The housing market continues to experience significant turbulence, particularly illustrated through the story of fictional homeowner Anthony Holmes, who invested heavily in a Florida property during the peak of the housing boom. Holmes purchased his house in a Tampa suburb for $550,000 in 2021 and subsequently made $50,000 in renovations, only to find himself struggling to sell after moving to Virginia for work. As he listed the house in February 2024, he anticipated strong interest, potentially even a bidding war. Instead, eight months passed without a single offer, forcing him to repeatedly lower his asking price in an attempt to attract buyers. The stark reality of the market is that, when no one shows up to open houses, the price is too high. Holmes’s experience serves as a microcosm of broader market challenges, where a significant disconnect exists between seller expectations and buyer willingness to pay.

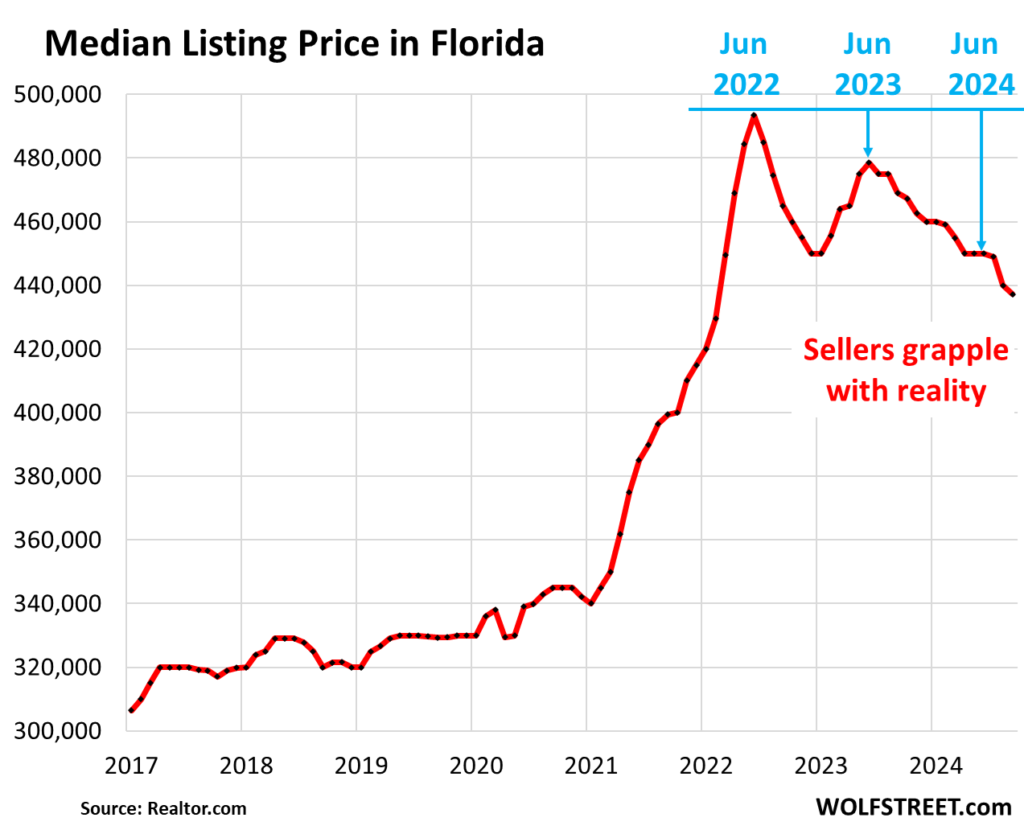

The current state of the housing market presents sobering data. By September, Realtor.com reported a median listing price of $437,251 in Florida—the lowest since February 2022—and a notable 11% decline from the seasonal peak in June 2022. Transaction prices for single-family homes have similarly fallen for three consecutive months, with year-over-year gains dwindling to just 1.5%. In addition, condo prices have been in a downward trend, marking the eighth consecutive month of decline. With sales plunging and homes remaining stagnant on the market, it’s clear that prices are struggling to align with buyer expectations. Holmes’s numerous price reductions illustrate that without aggressive pricing strategies, sellers are left in a precarious position.

Adding to the complexity of this environment is the emergence of institutional investors as net sellers. These investors, who primarily became significant players in the single-family rental market during the aftermath of the mortgage crisis, are now offloading properties in key markets like Tampa, Orlando, and Jacksonville. Their willingness to sell homes bought at lower prices puts additional downward pressure on market prices, as they aim for substantial profits even at lower price points. While Anthony Holmes is confronted with an uphill battle and a unique set of circumstances, he must contend with seasoned investors who can afford to price competitively without the emotional attachment or financial burdens that individual sellers bear.

For homeowners like Holmes, the consequences of inadequately managing property sales can be financially devastating. The longer a house remains unsold, the more costly it becomes due to carrying costs such as mortgage payments, insurance premiums, and maintenance expenses. This situation feeds a vicious cycle, where sellers who fail to receive offers may hold out in hopes of a rebound, inadvertently extending the time their property sits stagnant on the market. Moreover, as active listings in Florida saw a year-over-year increase of 35%, sellers confront an increasingly crowded field, aggravating the difficulties of making a sale.

The scope of vacancy and depreciation continues to stretch, as evidenced by the median days on market rising to 74 in September—the highest figure recorded since 2017. This statistic reflects both the hesitance of sellers to withdraw listings that fail to attract interest and the reality of slowing sales for properties that do manage to close. The escalation of days on the market symbolizes a brewing desperation among sellers who continuously opt for price reductions without grasping the necessity of a bolder strategy in a highly competitive environment.

Ultimately, Anthony Holmes’s predicament serves as a stark reminder of the volatile nature of the real estate market. His misjudgment in timing and pricing embodies the critical lesson that aggressive pricing is not just a business recommendation but a necessity. By underbidding and presenting his home competitively, Holmes could have potentially mitigated losses and expedited the sale. Instead, his hesitance in the face of declining interest further entrenches him within an increasingly difficult market, for both his future and the broader landscape of real estate sales, the adage “he who panics first, panics best” rings particularly true.