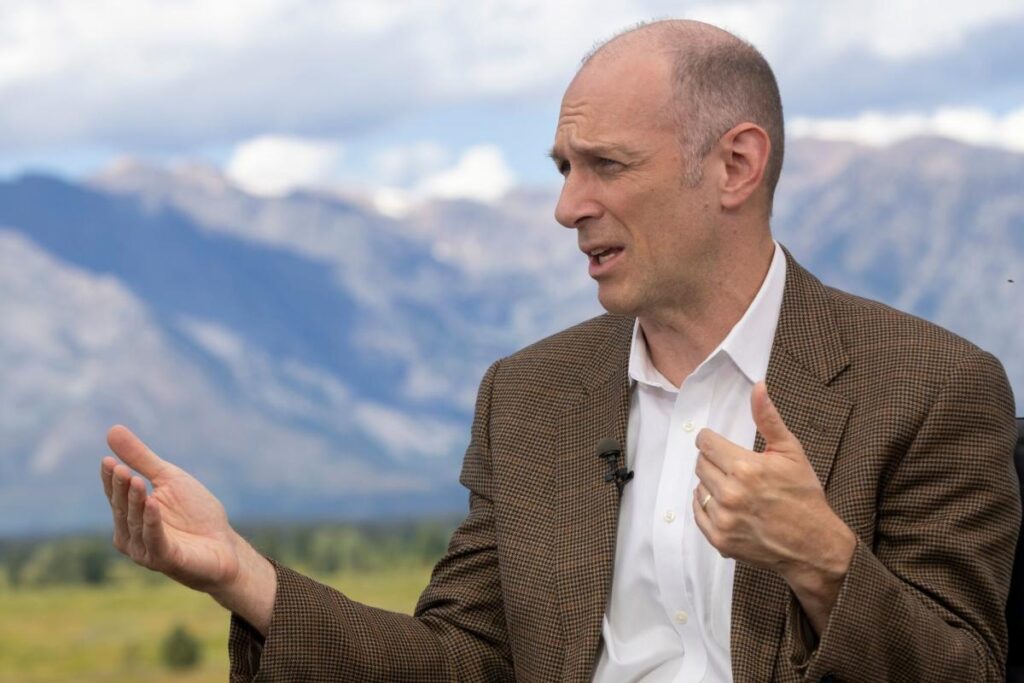

Federal Reserve Bank of Chicago President Austan Goolsbee expressed a cautious but optimistic outlook for the trajectory of interest rates in the next 12 to 18 months, contingent on inflation trends. He indicated that as long as inflation continues to trend toward the Federal Reserve’s 2% target, borrowing costs could potentially be “a lot” lower than current levels. Speaking on CNBC, Goolsbee echoed sentiments expressed by Fed Chair Jerome Powell, emphasizing that policymakers are not rushing to reduce borrowing rates dramatically. Instead, they are taking a measured approach, focused on steady progress toward price stability, which is critical for sustaining economic growth.

Goolsbee’s comments also highlight the importance of understanding the neutral interest rate—the point at which monetary policy neither promotes nor hampers economic growth. He acknowledged the existing uncertainty surrounding this neutral rate, which complicates the Fed’s decision-making process. As uncertainty persists, it becomes prudent to moderate the pace of interest rate cuts. Despite recent reductions, Goolsbee noted that current interest rates remain somewhat restrictive, implying that there is still potential for further cuts toward a more neutral stance.

The Federal Reserve had lowered interest rates by a quarter percentage point in the previous week, following a more substantial reduction in September. This move is part of the central bank’s cautious strategy to navigate economic conditions, which have shown surprising resilience. Several Fed officials, including Powell, have highlighted the economy’s robust performance as a reason to maintain a careful approach. This strategy aims to balance stimulating economic growth while managing inflationary pressures, ensuring that any policy adjustments align with overarching economic indicators.

Recent data supports Goolsbee’s viewpoint, as U.S. retail sales witnessed an uptick in October, bolstered by strong automobile sales. Additionally, revisions to previous months’ data have presented a more favorable outlook, indicating that consumers are entering the end of the year with substantial purchasing momentum. Such trends reinforce the strength of the economy, suggesting that the Fed does not need to rush into drastic monetary adjustments, as emphasized by Powell’s remarks about the absence of urgent signals from the economy.

However, while the overall economic picture appears positive, there are signs that progress towards the Fed’s inflation target has slowed. Recent reports indicated a persistent 0.3% increase in core consumer prices—excluding food and energy—for three consecutive months. This modest inflationary increase could prompt discussions among Fed officials about the appropriate timing and extent of future interest rate adjustments. As stakeholders review these developments, the Fed’s careful deliberation will be crucial in determining how to navigate potential economic challenges while remaining committed to its inflation targets.

In summary, the Fed’s current approach, as articulated by Goolsbee and Powell, is one of cautious optimism, emphasizing gradual interest rate reductions contingent on inflation progress. There is a recognition of the complexities surrounding the neutral interest rate and the strength of the economic indicators presented. Moving forward, the Fed’s decisions will strive to strike a balance between promoting growth and controlling inflation, ensuring that monetary policy remains aligned with the changing economic landscape.