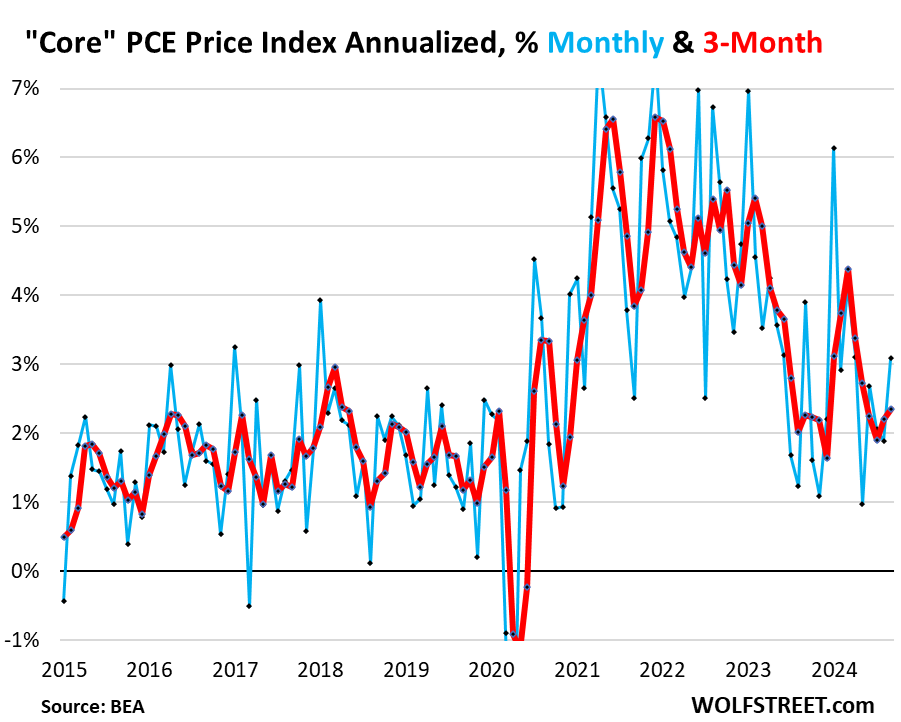

In September, the core PCE price index, which serves as the Federal Reserve’s primary measure for its 2% inflation target, increased by 3.1% on an annualized basis from August. This uptick is noteworthy, as it marks the largest month-to-month increase since April and follows a concerning trend of stagnation over the past five months, with the annual core inflation rate hovering around 2.65%. The index’s persistence above the Fed’s target reflects the underlying inflation pressures in the economy. Notably, while the overall index includes declining energy prices—which saw a sharp drop of 15.2% year-over-year—core inflation continues to signal challenges for policymakers, especially as they consider their options for monetary policy.

The acceleration in core PCE stemmed primarily from an uptick in core services, which rose by 3.7% annualized, the fastest pace observed since April, indicative of a rebound in spending on various services like housing, healthcare, and transportation. On the durable goods front, a notable reversal occurred after a string of negative readings, with the index rising by 4.0% annualized. This significant jump was primarily influenced by the price increases in motor vehicles and household goods. The changes in these core components reveal a more complex picture of inflation, suggesting that while energy prices may be falling, other areas of the economy are generating upward pressure on prices.

Analyzing inflation on a month-to-month basis, the core PCE price index’s recent trends have shown accelerated growth, with a marked increase in the three-month rates. The annualized growth rate for the three-month core index climbed to 2.35%, reinforcing concerns about persistent inflation despite its moderation in other areas. As one delves deeper into the data separating components, the results highlight that core services have remained a primary driver of inflation, with a three-month core services index rising to 3.35%, suggesting ongoing strength in domestic demand.

Interestingly, while the six-month core PCE index decelerated slightly to 2.3%, it still indicates elevated inflation levels compared to the same period last year. This variation emphasizes the need for careful monitoring of inflationary trends over different time frames, as short-term spikes could overshadow longer-term trends. Meanwhile, consistent with the historical performance of durable goods prices—typically trending negative during economic stability—the recent increases are an anomaly shaped by post-pandemic pressures and supply chain disruptions.

In contrast, the year-over-year data offers a more stable view of inflation, with the core PCE price index holding its ground around 2.65% for the past five months. The year-over-year rise in core services was slightly lower than previous records, further indicating potential stabilization, while durable goods witnessed a smaller yearly decline of 1.9%, the modest figure representing progress from earlier months. These year-over-year statistics may ease some immediate inflation fears, but they underline the challenges the Federal Reserve faces in steering the economy back to stable pricing without triggering a recession.

Overall, the mixed signals emanating from the PCE price index paint a complex inflation landscape. While the overall inflation rate—driven down by falling energy prices—reveals some improvement, substantive issues persist within core services and durable goods that could challenge the Federal Reserve’s inflation target. Policymakers must navigate this intricate economic environment carefully, balancing the need for tightening to combat inflation without stifling recovery and growth in consumer spending. The momentum in core services and durable goods will significantly influence future monetary policy decisions, ensuring that inflation remains an ongoing focal point for economic stakeholders.