Flowers Foods, Inc. has distinguished itself in the financial investment community by recently earning a spot on the Dividend Channel’s prestigious “S.A.F.E. 25” list. This recognition is reserved for stocks that demonstrate exceptional dividend characteristics, and Flowers stands out with an impressive dividend yield of 4.3%. The company’s robust performance is not merely a short-term phenomenon; it boasts a remarkable history of consistent dividend growth that has persisted for over two decades. According to the latest “DividendRank” report, Flowers Foods exemplifies the qualities that make it a reliable choice for dividend investors, offering both a solid return and a strong track record.

The inclusion of Flowers Foods in the ETF Finder highlights its significance within larger investment portfolios. The company is a key component of the iShares S&P 1500 Index ETF (ITOT) and constitutes 0.26% of the SPDR S&P Dividend ETF (SDY), which signifies the confidence investors place in its ongoing financial health and dividend reliability. The $55.8 million worth of FLO shares held in the SDY illustrates how institutional investors view Flowers Foods as a sound investment. This recognition underscores the company’s viability amid a competitive landscape, particularly in the food and beverage industry.

The criteria for being listed in the “S.A.F.E. 25” are rigorous and reflect the commitment Flowers Foods has shown towards its shareholders. The “S” in the acronym signifies a solid return, which encapsulates the hefty yield and positive DividendRank characteristics of the stock. The “A” stands for an accelerating amount, emphasizing the company’s consistent pattern of increasing dividends over the years. The “F” denotes a flawless dividend history; Flowers Foods has never missed or reduced its dividend payments, instilling confidence in its shareholders. Lastly, the “E” reflects the company’s enduring commitment to dividends, with over 20 consecutive years of payments that reinforce its standing as a dependable investment.

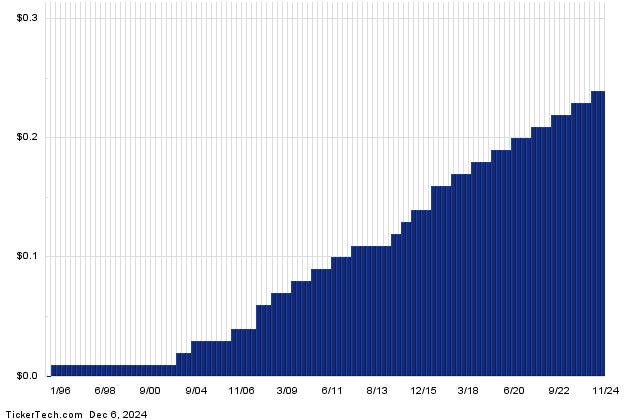

Investors interested in the current financial specifics of Flowers Foods will note that the company pays an annualized dividend of $0.96 per share, disbursed in quarterly installments. The most recent ex-dividend date, occurring on November 29, 2024, marks another significant moment in the company’s dividend timeline, as it allows current and prospective shareholders to gauge dividend eligibility. The long-term dividend history of FLO is crucial, indicating a consistent approach to returning value to shareholders over time. This history is presented in a comprehensive chart that details the steady climb of dividends, providing visual evidence of the company’s financial reliability.

Flowers Foods operates within the competitive Food & Beverage sector alongside major industry players such as Mondelez International and Kraft Heinz. The relative stability of Flowers amidst formidable competition reflects its strategic position in an ever-demanding market. The food industry is characterized by consumer loyalty and brand recognition, traits that Flowers Foods possesses through its well-regarded product lines. The long-standing tradition of quality and consistency has likely contributed to its loyal customer base and robust dividend-paying history, establishing a firm foundation for continued success.

In summary, Flowers Foods, Inc. has solidified its reputation as a top dividend stock by being featured in the Dividend Channel’s “S.A.F.E. 25” list. With a strong dividend yield, a flawless history of uninterrupted payments, and consistent increases to its dividend payouts over the decades, Flowers represents an appealing opportunity for investors seeking reliable income. Its membership in respected ETFs confirms its credibility and importance in the broader market, while its operational success in the competitive food and beverage sector enhances its attractiveness as a long-term investment.