The quest for the American Dream, once considered an attainable goal for many, has become increasingly elusive, particularly in light of the rising cost of living. Although the pandemic initially spurred wage growth that improved real income levels for some households, this increase came after decades of stagnant wage growth that failed to keep pace with inflation. Compounding this issue, housing prices have skyrocketed due to a limited supply of homes. Since the peak of construction in 2006, homebuilding has plummeted by 55%, which has exacerbated affordability challenges in the housing market. Such economic dynamics make it increasingly difficult for even those with competitive salaries to achieve significant financial progress.

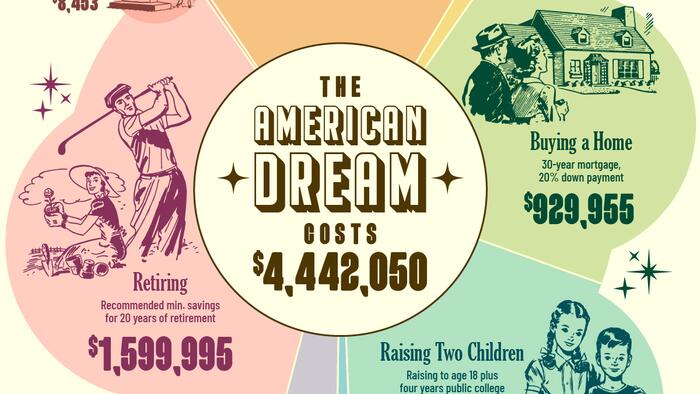

According to analysis from Investopedia presented by Visual Capitalist’s Dorothy Neufeld, the estimated lifetime cost of realizing the American Dream averages a staggering $4.4 million per household as of 2024. This figure exceeds the average lifetime earnings of individuals holding Bachelor’s degrees—$3.3 million for men and $2.4 million for women—making the dream financially out of reach for many. Breaking down this substantial figure reveals the significant expenses that contribute to the overall cost of achieving the American Dream, which encompass homeownership, child-rearing, education, and retirement.

A considerable portion of this cost, approximately $1.6 million, is attributed to retirement savings, reflecting the need for a robust nest egg to sustain oneself for two decades post-retirement. This figure is based on a 4% annual withdrawal rate, necessitating careful planning in light of average inflation rates of around 2.5%. The decline of private pension plans has severely impacted financial security for future retirees, making it challenging to replicate the financial safety nets that previous generations may have enjoyed. As a result, many individuals face the daunting reality of needing to save more aggressively to secure their futures.

Homeownership ranks as the second-largest expense, at an estimated $930,000 for purchasing an existing single-family home. The dramatic rise in housing costs has led to a stark reality: a reported 77% of U.S. households in 2024 are unable to afford a median-priced home. This statistic underscores a significant barrier to achieving one of the cornerstones of the American Dream, as rising property values often coincide with stagnating wages. As housing remains a critical wealth-building asset, this barrier has considerably hindered many from achieving financial stability through property ownership.

In alignment with the increasing costs of living, raising children has also become exceedingly expensive. The lifetime cost of raising two children, including their education, is estimated at $832,000, with financial concerns cited by 36% of Americans under 50 as a reason for not having children. College tuition has risen drastically, with a shocking increase of 748% since 1963 when adjusted for inflation. This surge in educational costs places additional financial strain on families, contributing to a cultural shift where parenthood is reconsidered amid economic pressures.

Furthermore, cultural milestones such as weddings have seen significant cost inflation as well. From 2019 to 2023, the average expense of weddings increased by $4,000 due to inflation and pandemic-related delays, reaching over $44,000. This encompasses not just the ceremony but also the reception and engagement ring. Increased wedding costs highlight another aspect of the financial burden that underscores the growing distance from the traditional American Dream. To better understand how some of these factors collide with housing, visual data on the average salary required to buy a home in key U.S. cities offers additional insights into the financial landscape that potential homeowners must navigate today.