The recent U.S. budget deficit figures have revealed a situation far worse than previously anticipated, continuing a trend of escalating fiscal irresponsibility associated with the Biden administration. The latest Treasury data indicates that in November—marking the second month of fiscal year 2025—the U.S. government reported expenditures of $584.2 billion, a 14% increase from the same period last year, thus setting a record for November. This follows an equally concerning record from October during a time characterized by unprecedented debt-fueled spending, suggesting that the administration’s fiscal policies are not yielding the purported economic successes. The growing budget deficit has ignited concerns among economists and policymakers, particularly as it coincides with a backdrop of stagnant tax revenue growth.

The surge in federal spending has primarily been driven by substantial increases in health, defense, and Social Security outlays, with a notable spike of $50 billion attributed to Medicare expenses alone. While tax revenues have shown modest improvement—collecting $301.8 billion in November, up from $274.8 billion the previous year—the increase remains relatively minor when juxtaposed against the monumental rise in government spending. The juxtaposition reveals a worrying trend, as the rate of expenditure growth continues to outpace revenue growth, fundamentally compromising the nation’s fiscal health. The six-month moving average of tax receipts has stagnated at approximately $380 billion, a figure that has not shown progress over the past three years.

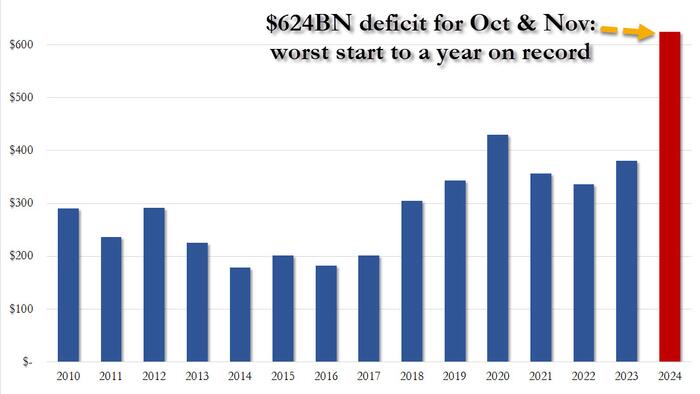

The combined budget deficit for October and November reached an eye-watering $624.2 billion, which is 64% higher than the same period the previous year and represents the worst start of a fiscal year for the U.S. Treasury on record, outpacing even the fiscal insanity witnessed during the COVID-19 crisis. Such statistics indicate an alarming trajectory for U.S. government debt, which stands at 120% of GDP following years of what critics deem reckless “drunken-sailor” spending. This shocking reality raises pertinent questions about fiscal responsibility moving forward and the ability of upcoming administrations to effectively manage and reduce such overwhelming debt levels.

Another point of grave concern lies in the rising costs associated with debt servicing. November’s gross interest payments totaled $87 billion, which had increased from the previous year. Projections suggest that December’s interest payments could surpass $150 billion, further stressing the government’s financial position. Interest payments have now reached nearly $1.2 trillion annually, becoming the second-largest expenditure category after Social Security. As this trend continues, interest payments are set to dominate federal spending, posing significant challenges for whatever administration inherits these financial burdens.

Despite recent reductions by the Federal Reserve, which have cut interest rates, the overall debt level continues to escalate, currently standing at $36.2 trillion. Even a modest decline in weighted average interest rates cannot buffer the impact of this surging debt, which likely ensures that interest payments will soon become the primary drain on federal resources. There appears to be little recourse to address these challenges, especially in light of rising opposition and political ramifications related to any proposed cuts in entitlement programs or other significant budget areas.

The recent expenditure spike underlines the monumental challenge facing future administrations, particularly challengers like Donald Trump, who are promising to rein in soaring U.S. debt levels. The fiscal landscape exacerbates the difficulties of implementing meaningful reforms and spending reductions, as the necessary cuts might provoke intense political backlash and unrest among various stakeholder groups. Given the current trajectory, the U.S. faces an imminent fiscal confrontation that could destabilize its economy further, leading to a potential collision with a debt sustainability crisis unless decisive and politically untenable actions are taken.