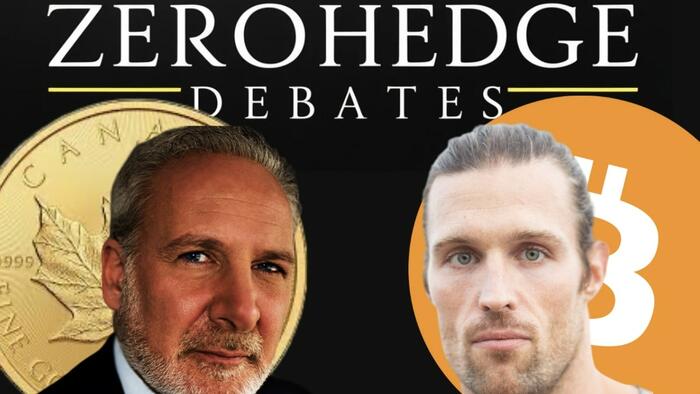

In a recent discussion featuring Austrian economists Peter Schiff and Robert Breedlove, the complexities and historical context of money were explored, shedding light on their differing opinions regarding the best form of currency. Both economists are well-versed in monetary history and recognize how governments manipulate money for various purposes. At the heart of their conversation lies the definition of money, which they break down into fundamental properties: durability, divisibility, portability, recognizability, scarcity, and its ability to act as a store of value. These attributes are the cornerstone for understanding and evaluating different monetary systems, including gold and Bitcoin, which are the primary subjects of their debate.

Schiff, a staunch advocate for gold, emphasizes its historical role as the ultimate form of money, citing its durability and intrinsic value derived from its scarcity and industrial uses. He argues that gold has stood the test of time, serving reliably as a store of value through various economic upheavals and inflationary pressures. For Schiff, the physical characteristics of gold, combined with its long-standing acceptance as a medium of exchange, solidify its superiority over emerging digital currencies. He warns against the volatility of cryptocurrencies, arguing that they lack the stability and historical credibility that gold possesses.

On the other hand, Breedlove advocates for Bitcoin as the future of money, highlighting its technological attributes and decentralized nature. He points out that Bitcoin embodies many of the properties essential for a successful currency, such as divisibility and portability, while also being scarce due to its capped supply. Breedlove argues that Bitcoin’s inherent programmability and security features position it as a more innovative and efficient form of currency compared to traditional money systems. He emphasizes that, unlike gold, Bitcoin is adaptable for the digital age, offering potential solutions to issues in current financial systems, such as inflation and government overreach.

The conversation further delves into the philosophical implications of money and its role in society, with both economists referencing Austrian economic principles to frame their arguments. They discuss how money is not just a medium of exchange but also a reflection of societal values and trust. Schiff expresses concern that Bitcoin, while innovative, may not adequately represent these values due to its speculative nature and the potential for government regulation. Breedlove, in contrast, sees Bitcoin as a revolutionary tool that empowers individuals and promotes financial sovereignty, challenging the status quo of centralized banking and state control.

As they argue their respective positions, both Schiff and Breedlove acknowledge the current economic environment characterized by excessive monetary printing and the resulting inflationary trends. They agree that understanding money’s historical context is crucial in navigating these challenges. Each economist offers insights into how their preferred form of money could serve as a safeguard against the uncertainty created by governmental actions and global economic shifts, suggesting that both gold and Bitcoin have roles to play in individuals’ financial strategies.

In conclusion, the discussion between Peter Schiff and Robert Breedlove exemplifies the passionate debate over the future of money and its various forms. Their insights highlight the essential qualities of money and the historical precedents that continue to shape perceptions of currency. While Schiff upholds the traditional view of gold as the best money, Breedlove posits that Bitcoin provides a fresh perspective for the digital age. Regardless of their differing views, both economists contribute to a deeper understanding of monetary value, history, and the implications of government manipulation, ultimately leaving the decision of what constitutes the best money to the individuals navigating tomorrow’s financial landscape.