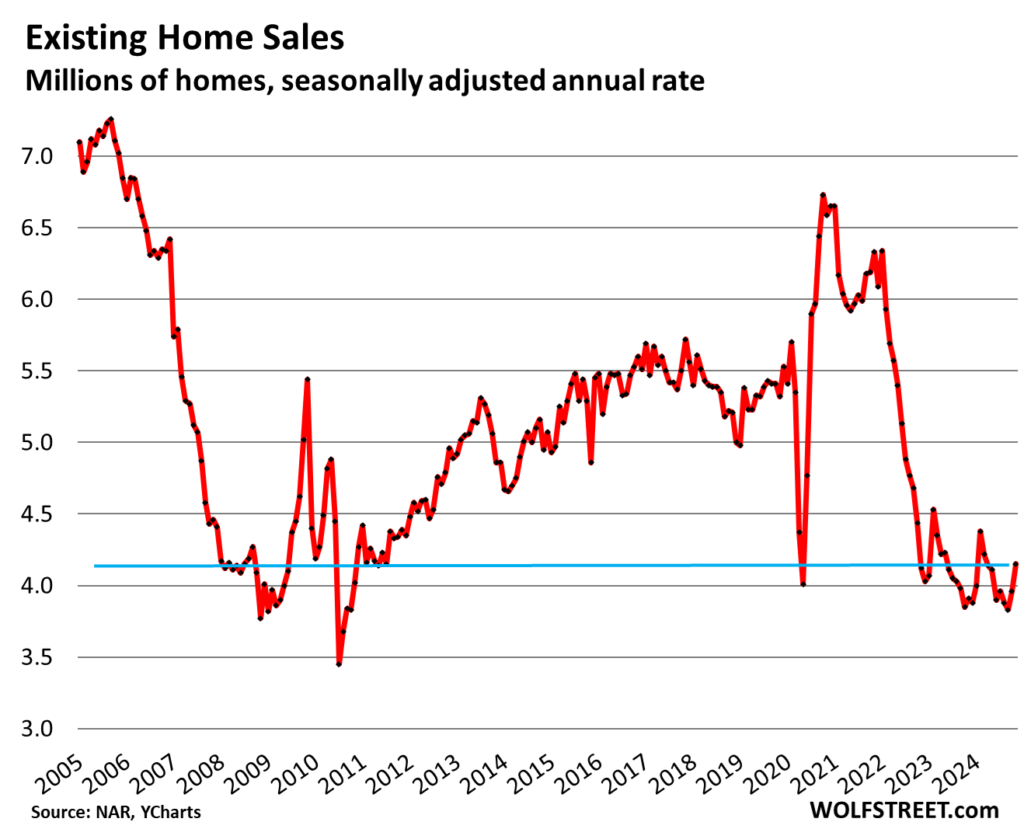

In November, existing home sales showed a slight uptick from historical lows, with a total of 315,000 homes sold, according to the National Association of Realtors (NAR). While this marks a year-over-year increase of 5% from the previous year’s very low figures—attributable to a spike in mortgage rates that briefly hovered around 8%—it still represents a striking 37% decrease from November 2021 levels. The overall seasonally adjusted annual rate reached 4.15 million homes, reflecting a 4.8% increase compared to October, yet this figure is still down by 34% from 2021 and 22% from pre-pandemic 2019. This persistent decline highlights the ongoing challenges faced by buyers grappling with high prices and reduced purchasing power, a situation exacerbated by fluctuating mortgage rates and economic uncertainty.

The significant demand destruction in the real estate market is noteworthy, with expectations for total sales in 2024 estimated to drop to around 4.04 million, marking the lowest level since 1995. This downturn contrasts sharply with the previous housing bust—the result of an economic and financial crisis—and is more directly linked to soaring home prices that surged nearly 50% from June 2019 to June 2022. Following this price escalation, mortgage rates normalized to the 6-7% range in 2023, causing further determent in buyer interest. The current real estate climate indicates that potential buyers now face a challenging landscape characterized by both high prices and elevated mortgage interest rates.

As the industry adapts to the new reality of mortgage rates hovering between 6% and 7%, experts are urging buyers and sellers to adjust their expectations accordingly. Fannie Mae, a key player in the mortgage market, has openly declared that reaching low rates similar to those seen during the pandemic may be unrealistic. With average 30-year fixed mortgage rates recently recorded at around 7.14% and Freddie Mac reporting 6.72%, the market seems poised to accept these rates as the new norm. This shift is significant, marking a departure from the historically low rates observed during the COVID-19 pandemic, which had fueled a housing frenzy characterized by rapid price increases.

The inventory of unsold homes saw a rise, with supply levels reaching their highest for November since 2018; however, the overall unsold inventory slightly dipped to 1.33 million homes due to seasonal trends. Supply, measured at 3.8 months, is considerably higher than in recent years, yet the number of days homes remain on the market continues to increase. November recorded a median of 62 days before properties were either sold or withdrawn, reflecting the current market’s struggles and sellers’ motivations. This extended duration indicates a hesitation amongst sellers, who may be reluctant to accept potentially lower offers in a market that is striving for stabilization.

The median price of single-family houses dipped modestly to $410,900, reflecting a year-over-year increase of 4.8%. However, the price dynamics demonstrate regional variability, with some metro areas experiencing price declines since mid-2022, while others continued to see slight increases even through late 2023. Notably, Austin’s housing market has experienced a significant correction, with prices plummeting by 22% from their peak, contrasting starkly with the resilience of markets like New York City. The divergent trends across different regions underscore the complexity of the current housing market and highlight regional economic conditions that affect buyer sentiment and pricing strategies.

Finally, demand fluctuations across the United States exhibit notable regional disparities. In the Northeast, the annual sales rate rose to 510,000 homes, while the Midwest saw similar increases, reaching 1 million. The Southern market displayed robust activity, accumulating an annual sales rate of 1.87 million homes. In contrast, the Western region maintained a steady sales rate of 770,000 homes, indicating varied recovery trajectories among the four Census regions. As the housing market continues to navigate through economic headwinds, the overall trends suggest a need for careful monitoring and strategic adjustments by both real estate professionals and potential buyers in the upcoming months. Overall, the current landscape is characterized by significant challenges, highlighting the necessity for adaptive strategies to mitigate ongoing demand destruction while addressing the evolving realities of homeownership.