The latest data on the housing market presents a mixed landscape, highlighting some contrasting trends within the industry. Housing starts have declined for the third consecutive month, registering a decrease of 1.8% month-over-month (MoM), significantly below the projected increase of 2.6% MoM. This downturn in housing starts has brought the seasonally adjusted annual rate (SAAR) near the low levels observed during the COVID-19 lockdowns. On the other hand, building permits exhibited a notable surge, rising by 6.1% MoM, which outperformed the expected increase of 1.0%. This sharp increase marks the largest month-over-month jump in permits since February 2023, bringing the SAAR for permits up to 1.505 million—its highest point since February 2024.

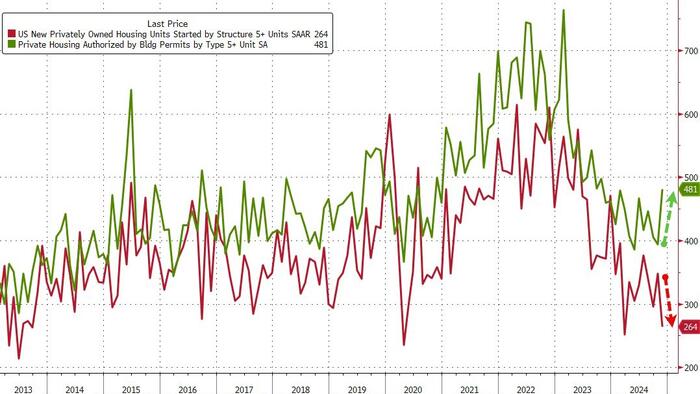

The remarkable rise in building permits, particularly in the multi-family sector, is noteworthy. Multi-family building permits surged by 22.1% MoM, reflecting strong demand for rental units amid shifting housing dynamics. However, the starts for multi-family units experienced a significant drop of 24.1% MoM, potentially influenced by external factors such as recent hurricane impacts that may have disrupted construction activities. This stark contrast raises questions about the sustainability of the current housing market dynamics and suggests that while permits are being issued, the actual construction may lag behind due to unforeseen challenges.

These fluctuating patterns in the housing market mirror past episodes where optimism in certain metrics did not lead to long-term success. Investors and market analysts may recall similar optimistic trends earlier in the year, which ultimately did not yield favorable outcomes. The current surge in building permits could spark cautious optimism among homebuilders, but many are aware of the risks that come with erratic fluctuations in housing demand and broader economic conditions. Such historical parallels provide a sobering reminder of the need for careful interpretation of these trends moving forward.

Interestingly, despite the headwinds presented by rising interest rates and a general decline in rate-cut expectations, homebuilders appear to exhibit signs of newfound optimism. This optimism might be linked to the prevailing narrative surrounding a “renter nation,” where the demand for rental housing is expected to persist. Homebuilders may be starting to reposition their strategies to align with this trend, focusing more on multifamily developments that cater to renters. As homeownership becomes less attainable for many due to rising mortgage rates, the demand for rental properties could lead to a robust niche market for builders.

With expectations of a hawkish stance from the Federal Reserve regarding potential rate cuts looming over the market, it remains to be seen how this will impact builder confidence. The housing market climate is continuously evolving, and while there may be reasons for cautious optimism, the broader macroeconomic factors—including interest rates, inflation, and employment figures—will ultimately shape the future landscape of construction and homebuilding. Homebuilders’ confidence in multi-family projects must be balanced with the realities of the economic environment and the potential for changing consumer preferences.

In conclusion, the current state of the housing market is characterized by conflicting signals that underscore the complexities of the real estate industry. While there is a notable rise in building permits, reflecting a strong pipeline of potential future projects, the decline in housing starts indicates challenges that builders are grappling with. As homebuilders navigate these dynamics, they are faced with a critical juncture where they must adapt to shifting economic indicators while remaining hopeful about a sustained demand for rental housing. The outcomes of upcoming economic meetings and broader market trends will play a vital role in determining the direction of the housing market, influencing both builder sentiment and consumer behavior in the months to come.