The recent economic data has stirred up concerns about inflation, as evidenced by a notable spike in the 10-year Treasury yield to 4.35%, its highest level since early July. Notably, major weather events and significant strikes have temporarily influenced the nonfarm payroll figures reported by employers. The October jobs report demonstrated the combined effects of Hurricanes Helene and Milton, which struck the southeastern United States, and strikes at Boeing that led to significant temporary layoffs in the manufacturing sector. Historically, such disruptions tend to deflate payroll figures initially; however, these figures often bounce back as affected businesses reopen and workers return.

The Bureau of Labor Statistics acknowledged that the October data reflected the disruptions caused by both the hurricanes and labor strikes. The establishment survey’s inability to isolate the impacts of extreme weather events resulted in uncertainty regarding their net effect on national employment changes for that month. Manufacturing jobs, critically impacted by the Boeing strikes, saw a sharp decline of 46,000 jobs, primarily concentrated in transportation equipment manufacturing. Consequently, the unemployment rate in the manufacturing sector rose sharply from 2.2% to 5.3%, highlighting the challenges caused by the holidays.

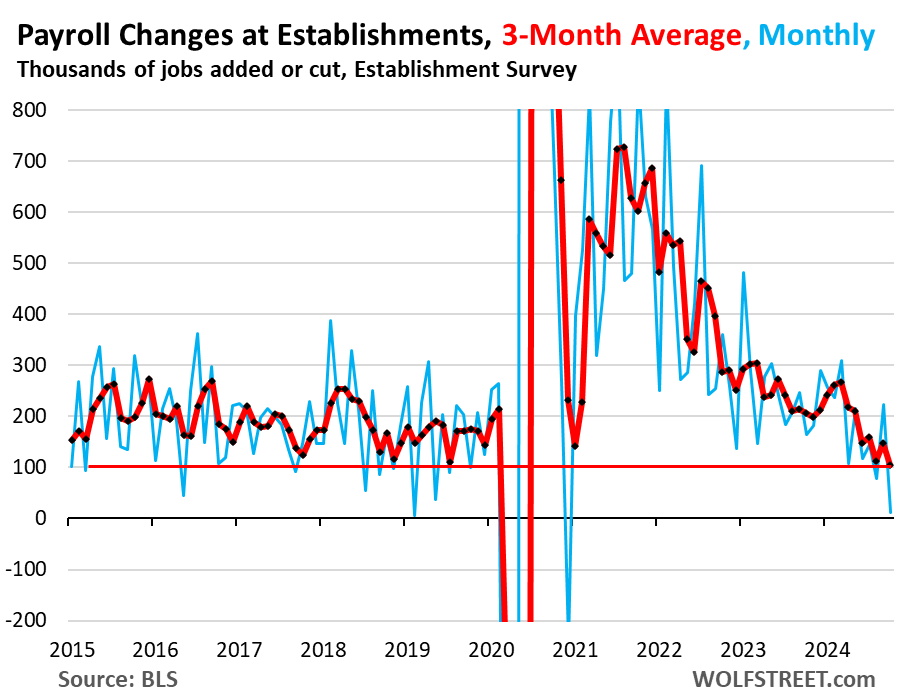

Despite these considerable setbacks, the overall payrolls still increased by 12,000 jobs in October, albeit with revisions that saw September’s job creation figures adjusted to 223,000. The three-month average of job creation fell to 104,000, indicating a possible slowdown. Nevertheless, average hourly earnings noted a significant increase of 4.5% annualized in October, the largest leap since January, suggesting continued upward pressure on wages. Year-over-year statistics indicate wage growth at 4.0%, the most substantial increase since May, which raises concerns for future inflation.

The headline unemployment rate, based on household surveys, stabilized at 4.1% in October, fluctuating from an earlier 4.3% in July. This statistic remains historically low, though it is above the tightening labor market experienced in 2022. The current unemployment rate is below the Fed’s projected median for 2024 and 2025, aligning with ongoing labor market trends influenced by an influx of new immigrants. Significant immigration is reshaping employment dynamics, with estimates from the Congressional Budget Office suggesting the arrival of around 6 million immigrants between 2022 and 2024, complicating the understanding of these figures.

An important metric in gauging labor market health is the number of unemployed individuals seeking jobs, which climbed back to 6.98 million after a recent decline. Although this figure reflects labor market trends, it does not demonstrate the changes in the labor force’s growth over the years. The unemployment rate itself accounts for these demographic shifts, presenting a rather nuanced picture of the labor market status. Crucially, the bond market responded swiftly to these developments as the workforce trends are expected to shift significantly in coming months.

Anticipation surrounds the results of the upcoming months, where a rebound in nonfarm payrolls due to the reinstatement of Boeing employees and the clean-up efforts from the hurricanes is expected. This anticipated recovery comes alongside rising average hourly wages that fuel inflation concerns. The combination of these factors pushed the 10-year Treasury yield higher, an indication that the bond market is interpreting economic data through an inflationary lens. In the wake of the Federal Reserve’s rate cuts, the growth in bond yields suggests a cautionary stance regarding future economic stability. The dynamics in labor markets, employment growth, and wage trajectories will likely be watched closely, especially by stakeholders in economic policy and finance.