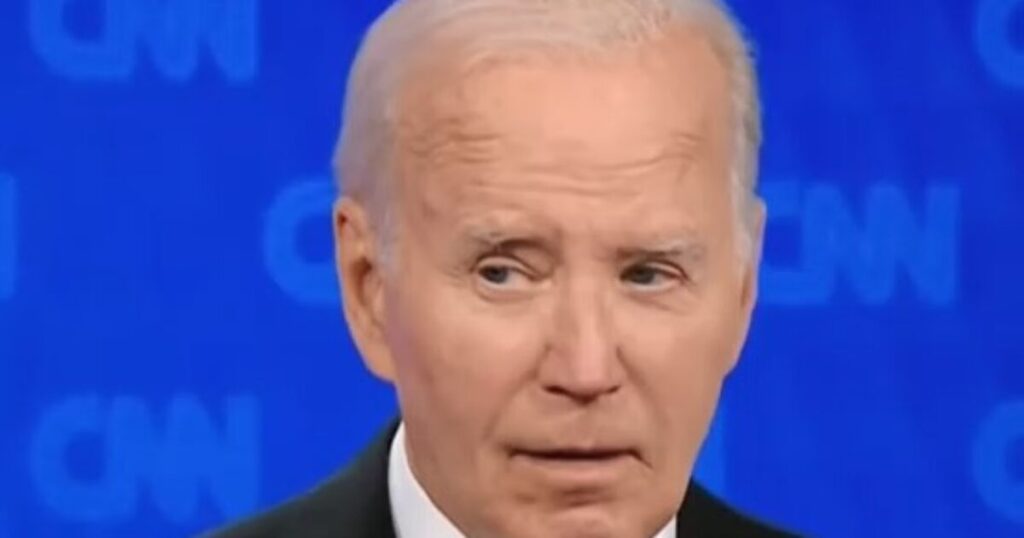

In recent news, President Joe Biden’s administration has faced criticism following a controversial presidential debate against former President Donald Trump. This comes amid Biden’s ongoing endeavors in student loan debt forgiveness, with the Department of Education proposing new measures intended to take effect after the anticipated inauguration of Donald Trump in January. Reports indicate that Biden’s government has introduced a series of student loan forgiveness programs, aiming to alleviate the financial burdens faced by borrowers. The estimated cost of the new forgiveness plan is projected at around $112 billion, although some analysts argue that this figure significantly underestimates the true financial implications, hinting that the actual costs could be as much as five times higher.

One significant feature of the proposed plan is its reliance on the concept of “hardship,” as determined by the Secretary of Education. This vague term can lead to discrepancies in who qualifies for loan forgiveness, raising concerns over fairness and accountability. Historically, Biden has made several attempts to implement student loan bailouts, including a 2022 proposal that aimed to forgive up to $20,000 in federal student loan debt for Pell Grant recipients and $10,000 for others earning below $125,000 annually. This initiative was grounded in a post-9/11 statute that allows for loan modifications during “emergencies.” However, the Supreme Court ultimately rejected this justification in 2023, declaring it insufficient to validate widespread loan forgiveness.

As the Biden administration navigates the legal complexities surrounding its previous proposals, it is noteworthy that a separate student loan bailout initiative is currently on hold due to ongoing legal challenges. Furthermore, taxpayers have already absorbed over $32 billion in student loan relief since Biden assumed office in January 2021, raising questions about the sustainability of such financial aid programs. Critics argue that the administration has not adequately provided reassurance that borrowers are truly facing severe hardships. In fact, reports have emerged countering the narrative that many individuals are “literally crushed” by their debts, as stated by White House Press Secretary Karine Jean-Pierre earlier this year.

Adding to the controversy, recipients of the student loan bailouts have expressed intentions to utilize their relief funds for discretionary expenditures, such as vacations, dining out, and even purchasing drugs, further intensifying criticism of the administration’s strategies. This perception of irresponsibility contributes to an overarching narrative about the potential pitfalls of Biden’s approach to student loan relief, effectively characterizing the initiatives as political tools rather than genuine economic support for struggling borrowers. Among opponents, there is a growing sentiment that such strategies resemble political bribes that fail to accomplish meaningful change, undermining the integrity of economic policies enacted by the government.

Amid this turbulent landscape, the Biden administration’s student debt relief efforts have ignited fierce debate regarding the balance between providing necessary assistance to borrowers and ensuring fiscal responsibility. Proponents often cite the necessity of addressing crippling educational debt, especially in light of rising tuition costs and an increasingly competitive job market. Opponents, however, question the long-term implications of massive debt forgiveness and its potential to encourage financial irresponsibility. They emphasize that a more sustainable approach may require reforming the education financing system to reduce reliance on student loans altogether, rather than repeatedly providing bailouts with vague guidelines.

In conclusion, the current discourse surrounding Biden’s student loan forgiveness proposals illustrates the complex interplay of economic realities, legal interpretations, and societal expectations. As debates continue to unfold, the ramifications of these policies will likely reverberate far beyond the immediate implications for borrowers. The outcomes of ongoing legal challenges and the administration’s ability to navigate the political landscape will ultimately shape the future of student loan relief efforts in America, making it a critical issue for Biden and his administration as they strive to find effective solutions to a pressing national concern.