The recent election outcome, marking a significant shift in the political landscape, has led to Donald Trump’s decisive victory over Kamala Harris, amplifying doubts about the reliability of the polling profession. Trump not only dominated the popular vote but also secured most swing states, resulting in a Republican sweep of both the Senate and the House of Representatives. This fallout from the election is expected to overshadow the forthcoming Federal Reserve’s rate cut announcement. The anticipated decision to lower rates is now viewed as less impactful, especially in comparison to the market movements seen in September. However, it still holds significance in shaping market expectations and economic sentiment.

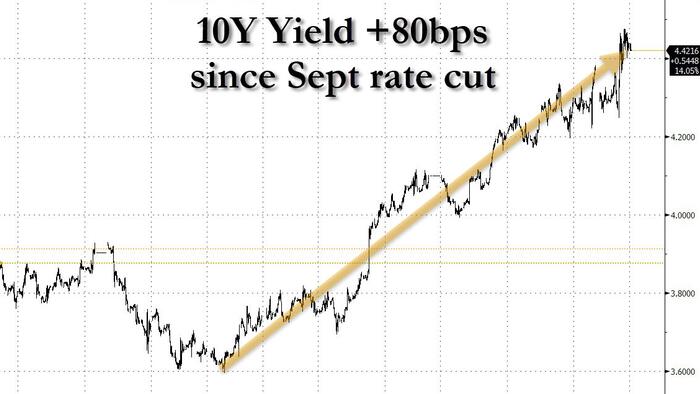

As the Federal Reserve approaches its meeting, a consensus among analysts indicates a high probability of a 25 basis points (bps) cut in November. Money markets are reflecting this expectation with an overwhelming certainty of 99.8%. This prospective rate adjustment would bring the target for the federal funds rate (FFR) to a range of 4.50-4.75%. This level aligns closely with expected trends in the 10-year Treasury yield, making the rate cut closely watched by investors and market participants.

The forthcoming Fed statement is expected to focus on the economic assessment, particularly regarding the balance of risks. Analysts are keenly anticipating how the Federal Reserve’s language will portray the current economic landscape, especially considering the recent political changes. Federal Reserve Chair Jerome Powell’s commentary during the press conference will be crucial as markets listen for any indications of the Fed’s approach to future rate adjustments in light of Trump’s victory and its implications for the economy.

Powell’s press conference is likely to emphasize a flexible, data-driven approach to monetary policy. He previously claimed that they could adjust the pace of rate changes based on new economic data, signaling a possibly cautious stance. This language supports the notion that the Fed will not rush into aggressive policy shifts but will carefully evaluate economic indicators before making further decisions. Any explicit preferences or guidance regarding the future rate path could significantly influence market perceptions and investor strategies.

In addition to observing rates, market participants will be scrutinizing Powell’s comments for insights into how the Fed anticipates Trump’s policies might shape economic conditions. The contemplation around potential fiscal policies under the new Republican leadership, such as tax cuts or increased spending, could lead to changes in economic projections and, subsequently, monetary policy. Therefore, Powell’s assessment could play a pivotal role in setting market sentiment and economic expectations for the near future.

Overall, while the imminent Fed rate cut may seem less dramatic against the backdrop of the election results, its implications for the economy and markets are substantial. The interaction between current monetary policy and the newly established political dynamics will create a complex environment for investors and analysts alike. The Fed’s forthcoming statements and Powell’s insights will be critical as stakeholders navigate the post-election landscape and its potential effects on the economic trajectory moving forward.