The year 2024 has proven to be particularly fruitful for U.S. stock investors, marked by substantial investment trends such as the rapid advancement of Artificial Intelligence (AI), rising electricity demands, a resurgence in Bitcoin and cryptocurrencies, heightened usage of GLP-1 drugs, and ongoing revitalization of U.S. infrastructure. As 2024 draws to a close, insights from equity analysts at William O’Neil + Co. shed light on potential investment themes expected to gain traction in 2025. Some of these emerging areas are continuations of previously established trends, while others reflect new opportunities poised to reshape the market landscape.

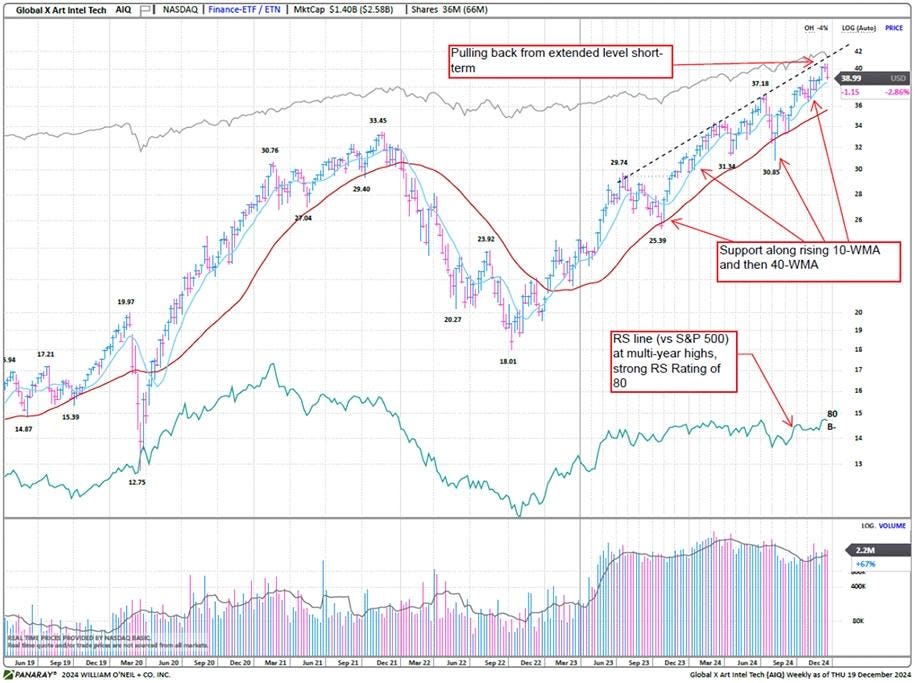

One of the most significant investment themes for 2025 is Artificial Intelligence (AIQ). The revenue from generative AI software is projected to grow at a staggering 46% compound annual growth rate (CAGR) over the next decade, potentially reaching $1.6 trillion by 2032. Notably, generative AI software alone is anticipated to expand even more rapidly at an 84% CAGR, indicating its transformative potential across various sectors, including enterprise productivity, cybersecurity, and data analytics. On the hardware side, major players such as Alphabet, Amazon, and Microsoft are heavily investing in data center infrastructure to maintain competitive advantages in the AI arena. These investments are predicted to lead to significant growth opportunities for semiconductor and networking product providers, particularly for companies like Nvidia, Broadcom, and Taiwan Semiconductor.

Amid increasing demand for data center infrastructure, the Industrials sector is likely to see heightened investment driven by AI’s appetite for more robust physical infrastructure. AI data centers require three times more power than conventional centers, prompting a demand spike for power management products and innovative cooling solutions. By 2029, the global liquid cooling market—an essential emerging technology for efficient AI cooling—is expected to reach $12.8 billion, reflecting a robust CAGR of 23%. The varied needs of these data centers will benefit companies involved in cooling systems and power management products, indicating a potential lucrative growth environment in this sector.

As we delve into the energy sector, forecasts project a significant rise in cumulative electricity demand in the U.S. over the next five years, driven largely by the increasing electricity consumption from data centers, which is expected to grow substantially as generative AI technologies become more pervasive. This uptick in electricity demand calls for a substantial increase in generation and transmission capacity, bolstering growth in related engineering, procurement, and construction companies. Natural gas and nuclear energy are emerging as the key power sources to meet this elevated demand, with predictions indicating a major increase in U.S. gas-fired power plant requirements, as well as an anticipated tripling of nuclear capacity by 2050. A strategic focus on these energy sources provides a promising narrative for stocks in the electrical and power generation sectors.

On the consumer front, inflation remains a pivotal concern, leading U.S. shoppers to adopt a selective spending approach in 2025. With prices remaining high, consumers are prioritizing purchases based on value and alignment with personal preferences, particularly within households earning over $100,000. Brands that resonate with these consumers are flourishing, while budget-targeted brands are struggling. This trend highlights a divide in consumer behavior, further fueled by anticipated inflationary pressures from tariffs and a strong dollar. Emerging themes shaping consumer sentiment in 2025 include a heightened focus on health and wellness, integration of innovative technologies, and experience-driven consumption, with various stocks identified as strong players in these categories.

The growth of digital advertising, particularly in video formats, is another significant trend likely to dominate the investment landscape in 2025. Streaming platforms are shifting toward ad-supported models, capitalizing on the migration of advertising dollars from traditional TV to digital. The digital video ad market is poised for rapid expansion, with projections indicating it could surpass linear TV ad spending imminently. Companies like Netflix, Disney, and platforms focused on short-form video are well-positioned to benefit from these changing dynamics, alongside programmatic ad players that are set to gain from increased video ad inventory. This transition further reflects the increasing importance of innovative marketing strategies within the media and technology sectors.

In summary, based on the analysis and insights from William O’Neil + Co., the year 2025 appears filled with promising investment opportunities across several emerging themes anchored in technology, energy, consumer behavior, and digital marketing. The continuation of trends identified in 2024, coupled with new developments, sets the stage for potentially robust returns in the investment landscape. The insights provided serve as a valuable guide for investors looking to navigate the evolving market terrain as they prepare for the opportunities and challenges of the upcoming year.