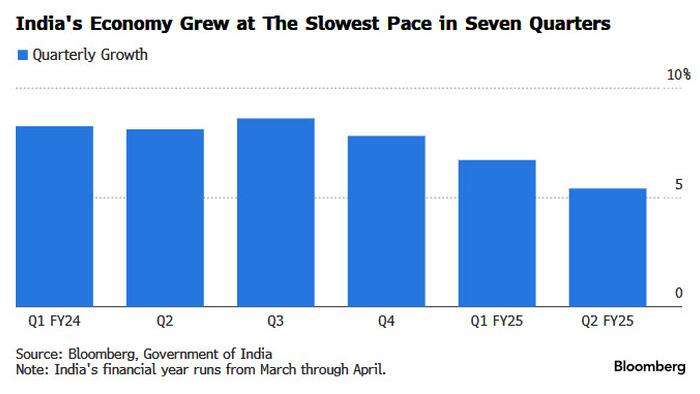

In recent weeks, the Indian stock market has experienced a notable decline connected to diminishing expectations for company earnings. This downward trend raised concerns over the sustainability of what has been regarded as a resilient stock market bubble over the past decade. A recent report confirming India’s economic performance, which revealed the slowest growth in nearly two years, adds weight to these concerns. GDP growth for the quarter ending in September hit just 5.4%, falling well short of the Reserve Bank of India’s (RBI) prediction of 7% and far below the pre-COVID growth rates of approximately 10%. The reported figures have caused economists and investment banks, such as Goldman Sachs, to reevaluate their forecasts for the country’s GDP, leading to warnings and revisions that suggest growth might be as low as 6.4% for the fiscal year ending March 2025.

The disappointing economic performance has implications for the RBI as it grapples with an economic environment characterized by strengthening challenges. With the next monetary policy meeting set for December 6, observers expect that this growth slowdown will influence decisions regarding interest rates. Although the RBI is likely to keep rates steady in the upcoming meeting, there is growing speculation that a cut may be considered in February 2024, due to the pressure mounting from these economic signals. Following the release of the GDP figures, the yield on India’s 10-year bond fell, indicating a response from the bond market to the perceived need for more accommodative monetary policy moving forward.

The economic downturn is primarily attributed to weaknesses in key sectors such as manufacturing and energy production, compounded by a contraction in the mining sector. These trends have been exacerbated by declining corporate profits, stagnant wages, and persistent inflation, which have all contributed to the economic deceleration. The RBI has maintained its policy rates for nearly two years amidst these turbulent conditions; however, Governor Shaktikanta Das has recently voiced caution regarding the timing of potential rate cuts, labeling it as a “very risky” proposition due to ongoing inflation concerns.

Amidst these developments, members of Prime Minister Narendra Modi’s administration have begun to express their worries that elevated borrowing costs are negatively impacting economic growth. A significant concern is the challenge of harnessing India’s demographic dividend—an opportunity driven by a youthful population that could potentially spur economic expansion. However, mounting joblessness, particularly among the youth, has emerged as a prominent issue in the political landscape, contributing to Modi’s less-than-expected performance in recent elections. The high unemployment rates have sparked increasing attention from voters and policymakers alike as they seek solutions to stimulate job creation.

Despite the slowdown, it is notable that India’s economy is still exhibiting growth significantly faster than that of its regional counterpart, China, where growth is projected to stall at around 5%. The contrasting economic trajectories highlight the ongoing challenges faced by both nations but underscore India’s relative resilience in a difficult global landscape. The Indian government finds itself at a critical juncture where it must navigate these economic headwinds while fostering an environment conducive to both job creation and sustainable growth.

Overall, the combination of worsening economic indicators, political pressures, and the urgent need for policy recalibration signifies a critical moment for India’s economy. As the government and the central bank evaluate next steps, the focus will need to remain on fostering growth that benefits a broad spectrum of society, while addressing the pressing matters of unemployment and inflation. The evolving situation will require careful consideration and strategic planning to ensure that India can leverage its demographic potential and return to a path of robust economic growth.