Tesla’s stock performance has recently reached remarkable heights, closing the week with shares trading at record levels. As investors renew their interest in the electric vehicle manufacturer, they are particularly focused on developments in full self-driving (FSD) technology, robotaxi services, new models to be launched in the near future, and the advancement of the Optimus robots. Year-to-date, Tesla’s shares have surged by 70%, and the company now holds a substantial market capitalization of approximately $1.3 trillion. In an interesting twist, Elon Musk addressed a Tesla short position held by Bill Gates on social media, suggesting it could eventually “bankrupt” the billionaire if Tesla solidifies its position as the world’s most valuable company.

As 2025 approaches, a team of analysts from Deutsche Bank organized a meeting with Tesla’s head of investor relations, Travis Axelrod, to discuss critical factors contributing to the company’s outstanding stock performance. The analysts highlighted four primary discussion points, including Tesla’s upcoming vehicle models and anticipated production growth in 2025. Additionally, they addressed the company’s margin outlook amid product launches while emphasizing the significance of operational efficiency and scalability across both the North American and Chinese markets. It was noted that the anticipated “Model Q” is expected to debut in the first half of 2025 at a competitive price point below $30,000. Additional models, as hinted by management, will help increase Tesla’s total addressable market (TAM) through planned vehicle releases later in the year.

Analysts also emphasized that while 2025 is earmarked for new product launches, these introductions may temporarily hinder profitability due to costs associated with early-phase production and fixed cost absorption. However, cost reductions from the introduction of more affordable products could offset these potential short-term pressures on margins. The company’s strategy appears to prioritize volume growth rather than achieving a specific gross margin percentage, signifying a shift towards enhancing profits through expansive production capabilities. Furthermore, Tesla aims to capitalize on existing manufacturing capacity and a responsive supply chain to boost volume growth, mainly in regions like China.

In terms of robotaxi developments, Tesla plans to launch its robotaxi services in California and Texas next year using existing Model 3 and Model Y vehicles. The company is adopting an internally developed ride-hail app to gain control of the ride-sharing value chain. Initial operations may include teleoperation for safety and redundancy while the company navigates regulatory challenges that are viewed as the major hurdle for broader execution of robotaxi services. Management intends to kick off this service with a company-owned fleet, adapting supply dynamically based on customer demand, which shows a strategic approach that aims to leverage operational flexibility to ensure operational success.

Tesla’s ambitious plans for the CyberCab, set to commence production in 2026, involve utilizing the innovative unboxed manufacturing process, which is projected to result in significantly lower vehicle production costs. As part of the rollout strategy, necessary investments in service infrastructure, such as wireless charging, will also be implemented. Additionally, there are positive advancements in Tesla’s FSD capabilities, with the latest updates indicating significant improvements in performance metrics enabling unsupervised use. The continuous scaling of training data sets has improved FSD adaptability, with expectations for further enhancements coinciding with robotaxi operations next year. The growing attach rate of FSD subscriptions reflects a successful marketing strategy, generating increasing interest amid upgraded offerings.

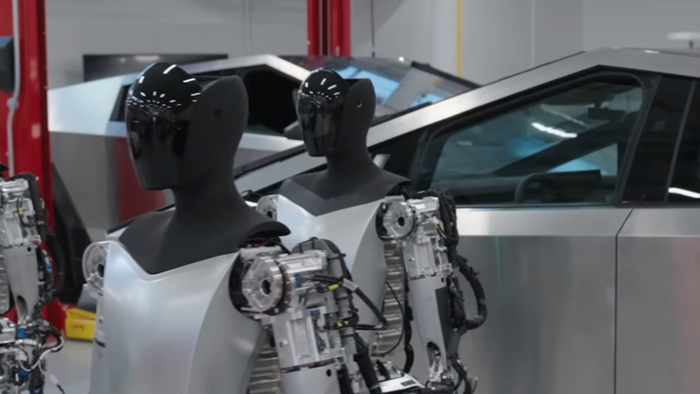

Finally, the potential of Tesla’s Optimus robot continues to evolve, with a goal of deploying over 1,000 units for internal use by 2026, eventually leading to external sales. While the initial applications focus on basic maneuvering tasks within industrial settings, future iterations aim to integrate learning capabilities that mimic human task execution. Manufacturing objectives include reducing the bill of materials (BoM) costs significantly. Broader market considerations revealed a robust demand for Tesla’s Megapack energy storage solutions, expecting over 100% growth. In light of the conversation with analysts, Deutsche Bank has increased their price target for Tesla shares, reflecting a refined valuation framework emphasizing autonomy efforts that encapsulate FSD and robotaxi prospects. Overall, Tesla’s advancements in technology and strategic market initiatives position the company favorably as it navigates the upcoming challenges and opportunities in 2025.