments. Specifically, looking at how the company has navigated past economic cycles, changes in market conditions, and its approach to shareholder returns will enable investors to gauge confidence in the stability of its dividends. Given JNJ’s long-standing reputation and solid fundamentals, the company’s ability to adapt and continue rewarding shareholders could make it an appealing investment choice.

In conclusion, Johnson & Johnson emerges as a noteworthy candidate for dividend investors, featuring both solid fundamentals and an appealing valuation. The current oversold status, coupled with the strong dividend yield, enhances its attractiveness, particularly for those looking to capitalize on potential market rebounds. As investors conduct their research, considering both technical indicators like the RSI and fundamental metrics such as the dividend history will be crucial in determining JNJ’s suitability for their investment portfolios. Such an organized approach will ensure investors are making informed decisions in this fluctuating market environment.