Air France-KLM is intensifying its lobbying efforts with the French government to impose restrictions on the number of flights that Chinese airlines can operate to Europe. Sources familiar with the matter, who requested anonymity, noted that the airline group is advocating for a suspension of the existing air traffic rights between France and China, as part of a broader attempt to shield European carriers from what they perceive as unfair competition. This move is reflective of growing concerns within the European airline industry over the surge of services from mainland China, which are reportedly benefitting from lower operational costs and strategic routing through Russian airspace—an avenue European airlines have eschewed since the Ukraine conflict began in early 2022.

The competitive landscape is further complicated by differing strategic approaches among European airlines. Deutsche Lufthansa AG is pressing the German government to tackle the perceived imbalance created by Chinese carriers, emphasizing a need for action to level the playing field in air travel. Lufthansa has already announced plans to reduce its services to China, including the discontinuation of its direct flight from Frankfurt to Beijing due to escalating operational costs. The airline’s CEO highlighted that Chinese airlines leverage significant operational advantages, such as avoiding European emissions trading system costs and shorter flight times, compounding the challenges for their European counterparts.

The tensions between European airlines and Chinese carriers are part of a broader context of deteriorating trade relations between the EU and China. The EU has initiated measures targeting what it sees as unfair state support for Chinese companies. This includes imposing tariffs on certain Chinese goods, such as electric vehicles, amid fears that such subsidies provide an unlevel playing field in international markets. Leaders within the airline industry, such as KLM’s CEO, have echoed calls for EU intervention to address perceived inequalities in competition, arguing for a reevaluation of the current operational landscape.

Flight dynamics in the European and Chinese markets are significantly swayed by geopolitical events, most notably the Ukraine war, which has resulted in the closure of Ukrainian airspace and prevented European carriers from flying over Russia. Consequently, Chinese airlines, which have not stopped utilizing these routes, continue to capture a significant share of air traffic, resulting in a cost and operational advantage. This trend mirrors responses during the COVID-19 pandemic when the U.S. government imposed limitations on Chinese carrier flights as domestic airlines faced operational restrictions.

The financial toll on European airlines is substantial. Lufthansa has projected losses of around half a million euros per flight on its route to Beijing. In stark contrast, state-supported Chinese airlines have reportedly received an influx of funding, totaling approximately $15.7 billion in subsidies aimed at bolstering their international routes. This disparity in support further exacerbates the competitive challenges facing European carriers, which are finding it increasingly difficult to restore services to pre-pandemic levels.

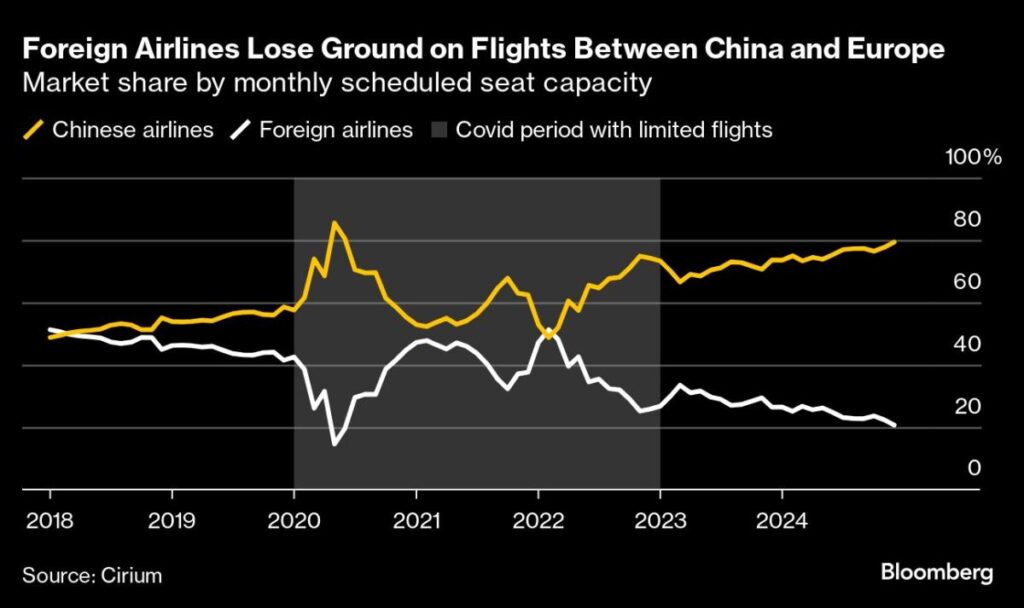

Looking forward, the operating environment for European airlines remains precarious. Data from aviation firms forecasts that by the end of the year, Chinese airlines could account for up to 75% of seat capacity for flights between Germany and France to China, and they are expected to monopolize the market share on routes to Italy and nearly dominate flights to the UK. This evolving competitive dynamic highlights the urgent need for coordinated responses among European airlines and possibly new regulatory interventions from the EU to secure a more equitable framework for international air travel.