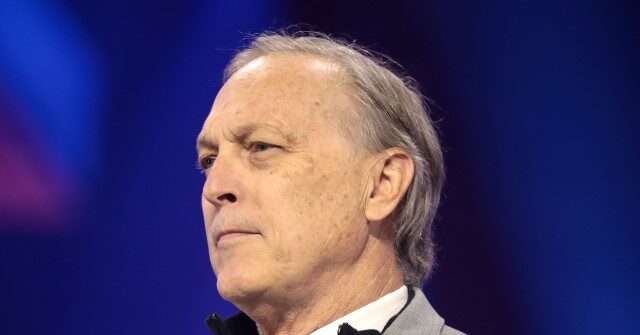

Rep. Andy Biggs from Arizona has recently introduced a pivotal piece of legislation known as the Stop Woke Investing Act, aimed at safeguarding American investments from the perceived overreach of “woke” policies propagated by the Biden administration. This legislation seeks to counteract the influence of Environmental, Social, and Governance (ESG) policies enforced by the Securities and Exchange Commission (SEC), aiming to limit the agency’s role in promoting agendas that Biggs argues do not align with the financial best interests of businesses and their stakeholders. Biggs emphasizes the need for Congress to combat what he views as the weaponization of the government against American businesses and ordinary citizens, highlighting the pressure that woke activists can place on private companies.

The SEC holds substantial power over how public companies present their shareholder ballots, including the ability to dictate what issues must be included or excluded from these ballots. In response to this authority, the SEC issued a bulletin in November 2021 that created a “significant social policy exception,” which essentially mandates that businesses address social issues that are often far removed from their financial operations. Biggs’ proposed legislation aims to counter this by requiring that shareholder ballots be strictly related to the financial and operational aspects of companies, thereby reducing the influence of non-financial social agendas that he believes detract from corporate responsibilities and priorities.

The emergence of ESG investing has been marked by varying opinions. While this approach has been used by large financial firms to encourage companies to adopt leftist positions on topics like climate change, diversity, and racial justice, it has also been met with mounting opposition. Critics have pointed out that ESG funds often underperform compared to traditional funds while demanding higher fees. Moreover, there are concerns that these funds may not deliver meaningful benefits regarding environmental or labor conditions. Biggs’ legislation is designed to curb this trend, emphasizing the need for financial prudence over social considerations in corporate governance.

The Stop Woke Investing Act aligns with a similar bill introduced in the Senate by Sen. Eric Schmitt from Missouri, reflecting a broader Republican strategy to challenge the prevailing influence of woke policies in corporate America. Schmitt has echoed Biggs’ sentiments, insisting that woke activism detracts from the economic duties of companies and should have no role in corporate governance. Through these legislative efforts, both lawmakers aim to refocus companies on their primary objectives: maximizing financial returns for their customers and shareholders, rather than conforming to perceived social or political obligations.

Notably, Rep. Biggs has been active in promoting this legislation even during the Congressional recess, indicating his commitment to this cause and setting a tone for future legislative initiatives as Republicans aim to retain control of the House and potentially seize the Senate. This proactive approach not only signifies the importance of the issue in the current political climate but also reflects a strategic move to lay the groundwork for further actions once Congress reconvenes.

As discussions surrounding this legislation unfold, there are speculations about the potential impact of future political changes, including a possible return of Donald Trump to the White House. Trump has indicated a willingness to roll back the harmful SEC regulations that have been perceived as restrictive on corporate freedom. Overall, the Stop Woke Investing Act represents a significant effort by Republican lawmakers to reclaim what they view as the primacy of financial performance in business, counteracting what they see as a detrimental influence of “woke” activism within American corporate culture.