Gold prices are approaching new record highs as investors focus on the upcoming U.S. presidential election, with polls indicating a highly competitive race. The yellow metal has emerged as one of the best-performing commodities in 2024, benefiting from its status as a safe haven asset amid increasing uncertainty. This surge is further fueled by significant demand from central banks, prompting many investors to reassess their portfolios as they grapple with the unpredictability surrounding the election results.

Amidst these developments, the U.S. dollar experienced a rally following comments from Republican candidate Donald Trump, who suggested he would significantly increase tariffs, reduce taxes, and enhance consultations with the Federal Reserve. Financial market participants are paying close attention to options markets, particularly regarding the Fed’s potential interest rate cuts and the overall health of the U.S. economy. Analysts from UBS Group AG have noted an expectation for rising volatility and uncertainty until a new U.S. administration is determined, recommending that investors consider gold and oil as potential hedges during this tumultuous period.

The prevailing consensus among Wall Street economists is that Trump’s proposed trade policies could bolster the dollar. By imposing higher tariffs, the flow of dollars abroad may be curtailed, potentially leading to inflation and higher interest rates, which would adversely impact global market sentiment. Such dynamics could complicate gold’s trajectory, as the precious metal generally thrives during periods of inflation or geopolitical unrest but tends to decline when the dollar strengthens and interest rates are elevated.

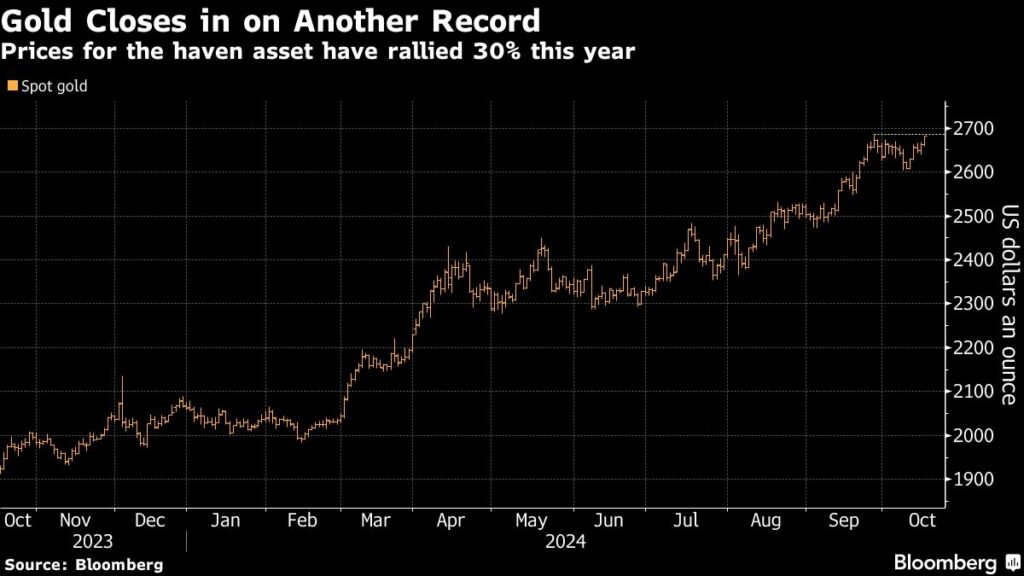

Despite the Federal Reserve’s high-interest environment over the past year, gold has continued its upward trajectory, reaching multiple record highs. Many investors are optimistic that a shift toward a more accommodating monetary policy, alongside a potential slowdown in U.S. economic growth, will fuel further appreciation in gold prices. This sentiment is echoed in recent projections from industry experts, who predict significant increases in the price of gold over the next year.

At a major annual gathering of the bullion industry in Miami, attendees forecast that gold could reach $2,917.40 per ounce by late October of the following year, marking a rise of approximately 10% from current levels. As of the latest reports, spot gold prices have climbed 0.6% to $2,679.21 per ounce, nearing the recent record high of $2,685.58 reached the previous month.

Overall, the strengthening of precious metals, particularly gold and silver, can be attributed to growing concerns over economic uncertainty and political instability associated with the upcoming U.S. elections. With gold prices up around 30% this year and all precious metals showing positive trends, the financial landscape appears increasingly favorable for safe-haven investments as market dynamics evolve against a backdrop of changing fiscal and monetary policies.