According to the International Energy Agency (IEA), the global energy landscape is transitioning towards a period characterized by lower energy prices, primarily driven by a substantial shift towards electricity. In its annual long-term report, the IEA projects that the demand for fossil fuels will plateau within this decade, with supply levels for oil and liquefied natural gas (LNG) set to increase significantly. This shift is underscored by a notable rise in electricity consumption, especially in China, forecasted to surge in the coming years. IEA Executive Director Fatih Birol indicated that unless disrupted by substantial geopolitical issues, markets will likely see downward pressure on oil and gas prices in the latter half of the decade, contrasting sharply with the heightened energy costs experienced post-Russia’s invasion of Ukraine in 2022.

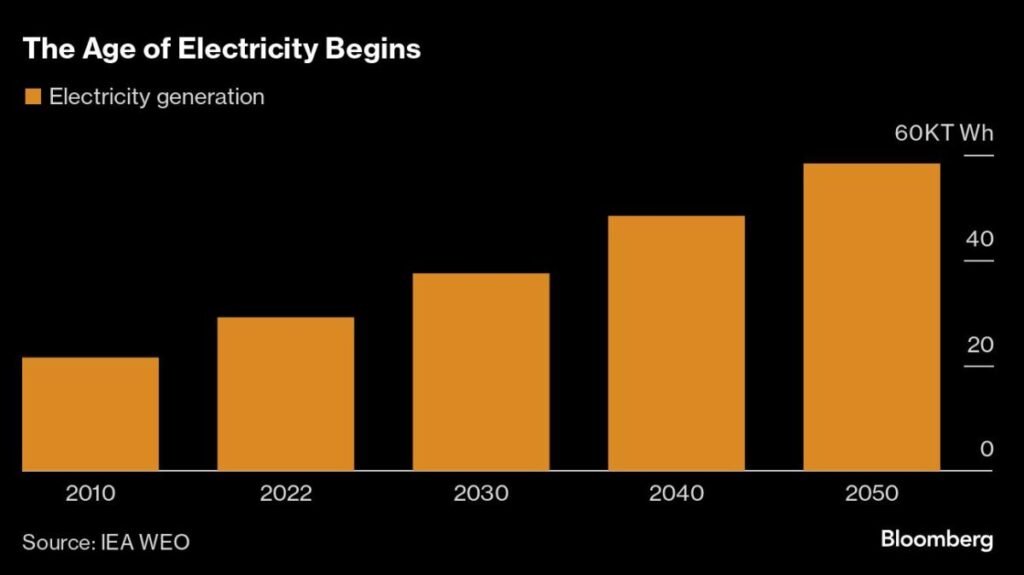

This prediction marks a departure from earlier years where skyrocketing energy prices contributed to global inflation. The report emphasizes the substantial increase in electricity use—growing at double the rate of overall energy demand over the last decade—that is expected to accelerate further. In particular, it anticipates that electric vehicles will represent half of all new car sales globally by 2030, a significant rise from the current 20%. Birol described this moment as a transition from the “Age of Oil” to the “Age of Electricity,” signifying a robust shift in market dynamics favoring electricity-driven solutions over fossil fuels.

While the IEA maintains projections of stagnant fossil fuel demand, it also highlights a corresponding increase in oil supply facilitated by new production from the US, Brazil, Canada, and Guyana. A considerable boom in LNG capacity is expected as well, with an estimated 270 billion cubic meters anticipated by 2030. Despite these trends, the agency suggests that crude prices might stabilize between $75 and $80 per barrel, contingent upon OPEC and allied nations’ decisions to trim output further. At present, OPEC+ is managing substantial spare production capacity, which could increase by 2030, implying that sustained adjustments in output will be necessary to avoid an oversupply market.

Critically, not all industry stakeholders share the IEA’s optimistic outlook regarding a rapid decline in fossil fuel’s relevance. Some major oil companies have reversed their earlier commitments to reduce fossil fuel output amid growing energy demands and market uncertainties. For instance, BP reportedly abandoned its targets to limit oil and gas production by 2030. Similarly, Goldman Sachs projects a continued increase in oil demand through 2034, contrasting sharply with IEA’s forecasts. These conflicting narratives underscore the debate within the energy sector regarding the pace at which fossil fuels will decline in favor of renewables, as some market leaders remain hesitant to abandon traditional energy resources prematurely.

On a broader scale, while the IEA acknowledges progress in reducing global carbon dioxide emissions—projecting a peak in emissions in the near term—it cautions that the world is still far from meeting essential climate targets. The data suggests that temperature increases by the end of the century could reach 2.4 degrees Celsius above pre-industrial levels, significantly exceeding the 1.5-degree goal outlined in the Paris Agreement. The surge in extreme weather events in recent years, including severe heat waves and catastrophic flooding, highlights the urgent need for effective climate action. The agency warns that both the environmental and economic costs of climate inaction are rising, further complicating the transition towards a sustainable energy future.

The evolving energy landscape reflects deeper structural changes in both consumption and production. As the transition to a cleaner energy matrix gains momentum, there will be significant opportunities for innovation and growth within the electricity sector and its related technologies. However, the path ahead remains fraught with challenges, including geopolitical volatility, market reactions to existing supply and demand dynamics, and the critical need for coherent energy policies that effectively bridge the gap between traditional energy sources and renewable replacements. As renewable capacity expands, alongside electric mobility, these factors will shape the future trajectory of global energy markets, potentially solidifying electricity’s role as the dominant energy source of the future.

In conclusion, the IEA’s report captures a pivotal shift in the energy market narrative, with indications of declining fossil fuel dependence and a rising tide of electricity consumption. While projections point towards an easing market for oil and gas, the reality of transitioning energy sources will require careful navigation of existing geopolitical landscapes and market expectations. As the world grapples with evolving energy demands and the implications of climate change, fostering investment in sustainable technologies will be critical. This will involve balancing short-term economic pressures with the long-term vision of achieving energy sustainability and resilience amid an increasingly complex global energy market.