In the latest second-quarter GDP report for 2024, the Bureau of Economic Analysis (BEA) revealed a considerable growth rate of 2.96%. This figure has ignited debate among investors and analysts, particularly those anticipating an impending recession, given the plethora of historical data that has accurately predicted economic downturns. Key indicators such as the yield curve inversion, a reduction in the leading economic index, and declining consumer confidence serve as forewarnings of a potential recession. Despite these signals, the U.S. economy has exhibited resilience, with substantial consumer spending acting as a vital engine for growth amid high inflation and rising interest rates. This article examines the implications of the GDP report, the threats to sustained economic growth, and investment opportunities in light of current conditions.

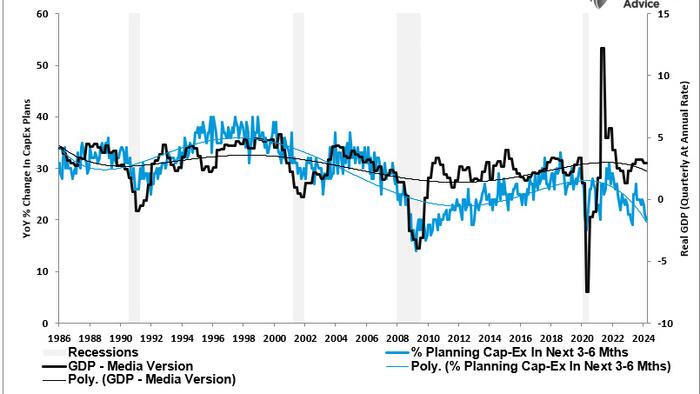

Despite an array of warnings from market analysts about a potential recession stemming from aggressive Federal Reserve rate hikes, rampant inflation, and geopolitical tensions, the GDP growth in Q2 2024 highlighted the robustness of the American economy. This resilience is chiefly manifested in strong consumer spending, which accounts for about 70% of GDP calculations, indicating that a recession remains unlikely unless spending significantly contracts. The labor market further reinforces this hypothesis; while there has been a slowdown in job growth post-pandemic, the data suggests employment is returning to long-term growth patterns. The remaining levels of job growth will help mitigate recession risks as long as they stay positive. Meanwhile, business investment, although not uniformly strong, continues to grow, suggesting that corporate expansion efforts remain a part of the economic narrative.

Investors responded favorably to the GDP report, reflecting a collective belief that fears surrounding a recession may have been overstated. Stock markets have surged, particularly in economically sensitive sectors that symbolize growth potential. When a significant number of cyclical market groups consistently perform well, as noted by Sentiment Trader, historical data shows an upward trend for equities in the following months. With recession risks deemed low, growth-oriented stocks are outpacing defensive options, as economic expansion enhances future earnings potential. This optimistic outlook has led to increased valuations in the market, driven by expectations of consistent earnings growth and a Federal Reserve stance that may further cut interest rates amid decreasing inflation.

Nevertheless, the second-quarter GDP report exposes vulnerabilities that could impede future economic growth, despite the positive indicators it presents. Foremost among these is the observed decrease in business investment. Although lower borrowing costs may stimulate some firms, constraints persist in industries affected by global supply chain disruptions and decreased external demand. Thus, if economic conditions worsen or if upcoming elections signify potential tax hikes and regulations, business investment may take a hit. Compounding these issues, the housing market is still under considerable strain due to elevated mortgage rates, limiting its response to potential rate cuts. Although these cuts may provide some relief, ongoing affordability challenges for buyers could dampen overall demand in the sector.

Moreover, while healthy consumer spending figures were evident in Q2, rising consumer debt levels—especially credit card debt—pose a significant risk. Although lower interest rates might alleviate some immediate burdens for borrowers, consumer debt remains a pressing issue, particularly as the labor market shows signs of cooling and wage growth begins to taper. A prolonged inflationary environment could further constrain household budgets, prompting a slowdown in spending. Over the years, personal consumption expenditures have been relatively stagnant despite household debt surges, indicating consumer caution may lie ahead.

In conclusion, while concerns about the economy’s trajectory are valid, particularly with heightened government spending and geopolitical uncertainties, the latest GDP report suggests that the dire predictions surrounding the U.S. economy may be exaggerated for the time being. A potential recession is inevitable at some point, whether it occurs in six months or three years; however, strategically investing in sectors and asset classes capable of withstanding both slow growth and inflation could provide valuable opportunities. As history illustrates, markets have a remarkable ability to signal forthcoming recessions, thus allowing investors to adapt their strategies in anticipation of shifts in the economic landscape. The current outlook emphasizes a focus on resilience and opportunity amidst uncertainty.