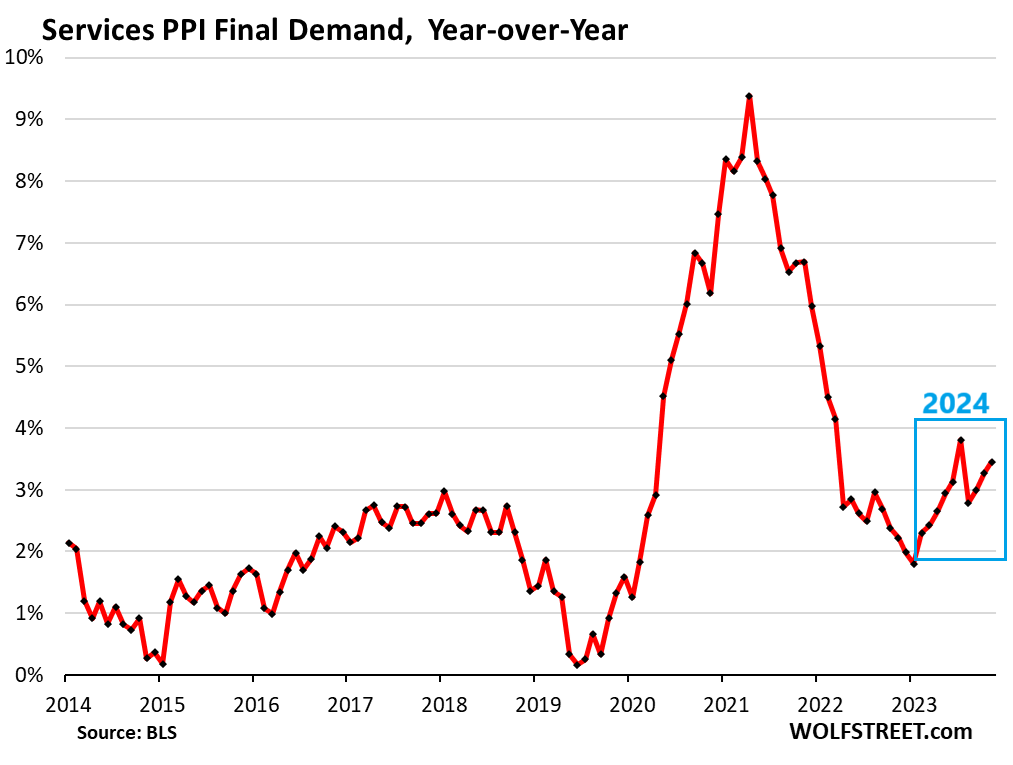

In a recent analysis by Wolf Richter for WOLF STREET, the Producer Price Index (PPI) showed a notable acceleration in inflation rates for October, driven mainly by the services sector. The overall PPI registered a 2.4% increase year-over-year, which marked an uptick from the 1.9% rise observed in September. This shift can primarily be attributed to the persistent uptrend in the services PPI, which has consistently gained momentum throughout the year and surged to 3.5% year-over-year in October. Contributing factors included increases in sectors such as portfolio management, airline passenger services, and transportation and warehousing services, indicating a broader trend where service-related costs are becoming increasingly burdensome.

The lower energy prices are playing a significant role in tempering overall inflation figures, as they have plummeted significantly since mid-2022. This decline, coupled with the turnaround in food prices—also dropping month-to-month—has helped cushion the rate of inflation, even as the services sector displays more robust increases. The PPI for final demand services accelerated to an annualized rate of 3.2% in October, while month-to-month revisions for previous months also suggested higher inflation than initially reported. Schisms in inflation calculation could be misleading, as revisions show that sectors such as outpatient care and retailing of computer hardware have seen notable price hikes.

A closer examination reveals the core PPI, which excludes food and energy prices, has remained relatively stable despite these turbulent trends in services. The finished core goods PPI rose only slightly by 1.5% annualized in October and has exhibited minimal inflation pressure for over a year. In fact, the year-over-year increase of 2.4% for finished core goods is commendable yet modest compared to service costs, illustrating that inflation has become “sticky” in services while more muted in goods.

Moreover, the revisions to previous months’ data indicate a potentially underappreciated and prevailing inflationary environment. Services PPI figures for August and September were revised upwards, and this, in tandem with rising annualized rates, suggests persistent inflationary pressure. Such adjustments impact the interpretation of inflation trends; for example, the services PPI reading for September was changed from 3.1% to 3.3%. This upward revision trend raises concerns about inflation resilience in service-oriented economies.

As energy prices continue their downward trajectory, it is crucial to assess how long this trend might persist. The decline in energy costs has acted as a buffer against rising prices in other sectors, particularly services. However, experts warn that steep energy price drops cannot continue indefinitely, and the potential for an upward reversal could significantly affect inflation trends moving forward. The interplay of stable core goods prices against rising service costs paints a complex picture of where inflation may head in the coming months.

In conclusion, while October’s PPI statistics reflect positive trends in certain sectors, such as declining energy prices and stable core goods inflation, the sustained increases in service costs highlight the need for ongoing scrutiny. The PPI’s focus on inflation for goods and services provides critical insight into where costs may shift, particularly as consumers continue to grapple with overall price stability. Moving forward, it will be essential to monitor energy price fluctuations and their influences on broader inflationary pressures, especially given the sticky nature of service costs. This analysis underscores the importance of understanding the nuanced dynamics influencing inflation in today’s economic landscape.