Goldback is set to introduce the Florida Goldback Series, expanding its unique line of gold-based currency with the addition of three new denominations: 1/2, 2, and 100 Goldbacks. Goldbacks are a novel form of fractional gold that incorporates a small amount of physical gold embedded in a polymer sheet, allowing for practical transactions in a manner similar to silver coins, rounds, and bars. Each 1 Goldback is equivalent to 1/1000th of a troy ounce of pure 24-karat gold, translating to an exchange value of approximately $5.46 based on the current gold market. However, this price reflects a significant premium over the actual melt value of the gold contained in the note, suggesting that purchasing large quantities of Goldbacks may not be the most economical choice for those interested in investing in gold.

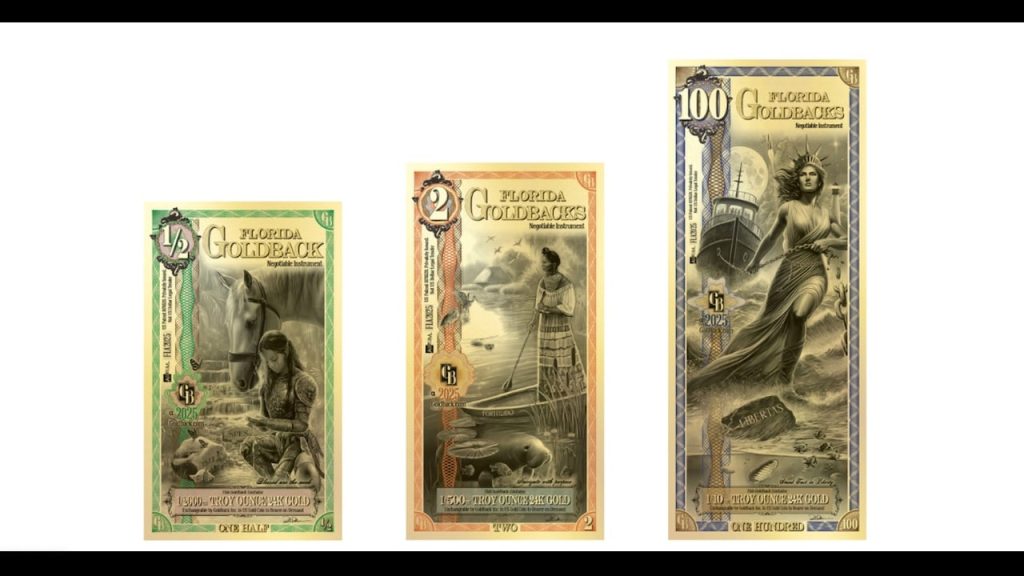

The manufacturing process of Goldbacks makes them relatively expensive for larger purchases, especially when more cost-effective options like bullion coins, bars, and rounds are available. As of now, about $200 million worth of these notes are in circulation. The Florida Goldback Series will be the sixth installment in the Goldback series, which includes notes that reference other states such as Utah, New Hampshire, Nevada, Wyoming, and South Dakota. Florida will offer denominations that align with typical currency (1, 5, 10, 25, and 50), plus the new 1/2, 2, and 100 denominations to enhance usability and flexibility in transactions. This expansion aims to facilitate everyday exchanges using gold, providing users with more options.

It’s imperative to clarify that while the Goldback notes reference states in their design, they are not legally recognized currencies of those states; their bearing state names is primarily a marketing strategy. Transactions using Goldbacks are voluntary barter processes, and users should be aware that these notes do not carry any legal tender status. Goldback CEO Jeremy Cordon has articulated their intention to create a sound money alternative that allows individuals to circulate gold without the need to sell it for dollars, thus maintaining the intrinsic value of their gold assets.

Cordon has noted that rising inflation is contributing to a growing interest in Goldbacks as individuals seek alternatives to depreciating currency. Over the past fifty years, the dollar has lost nearly 90 percent of its purchasing power, leading many to feel the pinch of inflation in their daily lives. Rising costs of essential items like food and housing are prompting consumers to consider practical alternatives for everyday transactions. Cordon stressed the significant advantages of gold in an inflationary environment, suggesting that as the dollar continues to weaken, the value of gold is likely to appreciate, creating a more favorable scenario for utilizing Goldbacks.

In discussing the comparison between Goldbacks and digital currencies such as Bitcoin, Cordon acknowledged Bitcoin’s role in the shift away from reliance on the dollar; however, he argued that physical gold remains superior for routine transactions. The immediate practicality and stability of Goldbacks provide a counterpoint to Bitcoin’s high volatility and transaction fees, which can render it impractical for day-to-day use. Cordon’s emphasis on the tangible benefits of gold speaks to a broader trend where individuals are increasingly looking for stable and reliable means of conducting business without the uncertainties commonly associated with cryptocurrencies.

As the market for alternatives to traditional fiat currency evolves, observers like Mike Maharrey, a seasoned journalist and market analyst from MoneyMetals.com, highlight the growing interest in precious metals. Supported by his background in both accounting and journalism, Maharrey presents insights into the dynamics of gold and monetary policy. The introduction of Goldback’s Florida Series could further shift perceptions regarding the usability of gold in everyday transactions, responding to an emergent demand for inflation-resistant currencies amid heightened economic uncertainty. In summary, Goldbacks offer a practical financial solution for consumers seeking to preserve their purchasing power while conducting transactions in a volatile economic landscape.