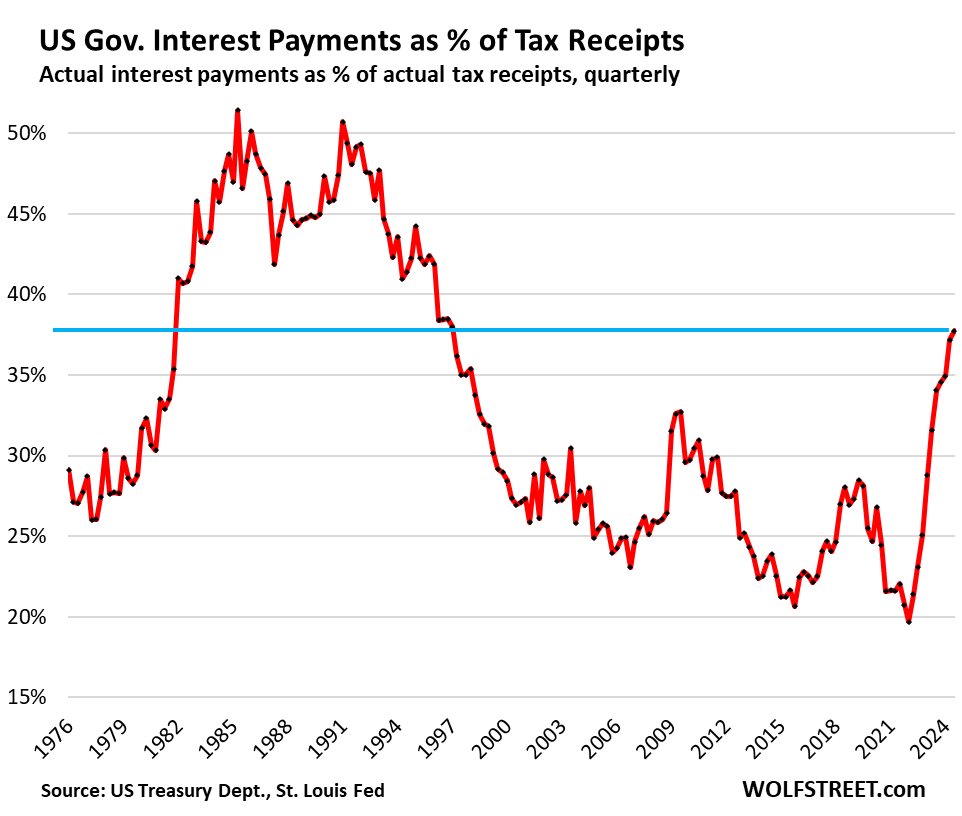

The recent surge in the U.S. national debt and its consequences on interest payments is alarming, as articulated by Wolf Richter in his analysis. The national debt, which has escalated to an extraordinary $36.1 trillion, has led to a significant spike in interest payment obligations that now consume an unprecedented percentage of tax receipts. In the third quarter of 2023, the ratio of interest payments to tax receipts reached 37.8%—the highest level recorded since 1996. This situation mirrors concerns originating from the 1980s, when similar fiscal distress prevailed. With interest payments rising dramatically, exceeding $279 billion in Q3 alone—15% more than the previous year—there’s a pressing need to scrutinize how these obligations are shaping the federal budget and the economy at large.

While tax receipts have also increased in nominal terms, rising by 4.1% to $740 billion during the same period, this increase is not sufficiently keeping pace with burgeoning interest payments. It is crucial to recognize that tax revenue can fluctuate significantly, heavily influenced by capital gains taxes which can surge during bullish market conditions. Notably, the tax receipts in early 2022 saw a windfall attributed to capital gains taxes, thanks to remarkable market performance in 2021. However, as financial markets struggled in 2022, tax receipts fell sharply in the subsequent quarters. The evolving nature of the markets—and the associated taxes—means that while there could be improvements in tax income in 2024, the more extensive economic landscape remains precarious.

The dynamics of tax receipts are strongly connected to employment rates, wage growth, and business profitability, with inflation also playing a pivotal role in boosting nominal tax revenues. However, it is essential to clarify that the tax receipts measured by the Bureau of Economic Analysis (BEA) focus on funds available for general government expenditures, which excludes dedicated funds like Social Security. The rapid accrual of interest obligations is thus becoming unsustainable, particularly given annual borrowing of $2.1 trillion even in a strong economy, raising questions about the federal government’s fiscal priorities and strategies.

Further complicating matters is the nation’s rising Debt-to-GDP ratio, which hit 120.8% in Q3 2023, signaling an unsustainable fiscal posture. The sharp spike in this ratio draws attention to the troubling trajectory of national debt relative to the country’s output—a scenario that unfolded essentially due to stimulus programs during the pandemic lockdown and has continued through fiscal management practices post-lockdown. The recovery had provided a brief decline in the ratio as GDP grew faster than the debt, but a reversal is evident as national obligations now increase more rapidly than economic output.

The historical context highlights systemic issues in fiscal management, with the massive accumulation of debt occurring in an era bolstered by the Federal Reserve’s low-interest-rate policies from 2008 to 2021. This prolonged easy monetary policy environment has created what many consider an unsustainable fiscal situation. With policymakers facing rising pressures, the notion of addressing the resultant fiscal disarray looms large, whether through inflationary measures or legislative actions needed to rein in spending and enhance revenue streams.

While the U.S. government controls its currency, which circumvents direct default risk, the prospect of entanglement in rising inflation and long-term interest rates is increasingly probable. This scenario threatens to upend economic stability and weighs heavily on both current and future taxpayers. The fiscal environment resembles a ticking time bomb, with debt levels soaring and interest obligations consuming a substantial share of fiscal resources, prompting a call for urgent attention to these imbalances for sustainable economic policy going forward. The situation necessitates vigilant monitoring and proactive policy solutions to mitigate risks and uphold the integrity of future economic growth.