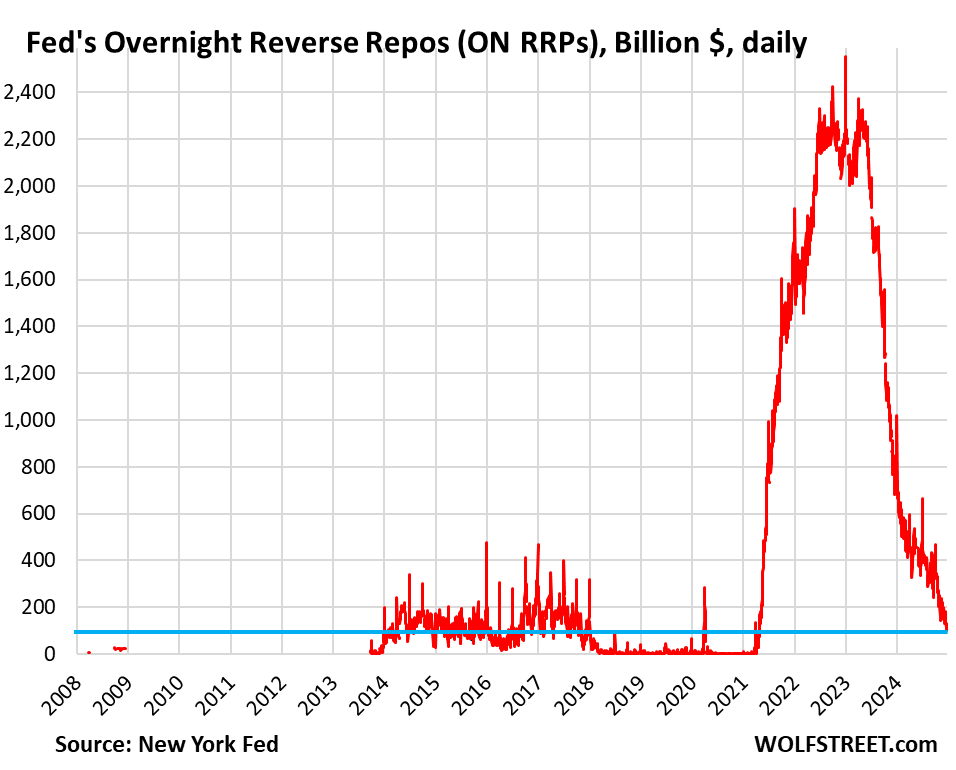

Since the initiation of Quantitative Tightening (QT) in July 2022, the Federal Reserve (Fed) has solely focused on draining Overnight Reverse Repurchase agreements (ON RRPs) without affecting reserves. As of recent data, ON RRP balances have significantly declined to $98 billion, marking a notable decrease from the $2.4 trillion peak at the end of December 2022. This decline indicates a move towards the desired normal levels akin to those seen before the pandemic, where ON RRP balances were near zero. The Fed’s preference is to bring these balances down as part of a broader strategy to manage liquidity in the financial system, though it still has a considerable distance to travel in achieving this objective.

In an effort to expedite the reduction of ON RRP balances, the Fed made a decision to lower its offering rate by 5 basis points, in conjunction with a broader 25-basis-point cut to its five policy rates. With the offering rate now set at 4.25%, it aligns with the lower end of the Fed’s target range for the federal funds rate. This change is aimed at encouraging money market funds (MMFs) to withdraw their cash from the Fed’s facility. By directing funds towards other investment opportunities that yield higher returns—such as repos or Treasury bills, which currently offer yields exceeding those of the ON RRP—the Fed seeks to stimulate market activity and maintain appropriate liquidity levels.

Money market funds play a crucial role in utilizing the ON RRP facility as they store excess liquidity generated during previous Quantitative Easing (QE) measures. This liquidity is essentially funds that financial markets find difficult to deploy elsewhere, leading to their deposition at the Fed as a safe asset. As part of the ongoing QT process, the Fed has successfully drained $2.1 trillion from the markets, with virtually all of this liquidity stemming from ON RRP balances. Conversely, reserves held by banks at the Fed have remained stable at approximately $3.28 trillion, suggesting that the Fed’s efforts regarding QT have not yet commenced in a substantive way affecting reserves.

Reserves are essential for banks, as they facilitate transaction settlements and earn interest from the Fed. Currently, the interest on reserves (IOR) stands at 4.40%, functioning as one of the Fed’s key policy rates. The Fed’s goal with QT is to gradually reduce reserves from a state of “abundance” to a more “ample” level. However, the specific definition of “ample” remains ambiguous for the Fed, complicating the strategy to achieve the appropriate reserve levels. Despite the significant reduction in ON RRP balances, QT has yet to make a tangible impact on reserve levels, indicating that the Fed has more adjustments to make before reaching its desired liquidity conditions.

Historically, the ON RRP offering rate is aligned at the bottom of the federal funds rate target range. Under normal market conditions, ON RRP balances typically trend towards zero, as evidenced by historical data. The Fed had previously adjusted the ON RRP rate in mid-2021, and until the recent cut, it had consistently remained marginally above the bottom of the federal funds rate target range. The current monetary strategy and market dynamics reflect the Fed’s responsive approach to managing liquidity and interest rates while systematically navigating its QT policy to ensure stability in the financial system.

In conclusion, the battle to effectively manage liquidity through QT highlights the Fed’s careful balancing act. With the ON RRP balances on a steady decline yet reserves remaining intact, the central bank has not yet started addressing reserve levels actively. As money market funds are encouraged to explore other investment avenues due to lower ON RRP rates, the Fed aims to gradually reshape the liquidity landscape. However, substantial work lies ahead to transform reserves from a state deemed “abundant” to strategically “ample,” requiring ongoing analysis of market conditions and careful policy adjustments. The road ahead for the Fed involves both quantifiable measures and market sensitivity to the evolving economic landscape, as it strives to navigate its monetary policy goals effectively.