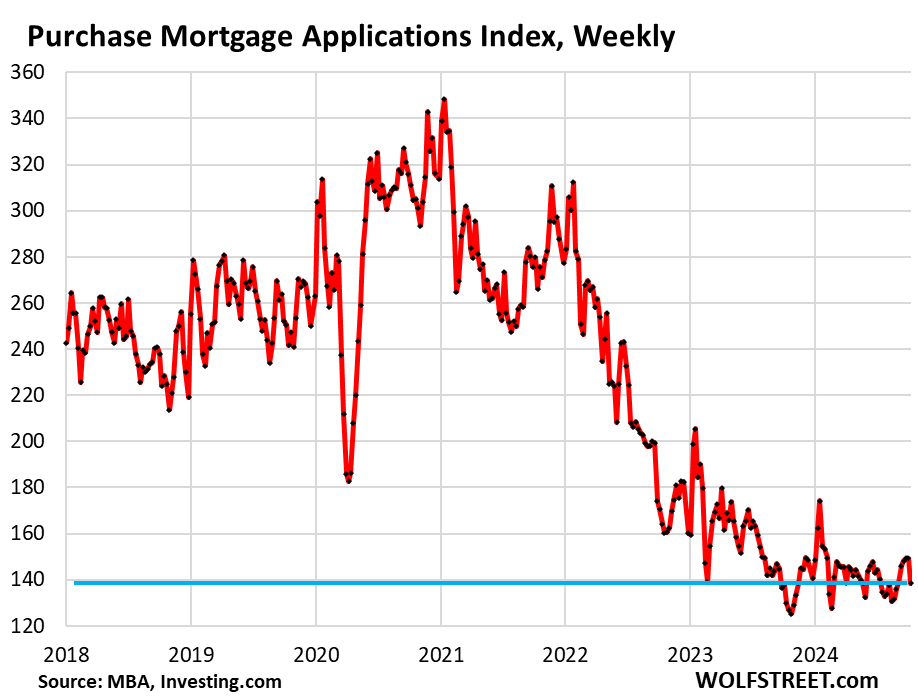

The evolving landscape of the U.S. housing market has undergone a significant transformation, characterized by an unprecedented collapse in demand for existing homes. The year 2022 marked a downturn as mortgage rates sharply rose, leading to a dramatic decline in demand that persisted into 2023, culminating in rates nearing 8% by October. Interestingly, despite a decrease in mortgage rates starting in November, demand remained stagnant at historically low levels. Not only has this demand continued to dwindle, evidenced by a drop in applications for mortgage purchases, but it has further spiraled downwards in the face of rising inventories. The crux of the issue remains clear—housing prices are simply too high for most potential buyers, resulting in what many are calling a “Buyers’ Strike.”

Further insights from Fannie Mae’s surveys confirm this sentiment. Respondents indicated that what they desire are lower home prices, reduced mortgage rates, and increased wages—essentially conditions that would render homeownership more accessible. With this general consensus, the trend of buyers refraining from entering the market becomes starkly apparent, reinforced by data from the Mortgage Bankers Association illustrating a drastic reduction in weekly mortgage applications. Affordability constraints have not only stifled demand but have led to predictions of decreased housing activity. Fannie Mae’s economists anticipate that 2024 could witness the fewest existing home sales since 1995, a sentiment echoed across the industry.

Comparing current statistics to historical data reveals the extent of the downturn. Sales of single-family houses and other residential properties have plummeted by 26% compared to 2018 and 2019, and 34% since 2021, with 2023 recording the lowest existing home sales figures in nearly three decades. Projections indicate that if current trends persist, 2024 may see annual sales contracts that fall even lower, potentially to around 4 million homes. This decline is stark and troubling, eclipsing even the demand destruction seen during the height of the Financial Crisis, underscoring how elevated housing prices have choked demand.

The dynamics of mortgage rates have further complicated this situation. After a temporary drop to a two-year low of 6.13%, re-evaluations of job growth, personal income, and inflation metrics have precipitated a sharp rise in mortgage rates, spiking to 6.52%. This dramatic reversal comes on the heels of a short-term period during which lower mortgage rates had failed to stimulate home sales, despite a surge in applications for refinancing existing mortgages as rates temporarily dropped. Instead, the rebound in mortgage rates has likely set the stage for an exacerbation of the current demand slump as buyers retreat even further from the market.

The volatility of refinancing activity reflects broader trends in buyer motivations in the real estate market. While mortgage rates had declined to some degree, resulting in a brief uptick in refinancing applications, the subsequent surge in rates has led to another sharp decline in refinancing activity. This inverse relationship between mortgage rates and refinancing applications further illustrates the challenges that potential homebuyers face in the current economic climate.

In summary, the current state of the housing market illustrates the profound disconnect between elevated home prices and stagnating demand. Affordability issues remain the primary roadblock to a more vibrant housing market, as many would-be buyers adopt a waiting strategy until prices and financing conditions become more favorable. With predictions indicating continued stagnation for the foreseeable future, the housing market appears poised for a challenging period as it grapples with the fallout from high prices and fluctuating mortgage rates. The culmination of these factors creates an uncertain landscape where potential homeowners remain on the sidelines, waiting for conditions to improve before making significant financial commitments.