In a bid to capitalize on the soaring demand for gold among retail investors, CME Group Inc. is set to launch a one-ounce gold futures contract in January, following a remarkable price surge of gold from $2,000 to $2,630—a 32% increase. This new contract is a response to the increasing popularity of smaller gold investment options, enabling retail investors to access and diversify their portfolios more effectively. Jin Hennig, CME’s Global Head of Metals, has stated that this product will significantly lower the barriers to entry for novice investors, particularly as the demographic of their clientele is becoming younger and more tech-savvy. Anticipated to launch on January 13, 2025, and subject to regulatory approval, this contract complements CME’s existing retail-focused products, such as the 10-ounce micro gold futures and 1,000-ounce micro silver futures, which have seen substantial growth and trading activity this year.

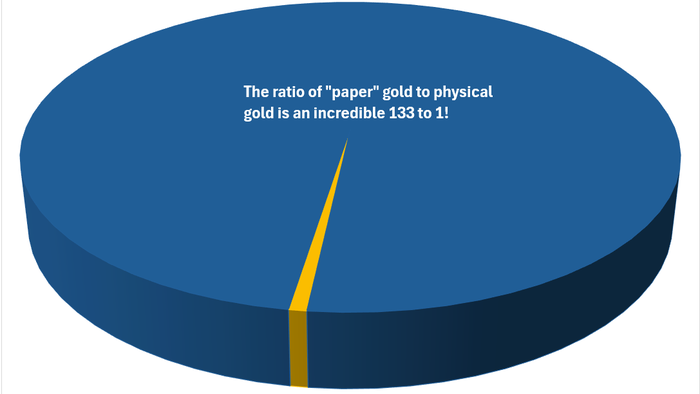

While the introduction of the one-ounce gold futures contract undeniably reflects a growing interest in precious metals and novel financial products, it raises several concerns regarding its cash-settled nature. Unlike physically-settled contracts, cash-settled futures do not allow traders to take physical possession of a one-ounce bullion bar or coin at expiration. This aspect may dissuade those investors who prefer the tangible ownership of gold. Furthermore, the absence of official backing by physical gold may render this contract another layer of “paper gold,” contributing to an already oversaturated market filled with futures, options, and exchange-traded funds. There is an alarming ratio of 133 ounces of paper gold for every ounce of physical gold currently in circulation, highlighting a precarious imbalance that could trigger market instability if a rush for physical gold were to occur.

The significant excess of paper gold over its physical counterpart raises serious risks, including the potential for a sharp price divergence between the two. The inherent advantages of owning physical gold—its simplicity and lack of counterparty risk—are somewhat undermined by the proliferation of derivative instruments. This concern aligns with the core tenets of Exter’s Pyramid, which illustrates that tangible assets occupy the most secure level of the financial stability hierarchy. In contrast, paper gold sits at the higher, more precarious levels, illustrating the risk that comes with such products. As such, the broader gold market’s architecture is affected, as the risk-laden nature of paper gold products could lead to financial turbulence should investors seek tangible assets amidst volatility.

Another pressing issue is the potential impact of the new one-ounce futures contract on demand for physical bullion. Analysts argue that the existence of numerous paper gold products weakens the market for physical gold, ultimately keeping its price lower than it might otherwise be. By making gold more accessible through the new futures contract, investors would need only a few hundred dollars in margin to control an equivalent stake in gold priced at $2,700. However, this increased accessibility threatens to divert potential investments from physical bullion, a concern echoed by industry experts outraged at the lack of a physical settlement option in this product.

Some industry figures have expressed disappointment that CME Group chose to offer a cash-settled contract instead of a physical one. Bob Coleman, the founder of Idaho Armored Vaults, emphasized that a physically settled contract could have reduced transaction costs and enhanced market transparency and liquidity, thereby benefiting participants in the physical bullion market. The move toward a cash-settled approach has led to speculation on platforms like X (formerly Twitter), where analyst Vince Lanci suggested that without proper physical backing, the futures product might actually reduce premiums on small gold bullion products, benefiting consumers at the expense of dealers’ profit margins.

Ultimately, while CME Group’s introduction of the one-ounce gold futures contract seeks to meet the needs of retail investors and create a more inclusive gold market, it also highlights critical challenges stemming from the pervasive influence of paper gold. This contract’s structure raises fundamental questions about market transparency, the ongoing demand for physical gold, and the overall stability of gold as a financial asset. As the landscape of gold investments continues evolving, it is vital to strike a balance between embracing innovative financial products and maintaining the intrinsic value associated with tangible assets like physical gold. Establishing this equilibrium will be crucial for preserving the long-term stability and integrity of the gold market, ensuring that the pursuit of financial innovation does not come at the expense of secure and reliable investment options.