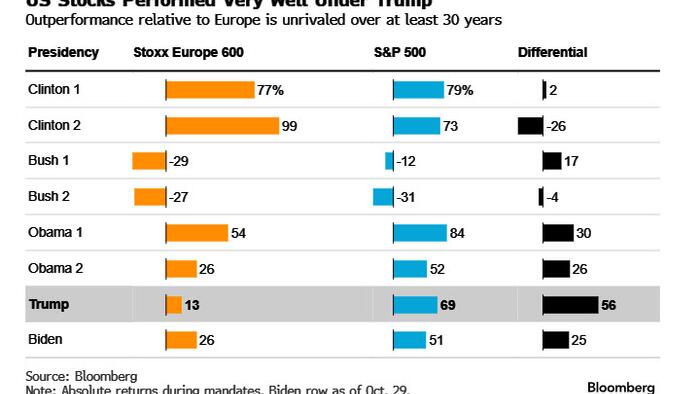

European investors are increasingly cautious as they anticipate a potential victory for Donald Trump in the upcoming U.S. presidential election. Observers recall the market’s reaction during Trump’s previous administration, which saw European equities sharply underperform relative to their U.S. counterparts. This underperformance was the most pronounced among recent presidencies, highlighting the far-reaching effects that U.S. political dynamics can have on global markets, particularly those in Europe. Investors are particularly concerned about Trump’s stance on trade and the potential for protectionist policies that could negatively impact relations with key partners, notably the European Union.

One of the main fears surrounding a Trump presidency is the potential for heightened trade tensions between the U.S. and Europe. This concern is exacerbated by the fact that many European firms rely heavily on exporting goods and services to the U.S. In fact, data indicates that around 40% of sales generated by companies in the Stoxx 600, a benchmark index for European equities, come from domestic sources, emphasizing the importance of international markets for these businesses. A president who adopts a more isolationist approach could jeopardize these crucial export relationships, creating uncertainty and volatility in European markets.

Additionally, the ripple effects of potential U.S. protectionism could lead to market instability, further impacting investor confidence and equity valuations in Europe. Previous experiences have already shown that Trump’s trade policies, specifically tariffs and other trade barriers, can disrupt global supply chains and affect the profitability of multinational companies that are reliant on free trade. Such policies could lead to a retraction in economic growth not just in the U.S. but also in Europe, where many companies have substantial interests in American markets.

In anticipation of these risks, investors are reviewing their portfolios and may consider reallocating investments to mitigate exposure to potential downturns. This could involve shifting capital towards sectors or assets that are less sensitive to trade dynamics, as well as into industries that may benefit from a more nationalist economic stance. However, finding safe havens in this environment poses its own challenges, as global uncertainties often lead to market-wide volatility.

The geopolitical ramifications of a Trump win extend beyond trade policies and economic impacts. Investor sentiment could also shift regarding Europe’s regulatory framework and its own economic stability. European policymakers may need to adapt to a changing international landscape and reevaluate their trade strategies. Strong coordination and contingency planning may become necessities as European companies brace for unpredictable policies emanating from Washington.

Ultimately, Europe finds itself at a crossroads, navigating the complexities of a potential Trump presidency that could alter the existing economic ties and regulatory environment. Investors are tasked with balancing the challenges brought about by this scenario while remaining vigilant to global market trends and developments. Adapting investment strategies accordingly will be crucial as Europe prepares to face the uncertainties associated with political shifts in the United States.