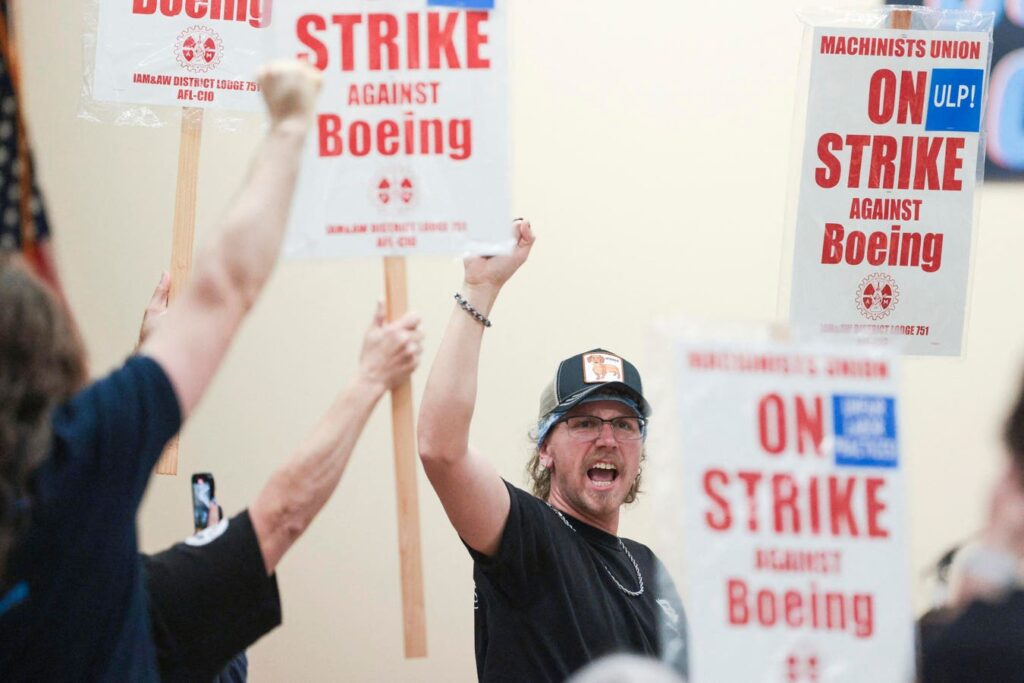

Boeing is currently navigating a turbulent phase, marked by significant challenges such as the 737 MAX disaster, supply chain disruptions, labor conflicts, and substantial financial difficulties. On September 12, 2024, union members overwhelmingly voted to strike after rejecting a proposed contract, signaling ongoing discontent among workers in the Seattle area. This rejection follows a series of setbacks for Boeing, which has struggled to rebound following periods of intense scrutiny and financial instability. Despite such troubles, seasoned investors are left contemplating whether these difficulties have already been factored into Boeing’s stock price, creating potential opportunities for growth as the company works toward recovery.

The troubles Boeing faces mirror those experienced by major automotive manufacturers like Ford and General Motors during the 2008 financial crisis. While Ford managed a turnaround by focusing on fuel-efficient vehicles and restructuring operations, GM emerged from bankruptcy with strategic leadership changes and government support. Observing Boeing’s situation, it becomes clear that a successful turnaround may similarly hinge on operational realignment, changes in leadership, and an emphasis on safety and efficiency. Investors may find hope in these parallels, as successful transformation could set the stage for a resurgence in Boeing’s stock performance.

The grounding of the 737 MAX had far-reaching consequences, not just financially but also in terms of reputation. Having spent years addressing safety concerns and actively working to regain public trust, Boeing appears to be on a recovery trajectory. The introduction of machine learning to enhance safety protocols and significant revisions of their Quality Management System indicate a commitment to improvement. With leadership changes prioritizing safety and quality management, alongside collaborative efforts with partners like Spirit AeroSystems, Boeing is laying the groundwork for a safer and more compliant future.

Boeing’s struggles are compounded by persistent supply chain issues, manufacturing delays, and labor unrest, which have significantly impacted the company’s ability to deliver on commitments. Yet, the market often factors such challenges into stock valuations over time. The company is reportedly improving its operations, suggesting that while current disturbances have led to volatility, they may not pose as much risk for long-term investors who view these as temporary setbacks rather than systemic failures. The ongoing work to resolve labor conflicts and streamline manufacturing processes may further fortify the company’s position in the coming years.

Financially, Boeing has faced considerable headwinds due to stretched cash flows and escalating debt levels. Recent reports, however, indicate signs of recovery, including improved liquidity and a stronger cash position. Data from Q3 2024 reveals resilience within the company’s Global Services segment, which enjoyed growth alongside a favorable operating margin. With a substantial backlog of orders and a renewed focus on financial stability, there are signs that Boeing could be turning a corner and that some of the toughest financial challenges may already be reflected in its stock price.

Finally, under new leadership, Boeing is undergoing a cultural transformation that prioritizes safety and transparency—qualities that are vital for both regulatory compliance and consumer confidence. This shift in focus from rapid growth to sustainable operations is crucial in reviving internal morale and external trust. For investors, the current stock price may represent a significant opportunity, as sentiment often lags operational recovery. As internal changes take root and Boeing continues to enhance its safety culture, signs of recovery may lead to a gradual restoration of investor confidence, potentially opening the door for significant stock performance improvements. For those with a long-term investment perspective, the future of Boeing may hold promise as the company navigates these pivotal changes.