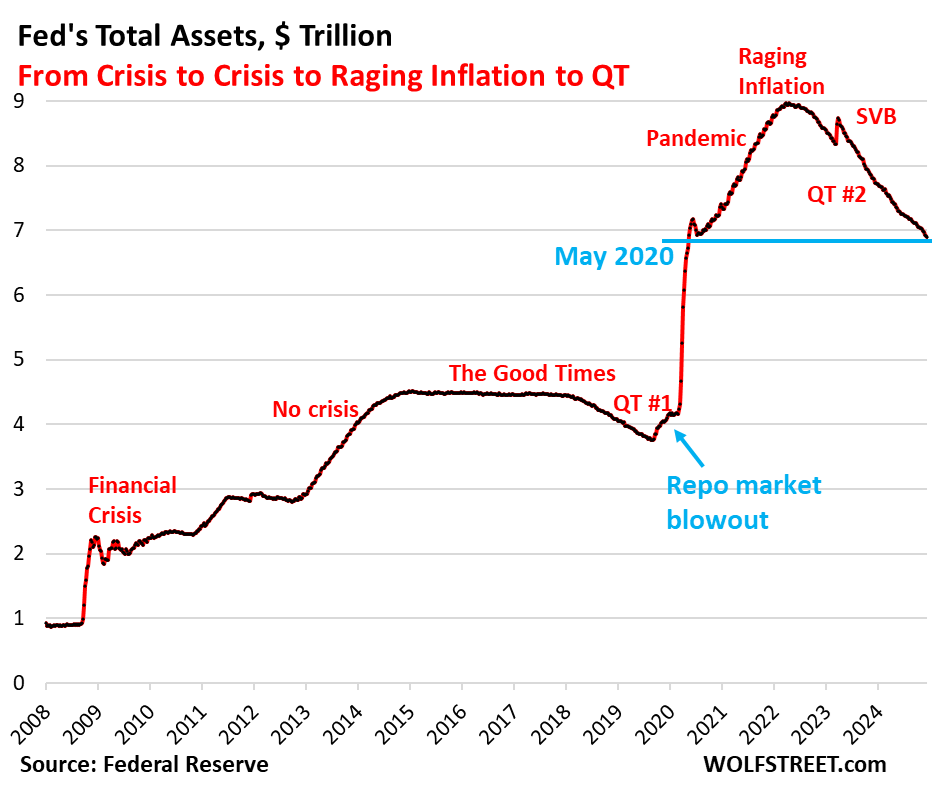

In November 2023, the Federal Reserve’s balance sheet experienced a significant reduction in total assets, with a decline of $98 billion, bringing the total down to $6.896 trillion – the lowest level since May 2020. This development results from the ongoing quantitative tightening (QT) measures initiated after the end of the pandemic-era quantitative easing (QE) in April 2022. Since that time, the Fed has reduced its asset holdings by $2.07 trillion or 23% of its total assets, with a notable 43% reduction of the assets accumulated during the pandemic QE phase. A key contributor to this significant drop was the Bank Term Funding Program (BTFP), a facility launched in March 2023 to mitigate bank liquidity concerns following the collapse of Silicon Valley Bank (SVB).

The BTFP, which is set to vanish completely by March 11, 2025, saw a reduction of $39 billion in November alone, reflecting a 77% decline from its peak. The BTFP’s decline illustrates the rapid cooling of bank liquidity demand as its mechanism proved flawed. Initially designed to offer terms based on market rates, it inadvertently created opportunities for banks to profit through arbitrage, leading to inflated borrowings under the program. In light of these challenges, the Fed decided to revise the terms of the BTFP, and ultimately let it expire, signifying a substantial tightening of the financial landscape.

Other asset categories also contributed to the overall asset reduction. Treasury securities fell by $24 billion in November, marking a cumulative decrease of $1.46 trillion since their peak in June 2022. This reduction is significant, as the Fed has shed 45% of the Treasuries acquired during the pandemic period. Meanwhile, Mortgage-Backed Securities (MBS) saw a decline of $17 billion, amounting to a total reduction of $491 billion from their peak. The disposal of MBS slowed considerably due to the ongoing decline in the housing market, with lower rates of mortgage refinancing and home sales diminishing the Fed’s cash inflow from MBS investments.

Despite the easing of stress from bank liquidity concerns, the Fed’s remaining bank liquidity facilities show mixed results. The Discount Window, a traditional liquidity provision for banks, rose slightly by $830 million to $2.4 billion – well below the $153 billion peak experienced during the March 2023 panic. Fed Chairman Jerome Powell has been pushing banks to utilize the Discount Window more actively, despite its perception as a source of last resort. The Fed’s ability to promote this facility reflects increasing qualitative pressures following recent financial market upheavals.

The balance sheet’s decline was also attributed to various other minor factors beyond the major asset categories. Approximately $16.2 billion in additional reductions came from accrued interest on bond holdings and the amortization of bond premiums. When the Fed received interest payments, it effectively destroyed that money, thereby contributing to the downsizing of the balance sheet. The amortized losses from the Fed’s bond purchases during the QE period have also resulted in a gradual decrease in unamortized premiums, which currently stands at $252 billion, down from a higher level in late 2021.

As the Fed continues to gradually unwind its sizable balance sheet, the implications of QT, the challenges of managing liquidity facilities, and the impact on broader economic conditions loom as critical considerations. Policymakers face an intricate balancing act; while the objective of QT is to normalize monetary policy following an extended period of ultra-low interest rates and excess liquidity, the associated risks of economic slowdown and financial instability remain substantial. Observers of the Fed’s forthcoming actions will undoubtedly monitor future monetary policy moves with cautious anticipation as the financial system reacts to these ongoing developments.