In the wake of a closely contested U.S. presidential election, which may not conclude swiftly due to a tight race between Vice President Kamala Harris and former President Donald Trump, central banks across the globe are expected to implement interest rate cuts. The Federal Reserve and other central banks responsible for over a third of the global economy will navigate this uncertain political landscape as they set borrowing costs. Economists anticipate a quarter-point cut from the Federal Reserve after a recent half-point reduction in September, particularly in light of disappointing employment data. This financial strategy reflects a continued intent for gradual adjustments in monetary policy, as officials seek to address economic concerns without becoming entangled in political conflicts.

Markets are jittery regarding the possible outcomes of the election and potential changes in U.S. trade policies. Economists highlight the significance of the presidential victor’s ability to influence international trade dynamics and express concerns about the repercussions of Trump’s tariff threats. Similar to the U.S. case, central banks outside the United States are also grappling with economic growth slowdowns and inflation challenges. As policymakers from countries such as the United Kingdom, Sweden, and the Czech Republic prepare for possible rate cuts, others like the Reserve Bank of Australia may choose to delay actions based on persistent inflation pressures. The overarching uncertainty in the election is set to contribute to a prolonged decision-making process among these monetary authorities.

Beyond the U.S., the week will see significant economic data released, providing insight into the health of labor markets and productivity in both the U.S. and Canada. U.S. economists are looking forward to reports on productivity growth, service sector activity, and consumer sentiment, while the Bank of Canada will assess recent job statistics. A surprisingly strong report from September highlighted resilience in Canada’s labor market, prompting speculation about the subsequent labor survey results. Meanwhile, in Asia, multiple countries will be releasing inflation updates and GDP data, further informing central bank strategies across the region.

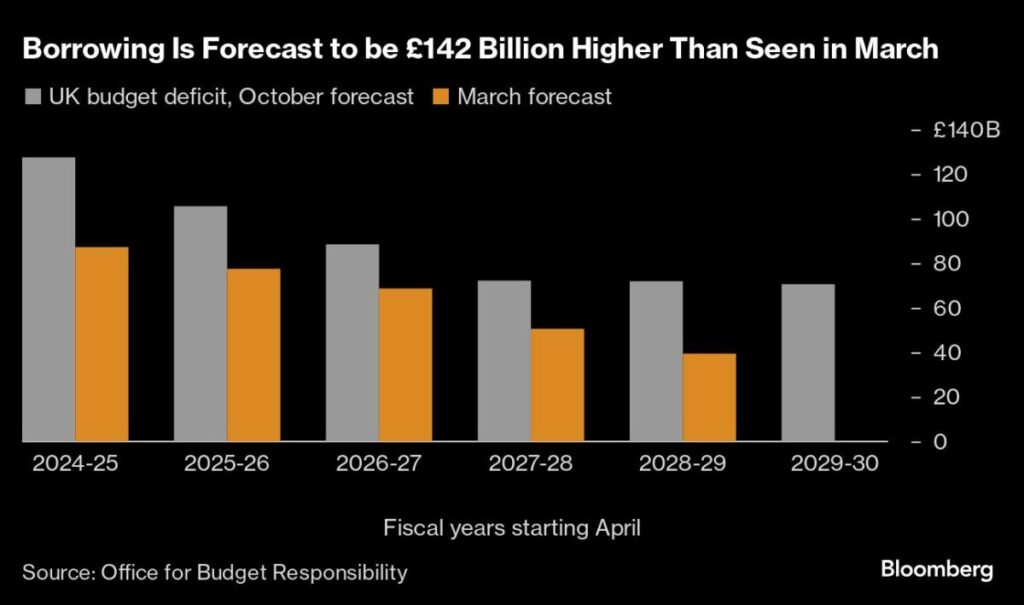

European monetary authorities are also bracing for significant developments, with the Bank of England anticipated to lower rates amid rising concerns over the budget and borrowing costs. The Swedish central bank is likely to respond to a stagnant economy with its own interest rate reduction. Despite varying economic indicators, there is a consensus among analysts suggesting that many European central banks are leaning toward easing policies to bolster economic growth and curtail inflation risks. Other nations, such as Norway and Poland, may maintain their rates, looking for signs of economic stabilization before making policy decisions.

In Latin America, Brazil stands out with expectations of a rate hike, given recent inflationary pressures. The central bank’s actions may provide insight into its strategies for managing rising price levels. Peru’s central bank is projected to decrease rates slightly, while Colombia is expected to continue its easing cycle in response to local economic conditions. As the region wrestles with inflation volatility, the mixed policy responses from various central banks further reflect the diverse economic landscapes and varying degrees of inflationary challenges faced across Latin American nations.

Overall, the upcoming week presents a complex tapestry of decisions as central banks worldwide balance the imperatives of their domestic economies against a backdrop of geopolitical uncertainty shaped by the U.S. elections. The integration of election outcomes into monetary policy discussions is particularly pronounced, as central banks navigate the delicate interplay between economic stability and political developments. With the political landscape shifting and economic indicators showing signs of distress, monetary authorities are poised to adopt strategies that cater to economic resilience while cautiously analyzing the implications of global trade dynamics and electoral outcomes.