For many years, inflation loomed like the mythical White Walker of economic concerns—a ghostly fear tied to the memories of double-digit Consumer Price Index (CPI) increases. Economists often warned of historical periods defined by rampant inflation, yet the reality of consistently low inflation left many indifferent. The year 2021 marked a significant turning point, awakening a new generation of economists, including Carola Binder, to the profound role price stability plays in American economic and political landscapes. Her reflections were sparked by an unlikely 2022 Washington Post article that prompted discussions about inflation’s effects, showcasing that the handling of price stability was not solely in the Federal Reserve’s hands but intricately entwined with political power.

In her book “Shock Values: Prices and Inflation in American Democracy,” Binder embarks on an exploration of the historical complexities surrounding inflation’s twin roles as either a liberator or an oppressor within American political life. Historically, the struggle over price stability has manifested itself in debates over agricultural product prices, and opinions on achieving that stability have shifted drastically over time. For instance, Andrew Jackson, a populist president, viewed the gold standard as a protector against government overreach, antagonistic to paper money which he believed favored the wealthy. Conversely, later political figures such as William Jennings Bryan argued that the gold standard disenfranchised the common man, promoting a narrative that resonated through his famous declaration against “crucifying mankind upon a cross of gold.”

This cyclical dance of economics and politics has extended to views regarding the regulation of paper money as both a facilitator and a detriment to democracy. Abraham Lincoln, for instance, espoused a beneficial view of paper currency as a means to empower the populace, aiming for a system where “money will cease to be the master.” Conversely, periods of price controls, such as those seen during WWII under the Office of Price Administration, displayed a more interventionist state. This office monitored and enforced price control, illustrating a collective societal effort to maintain economic stability during a time of crisis—yet its extensive oversight also raises concerns that resonate with current fears of overreach.

The aftermath of inflation control efforts in the 1970s, led by Paul Volcker, heralded a retreat from direct political involvement in inflation management. The establishment of an independent central bank emerged from a consensus that less political interference would foster price stability. Politicians appeared to willingly accelerate this shift, recognizing the benefits in avoiding accountability for economic downturns while passing the responsibility for difficult monetary decisions to the Fed. This political detachment, combined with sustained low inflation, allowed most of the public and political discourse to sidestep the inflation conversation entirely—a condition that persisted until the resurgence of inflation concerns in 2021 transformed the narrative around price stability.

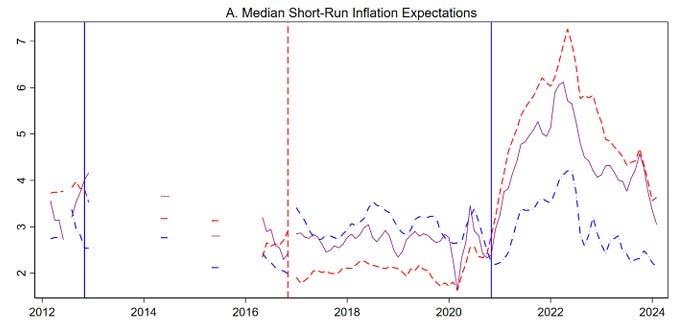

The resurgence of inflation during recent political cycles has demonstrated its potent role in influencing public sentiment. Data from Binder’s research underscores shifting perceptions based on party affiliation, revealing that inflation expectations among Republicans and Democrats diverged sharply as leadership changed due to rising inflation fears amid the COVID-19 pandemic. By early 2024, while Democratic sentiment had shifted towards more optimism about inflation, Republicans maintained higher inflation expectations, underscoring how political affiliation shapes economic perceptions. This dynamic points to an inherent link between political ideologies and economic emotions, emphasizing that inflation expectations cannot simply be analyzed as economic phenomena but rather must be viewed through the lens of political perspectives that influence them.

Furthermore, Binder’s discussions highlight the implications of governmental borrowing and the consequences of being the biggest debtor in a nation bent on controlling its currency. Irrespective of the historical context where debtors traditionally favored inflation due to its capacity to reduce real burdens, the contemporary scenario exhibits unique risks given that the government itself wields control over monetary policy. While Binder maintains that the independence of the Federal Reserve serves as a buffer against inflationary pressures stemming from governmental interests, there is an increasing realization that the long-term sustainability of such independence is uncertain. As the contours of public policy and economic stability continue to evolve, this relationship merits further scrutiny, prompting calls for a reevaluation of central banking practices and their role in shaping future inflation dynamics.

In conclusion, Binder’s examination into the interconnections between political ideology and inflation underscores the multifaceted nature of price stability in American democracy. Her historical scrutiny illustrates that the dialogue around inflation is as much about political power dynamics as it is about pure economics. The cyclical roles that advocates for and against various monetary systems have played throughout U.S. history reveal a persistent and evolving interplay between democracy and economic principles. As current inflationary pressures challenge the status quo, it may be vital for both economists and policymakers to reassess their understanding of inflation’s implications on contemporary governance and to contemplate pathways that ensure both economic stability and political accountability in a landscape increasingly defined by uncertainty.