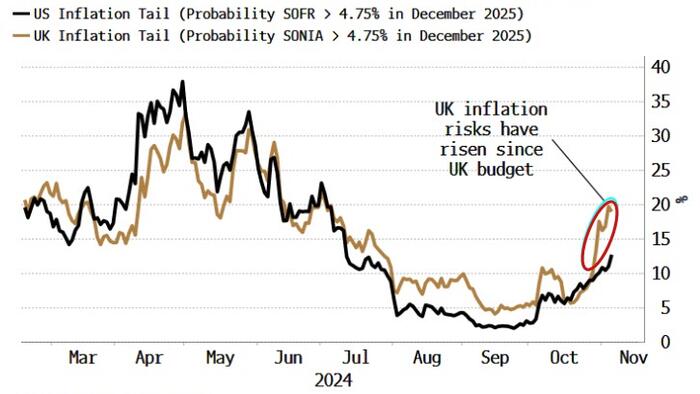

Simon White, a Bloomberg macro strategist, discusses the rising inflation risks in the UK as evidenced by the rates options market. Inflation has been a significant concern that has influenced political outcomes, notably in the United States where voters, driven by concerns about price pressures, played a crucial role in Donald Trump’s election. This trend is not lost on political leaders and parties across the globe, including the Labour party in the UK, which is keen on avoiding a similar electoral backlash. The historical context shows that economic pressures can lead to political upheaval; thus, understanding and managing inflation becomes paramount for incumbents who wish to maintain power.

In the UK, the current inflationary environment poses challenges not only for policymakers but also for the populace at large. Rising prices can erode purchasing power, leading to dissatisfaction among voters. As inflation expectations increase, the political landscape must adapt, prompting parties to take proactive measures. The Labour party’s focus on addressing inflation may play a significant role in shaping its policies and campaigning strategies as it seeks to retain voter support amidst growing economic concerns.

Moreover, the importance of hedging against inflation is underscored by the growing popularity of inflation-linked securities. Such financial instruments offer a buffer against the erosion of value due to rising prices, and their increased use indicates a shift in investor sentiment toward safeguarding against potential economic instability. This trend reflects a broader awareness of the intricate relationship between economic conditions and political stability, as inflation can directly influence voter sentiment and behavior.

In light of these inflationary pressures, political leaders are likely to emphasize their commitment to economic stability. Messaging around fiscal responsibility and measures to combat rising costs will become central themes in political discourse. By proactively addressing inflation, incumbents can mitigate fears of political backlash, as voters tend to favor parties that demonstrate effectiveness in managing ongoing economic challenges.

The interplay between inflation risks and political dynamics is evident not only in the UK but also in various global contexts. Political incumbents must navigate these turbulent waters carefully, making informed decisions that balance economic realities with the expectations of their constituents. Failure to do so could result in significant political repercussions, as seen in past elections where economic discontent directly correlated with voter turnout and preferences.

In conclusion, the rising inflation risks in the UK, as highlighted by Simon White, serve as a pivotal reminder of how economic factors influence political landscapes. Political parties, particularly the Labour party, must prioritize inflation management within their agendas to retain support and avoid the fate seen in other countries. Hedging against these risks, both financially and politically, will be essential for maintaining stability and ensuring that economic challenges do not lead to electoral fallout.