As polling hours wind down and the cash market prepares for closure, recent observations have highlighted how markets historically react to U.S. elections. An analysis by DB’s Henry Allen reveals considerable variability in market responses across six elections since 2000. Specifically, the S&P 500 index saw gains in three instances and losses in three others by the end of November. Treasury yields, on the other hand, dropped following four elections and increased two times. It’s crucial to recognize that market movements typically reflect settled expectations prior to the elections. For example, in 2008, the anticipated victory of Barack Obama resulted in minimal market fluctuations, whereas Donald Trump’s unexpected win in 2016 produced a significant shift in Treasury yields. Context is further critical since other simultaneous events—like the announcement of a COVID-19 vaccine in 2020 or ongoing financial crises—have shaped market behaviors markedly.

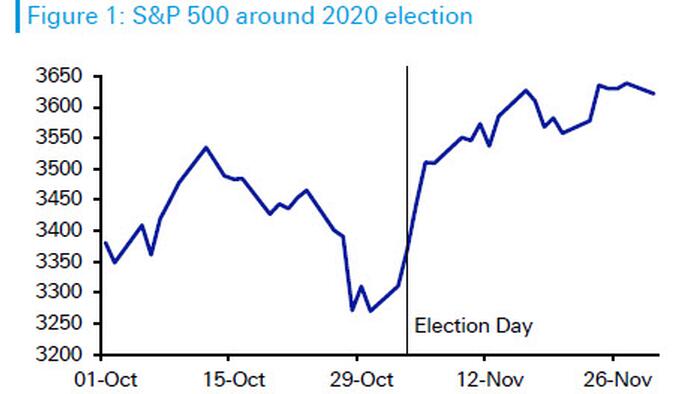

In the aftermath of the 2020 election, initial market responses were positive, fueled by prospects of a divided government where Biden’s Presidency presaged less aggressive tax policies and regulation amidst Republican Senate control. The key developments followed the tightly contested election night, as President Trump outperformed polling predictions, although Biden’s eventual victory became apparent shortly thereafter. The market was also invigorated by the outcomes of two forthcoming runoff elections in Georgia that would ultimately determine Senate control, along with the supportive announcement of a highly effective Pfizer vaccine, contributing to a significant rally in risk assets. This response underscores the multifactorial nature of market dynamics, particularly how economic trends intersect with electoral outcomes.

Contrasting sharply with 2020, the 2016 election produced a dramatic market reaction following Trump’s unexpected victory. While polls and predictions heavily favored Hillary Clinton, the reality of a Republican-controlled Congress opened avenues for substantial fiscal measures, most notably the Tax Cuts and Jobs Act implemented in 2017. Following Trump’s win, Treasury yields saw an immediate rise, with the 10-year yield climbing significantly in the ensuing days, marking a sharp and distinct market shift compared to prior expectations. This response illustrates the profound uncertainty and resultant market volatility when outcomes diverge from established predictions.

The 2012 election offers another contrasting scenario, where despite an expected outcome—a second term for Obama—the aftermath was characterized by risk aversion across markets. Concerns pertaining to the looming “fiscal cliff” and the persistent European sovereign crisis contributed to market disquiet. After the election, the S&P 500 dipped noticeably, reflecting investor anxiety over potential stagnation in legislative progress under divided government and the unresolved debt situation in Europe, which collectively dampened global confidence. Consequently, the election’s certainties were overshadowed by broader economic uncertainties, impacting market sentiment negatively.

In stark contrast, the 2008 election, while politically decisive with Obama’s win, hardly saw market movement reflective of election outcomes as it unfolded under the dire conditions of the Global Financial Crisis. The sharp downturn in market performance was driven predominantly not by electoral factors but rather by deteriorating economic conditions, such as job losses and plummeting service sector metrics. This period underscored how elections can be secondary to prevailing economic crises, as markets sharply corrected following a noteworthy decline in economic indicators that coincided with the election timeframe.

Looking back at the 2000 election, the protracted uncertainty surrounding the Florida result led to significant volatility as the electoral process unfolded. The ensuing legal disputes and recounts created an environment of ambiguity, resulting in substantial market losses during November as investors reacted to the troubling lack of clarity. This period marked the S&P 500’s poorest monthly performance for that year, reflecting the pronounced influence of electoral uncertainty on market stability. Overall, analyzing these historical patterns reveals that the interplay between electoral outcomes and other external economic variables can produce varied market responses, oftentimes unpredictable and heavily contingent upon concurrent events in the macroeconomic landscape.