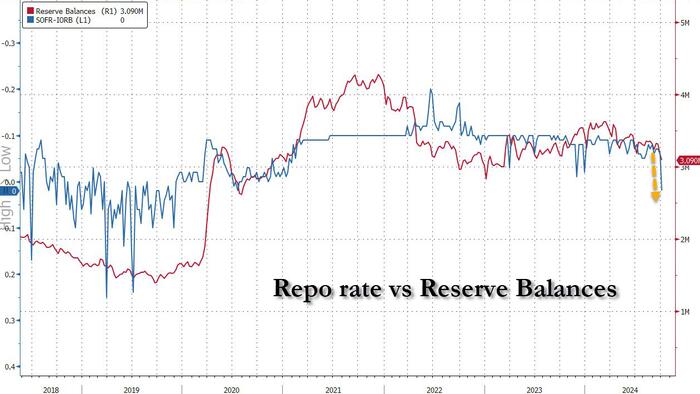

In early October, a concerning situation in the U.S. financial system was highlighted, specifically regarding the Federal Reserve’s repo rate corridor. This corridor acts as a crucial anchor for overnight lending rates, which are essential for the stability and functioning of the financial system. A significant disturbance occurred when General Collateral (GC) rates surged nearly 40 basis points above the reverse repo facility rate. This facility is meant to serve as the upper limit for a variety of overnight rates. However, the snapshot of the financial environment demonstrates serious instability, particularly at critical financial junctures like month-end and quarter-end.

During these month-end and quarter-end periods, banks often engage in activities to enhance their balance sheets by aggressively seeking additional liquidity. This practice, known as “window dressing,” exposes vulnerabilities in the liquidity landscape. The September 30 end-of-quarter period particularly highlighted the fragility of the financial system when banks attempted to maximize the liquidity on their books. The situation underscores a notable disconnection between market rates and the official measures set by the Federal Reserve.

On October 1, 2024, a chart was shared on social media illustrating the severity of the issue, depicting a stark reality where the liquidity dynamics were out of balance. The term “naked” was aptly employed, indicating that the system was devoid of the necessary liquidity to effectively support the banking infrastructure. This visual representation helped emphasize how reliance on the Fed’s influence could turn precarious under stress, revealing the underlying flaws in liquidity management strategies.

The Fed’s reverse repo facility is designed to control short-term interest rates by providing a safe place for banks and financial institutions to park their excess reserves. When rates deviate significantly from the intended corridor, as was observed in the recent spike in General Collateral rates, it signals a disconnect in the intended functioning of monetary policy. The reliance on this mechanism is supposed to ensure liquidity and stability, but when market demands overwhelm these safeguards, it can lead to chaotic conditions in the financial markets.

This incident serves as a warning about the broader implications of liquidity management in the face of heightened demand for cash. The circumstances raised serious questions about the resilience of the system and the ability of the Federal Reserve to maintain control over short-term interest rates amidst banking pressures. The implications of this disturbance could ripple through the financial system, affecting everything from borrowing costs to overall economic stability.

In conclusion, the recent turmoil surrounding the Fed’s repo rate corridor is indicative of more profound systemic issues within the U.S. financial system. The failure of liquidity management practices during critical periods signals potential risks to economic stability and raises important discussions about the efficacy of current monetary policy tools. As market participants continue to navigate these challenges, the need for more robust solutions to maintain liquidity and prevent future instability becomes increasingly urgent. The circumstances surrounding the end of September have revealed cracks in the financial foundation and necessitate a reevaluation of strategies aimed at safeguarding the banking system and broader economy.