Donald Trump’s potential return to the presidency has reignited discussions around Iranian oil exports, which had previously been stifled during his administration’s aggressive maximum pressure campaign that began in 2019. At that time, the United States implemented stringent sanctions aimed at crippling Iran’s oil revenues, limiting its capacity to finance various activities, including those considered hostile to U.S. interests. Under President Joe Biden, however, Iranian oil flows surged once more. His administration adopted a less confrontational strategy that allowed for higher export levels, although tensions remained evident. With Trump indicating his intention to take a hard line against Tehran should he regain power, it raises significant questions about the future of Iran’s oil industry and international relations in the region.

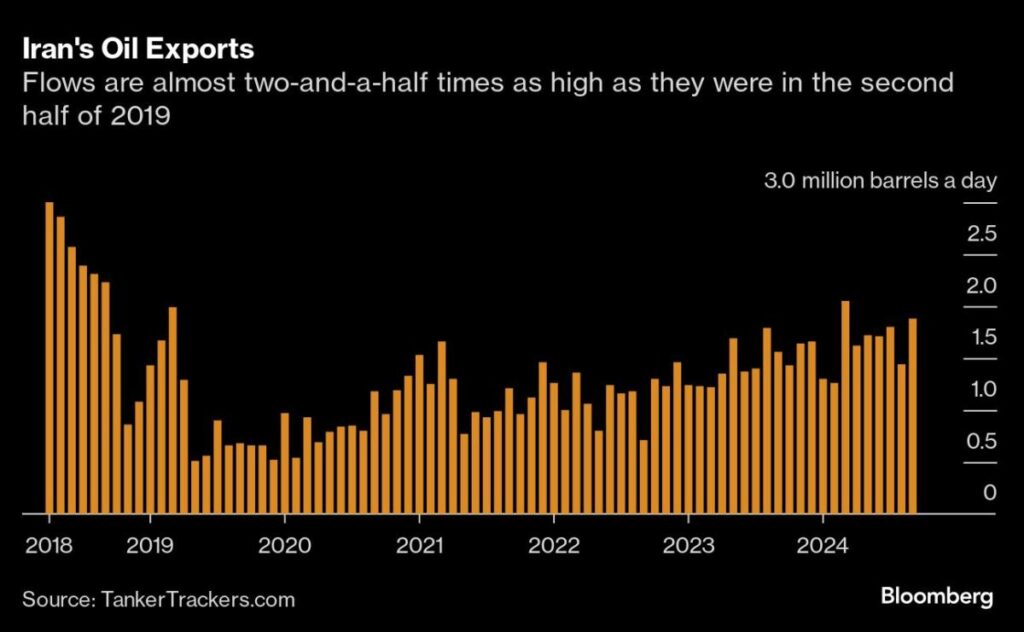

Currently, Iranian oil exports are experiencing a remarkable resurgence, averaging roughly 1.7 million barrels per day in the third quarter of the year, a stark contrast to the levels seen during the latter half of 2019 when exports had plummeted. This increase reflects Iran’s adaptation to sanctions through the use of covert shipping techniques and a network of tankers that evade Western scrutiny. Analysts like Ben Cahill from the University of Texas predict that a Trump presidency could indeed lead to a reduction in Iranian oil exports by as much as 1 million barrels per day, potentially bringing output back to levels last seen during the early days of the COVID-19 pandemic. The repercussions of such sanctions may be profound, affecting not only Iran’s economy but also global oil supply.

One key aspect of Trump’s anticipated strategy involves targeting the geopolitical relationships that facilitate Iran’s oil sales, particularly its ties with China, a primary buyer of Iranian oil. Bob McNally of Rapidan Energy Group speculates that Trump’s approach will include engaging with Chinese leadership to emphasize the importance of reducing their imports of Iranian crude. With an estimated capacity to disrupt up to 1.3 million barrels per day, the implications of such a tactic could send shockwaves through the oil markets, depending on how it is executed in the face of existing geopolitical complexities.

Moreover, Trump’s policy will likely necessitate a recalibration of U.S. relations with Saudi Arabia, given the shifting regional dynamics. The normalization agreement struck between Saudi Arabia and Iran in 2023, the first in seven years, has brought a new level of diplomatic engagement that could conflict with hardline U.S. positions on Iran. This evolving relationship will require strategic consideration from the new administration to balance the interests of these two significant players in the Middle East. The stabilization of relations with Saudi Arabia has implications for OPEC’s overall performance and could influence global oil prices in turn.

Experts suggest that the upcoming election could hold significant sway over global oil dynamics. With energy markets potentially facing surplus conditions next year, Trump’s policies may shape not only Iran’s economic landscape but also broader international relationships surrounding oil production and export. The culmination of these political maneuvers could result in a fragile equilibrium as Iran navigates its place in the global oil sphere while attempting to sidestep punitive measures from Washington. The stakes are exceptionally high, and the direction taken by Trump or his possible administration will undoubtedly be scrutinized by energy analysts and geopolitical strategists alike.

As the world watches and anticipates the outcomes of the election, the implications of U.S. policy on Iranian oil exports remain clear. Whether Trump can effectively reinstate a similar pressure campaign as before will depend significantly on the landscape he inherits, the strategies he opts to pursue in relation to China and Saudi Arabia, and the resilience Iran has built in response to years of sanctions. Ultimately, the election may serve as a pivotal moment for both Iranian policy and the greater energy market, demonstrating the lasting link between political decisions and economic ramifications in the realm of international oil trade.