In recent economic discussions, a notable shift in the data landscape has emerged, altering the prognosis for U.S. economic growth. Following the Federal Reserve’s decision to cut policy rates on September 18, many analysts raised concerns about a slowdown in job creation, weak income growth, and declining consumer savings. However, as new data and significant revisions to previous figures were released shortly after the Fed’s meeting, the outlook began to look considerably more favorable. Updated figures for GDP growth showed an unexpected surge, with three of the last four quarters outperforming the 10-year average. This notable change in economic growth, catalyzed by upward revisions in consumer income and savings, brought to light the resilience of consumer spending, a critical driver of the U.S. economy.

Several notable adjustments in economic metrics were released a short time after the Fed’s rate cut, raising optimism about growth. The Q3 2023 GDP growth estimate was reported as 4.4%, with consumer spending contributing 2.2 percentage points and nonresidential fixed investment adding another 0.9 percentage points. Further bolstering this positive sentiment, the aftermath of natural disasters in affected regions adds a layer of complexity, with temporary spikes in unemployment likely to be followed by spending and investment booms due to rebuilding efforts. As data flows in, the economic narrative surrounding recovery from these disruptions remains cautiously optimistic, underscoring the vital role of resilience in the face of adversity.

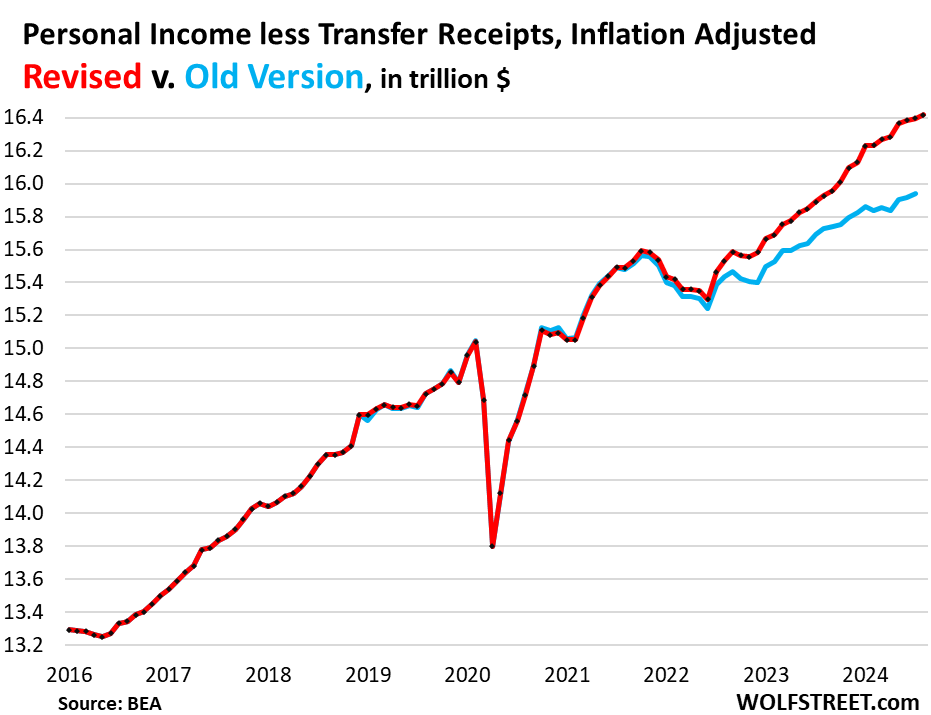

The substantial upward revisions in consumer income and the savings rate helped clarify why consumer spending appeared more robust than expected, resolving prior uncertainties. The consumer savings rate, initially reported at just 2.9% for July 2023, was revised to an encouraging 4.9%. This development indicates that consumers were spending significantly less than they earned over the past two years, accumulating savings that could enhance future consumption. Alongside this, cash holdings across various financial products, such as money market funds and CDs, have surged, reflecting a healthier financial condition among households than previously believed. These adjustments illustrate a more favorable financial landscape, with consumers poised to sustain spending despite the initially troubling economic indicators.

The labor market data, which had signaled a downturn just before the Fed’s interest rate decision, underwent an overhaul following more recent reports. Initial worries about deteriorating employment figures were mitigated by revisions that showed stronger than anticipated job gains and wage growth. The revisions also clarified the reasons behind discrepancies in employment metrics. Notably, accelerated wage growth could signal emerging inflationary pressures, which the Federal Reserve has been monitoring closely. As wages rise, core inflation metrics, such as the core Consumer Price Index (CPI), have begun to ascend, raising concerns that the trajectory of inflation could disrupt the efforts made to tame it in recent years.

Despite some sectors showing indicators of economic strain, such as commercial real estate, the overall economic landscape displayed signs of vitality fueled by investment activities within burgeoning sectors such as artificial intelligence. The optimism surrounding AI has led to a wave of startup investments, hiring, and hefty corporate spending, illustrating that while some areas languish under high interest rates, others are thriving. The disparity in economic performance across sectors suggests that while certain industries are grappling with a tightening financial climate, others are benefiting from increased capital inflows and demand, thereby complicating the Fed’s assessment of the broader economic environment.

As the Fed navigates this complex economic terrain, it remains acutely aware of inflationary threats. The mix of positive revisions in growth data alongside the potential for accelerating inflation places the Federal Reserve in a precarious position as it contemplates future interest rate decisions. If inflation trends toward sustained acceleration, it could necessitate a pause on rate cuts or even a return to hiking rates to maintain control. While the media may proclaim a victory over inflation, the Fed understands this situation is far from resolved. The negotiations around interest rates will resume soon enough, and as data continues to flow in, the Fed’s approach will likely remain responsive to evolving economic realities, with attention keenly focused on the interplay between growth and inflation.