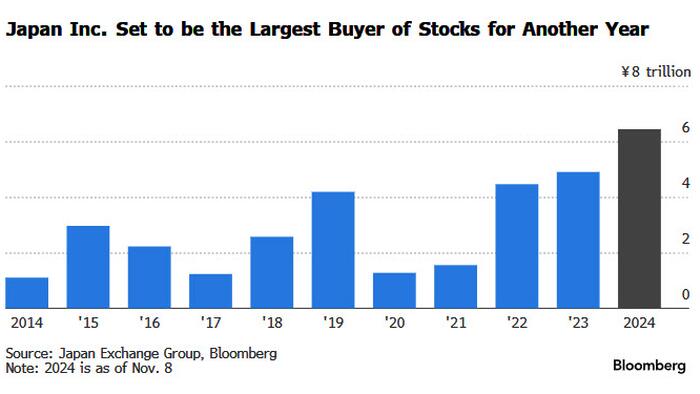

Japan’s stock market is experiencing a notable surge, bolstered by record-high share buybacks by domestic companies. As reported, companies have engaged in a massive ¥6 trillion ($38.8 billion) spend on purchasing their own shares as of November 8, 2023. This figure significantly surpasses the total of ¥4.9 trillion recorded for the entirety of 2022. The trend reflects corporate confidence amidst the current earnings season, as firms prioritize profit-sharing initiatives in a bid to engage investors more effectively.

These buybacks are seen as a strategy to enhance shareholder value, especially in a climate where return-on-investment is a critical metric for evaluation. The increase in corporate buybacks not only strengthens stock prices but also serves as a signal of financial health and confidence among Japanese companies. As more firms adopt these strategies, it is anticipated that this will further bolster the performance of the Tokyo stock market, helping it to maintain a positive trajectory as the year approaches its end.

The Japan Exchange Group Inc., which provides vital data on these market activities, indicates that companies are positioning themselves to be the leading purchasers of domestic stocks this year. This movement marks a significant shift in the market landscape, notably in a region where such aggressive buyback measures were not historically common. Analysts predict that continued buyback activity could yield promising results for investors, fostering a more favorable trading environment as the year concludes.

As the earnings season progresses, many businesses are highlighting their commitment to returning profits to shareholders, a move that resonates well with an increasingly discerning investment community. Such actions can lead to enhanced market sentiment, boosting investor interest and potentially attracting foreign investment into Japan’s markets. The implications of this trend extend beyond just the numbers, reflecting a broader cultural shift within the corporate sector toward prioritizing shareholder returns.

Economically, these buyback activities coincide with a relatively stable macroeconomic environment in Japan, fostering optimism among investors. With growth in corporate earnings and improved economic indicators, stocks appear to be an attractive asset class. The rising momentum from buybacks could lead to further market rallies, as companies continue to support their stock prices and signal confidence in their future profitability.

Overall, Japan’s remarkable increase in share buybacks illustrates a strategic response by domestic companies to the evolving market landscape. As firms engage in this trend, they not only reinforce their commitment to investors but also drive momentum for the entire stock market. With expectations for continued strong performance, the potential for a positive year-end finish in Tokyo’s stock market remains high as companies leverage buybacks as a key element of their growth strategy.