In the world of investing, successful strategies often outweigh the emotional facets that can derail an investor’s decisions. As a seasoned investor and writer for Forbes, I attribute much of my understanding to mentors who imparted invaluable financial wisdom early in my career. The tumultuous investment landscape of today reinforces the importance of sticking to foundational principles rather than yielding to fleeting trends. Through my experiences and observations shared in my writings, I’ve drawn lessons that remain relevant and beneficial, regardless of market conditions. The essence of successful investing lies not in emotional attachments or opinions, but in strategic financial decisions designed to enhance monetary growth.

Following market trends is one of the most robust tools at an investor’s disposal. I suggest relying on tested indicators such as the 200-day moving average (SMA), which serves as a straightforward gauge for market sentiment. Investors should monitor whether the S&P 500 Index is above or below this average, especially significant when assessed at month-end. Additionally, indicators like the Volatility Index (VIX) provide insight regarding market anxiety and potential reversal points. During periods of market instability, understanding such signals facilitates informed investment choices, empowering investors to navigate through uncertainties with a level head.

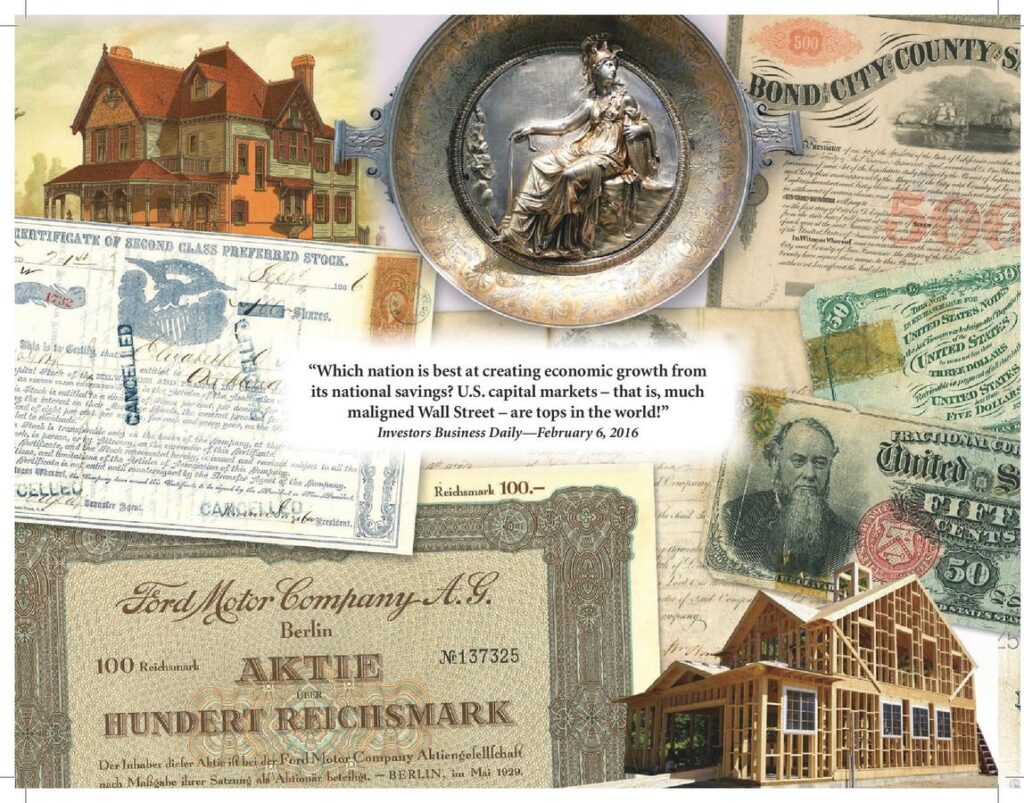

Sticking to American stocks and bonds has proven to be advantageous. While global markets may show diverse trends, U.S. investments have historically provided a stable haven. Investors in the U.S. benefit from a sophisticated financial environment that consistently draws overseas capital due to its stability and liquidity. Particularly during turbulent times, American indices have not only held their ground but thrived, reflecting a broader confidence in U.S. economic resilience. This foundation allows domestic investors the flexibility to remain fully invested within a seemingly safe and regulated marketplace, separating them from the uncertainties that can plague international investments.

In many instances, the most unassuming stocks operating in lesser-known or less glamorous sectors have outperformed the broader market. An analysis of stocks since 2000 reveals that what could be deemed “boring” is often what carries strong upside and minimal volatility. Companies that lack the spectacle typically associated with tech giants can offer stability and dependable returns, demonstrating the importance of diversification in an investment portfolio. Allocating assets across various industries helps mitigate risk, presenting an essential lesson for any investor focused on long-term success and capital preservation.

Engagement with a variety of asset classes also provides opportunities for profit through technical analysis. Despite the fascination with cryptocurrencies, seasoned investors should explore more established markets such as commodities, which have shown substantial gains. Leveraging analytical tools to track the price movements of both traditional and emerging assets helps harness volatility for profitable trading strategies. Events such as breakthroughs in Bitcoin and Ethereum pricing illustrate their tradable nature, reinforcing that the legitimacy of such assets as investment vehicles grows stronger as they demonstrate behavior similar to stocks and commodities.

Lastly, one must avoid the pitfalls of politicizing investment decisions. Historical performance metrics show no significant benefit in aligning investment portfolios with political sentiments or administrations. By examining the total investment performance across various presidencies since 1900, it becomes clear that economics will ultimately dictate market trajectories, not political ideologies. This perspective urges investors to ground their decisions in financial analysis rather than the day-to-day political climate, lending better odds to successful investment outcomes. As history suggests, adapting strategies rooted in sound financial principles far outweighs the folly of leaning into transient emotional currents.