On November 8, 2024, three prominent companies—Federated Hermes, Apple Inc., and Mueller Water Products—will have their shares trading ex-dividend as they prepare to distribute their respective quarterly dividends. Federated Hermes has declared a quarterly dividend of $0.31, set for payment on November 15, 2024, while Apple will pay $0.25 on November 14, 2024. Meanwhile, Mueller Water Products plans to distribute a smaller quarterly dividend of $0.067 on November 20, 2024. This event highlights a regular cycle of dividend payment that not only serves to reward shareholders but also affects the trading behavior of these stocks around the ex-dividend date.

When shares go ex-dividend, they typically experience a price adjustment reflecting the dividend paid. For Federated Hermes, with a recent share price of $40.44, the upcoming dividend translates to a reduction of approximately 0.77% in share price. Investors can anticipate Federated Hermes’ shares to open significantly lower once the market resumes after the ex-dividend date on November 8, 2024. Similarly, Apple’s stock price is expected to decrease by about 0.11%, while Mueller Water Products’ shares are forecasted to decline by approximately 0.30%. These adjustments are a standard market response, reflecting the value of the dividend being taken from the share price.

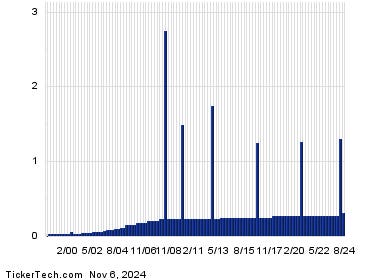

To assess the reliability and potential sustainability of these dividends, investors can analyze the historical dividend payments of each of these companies. This investigation offers insights into how consistent and stable the companies have been in providing dividends over time, which could be indicative of their future practices. For Federated Hermes, historical yields suggest a promising rate of 3.07%, while Apple and Mueller Water Products have estimated annualized yields of 0.45% and 1.18%, respectively. Such evaluations serve as critical groundwork for investors looking to understand the risk and stability of these dividend investments.

While dividends typically provide financial returns to shareholders, their fluctuation is often tied to the underlying performance and profitability of the issuing companies. Predicting dividend payouts can be challenging as they often fluctuate with the ups and downs in company earnings. Therefore, assessing past dividend distributions can offer a sense of the companies’ financial health and their commitment to returning capital to shareholders. A stable dividend history can be a reassuring sign for potential investors considering these companies for income generation.

In addition to analyzing dividends, market performance on the trading day preceding the ex-dividend date can provide context for investors. On the latest trading day recorded, Federated Hermes shares increased by approximately 1.1%, indicating positive investor sentiment. Apple also experienced a favorable uptick, with its share price rising about 0.7%. Notably, Mueller Water Products saw an even more substantial gain of approximately 2.9%. These price movements reflect broader market trends and investor reactions as they prepare for upcoming dividend distributions, suggesting a generally positive outlook for these companies.

In summary, the upcoming ex-dividend date on November 8, 2024, for Federated Hermes, Apple Inc., and Mueller Water Products marks an important financial moment for shareholders of these companies. The predictable price adjustments following the ex-dividend announcements, coupled with insights gained from historical dividend payments, illustrate the critical role dividends play in stock valuation and investment strategy. While dividends can serve as a reliable income source, their variability underscores the importance of thorough due diligence by investors. With their recent share price performance demonstrating positive investor sentiment, these companies appear poised for continued shareholder engagement as they navigate the complexities of dividend distributions.