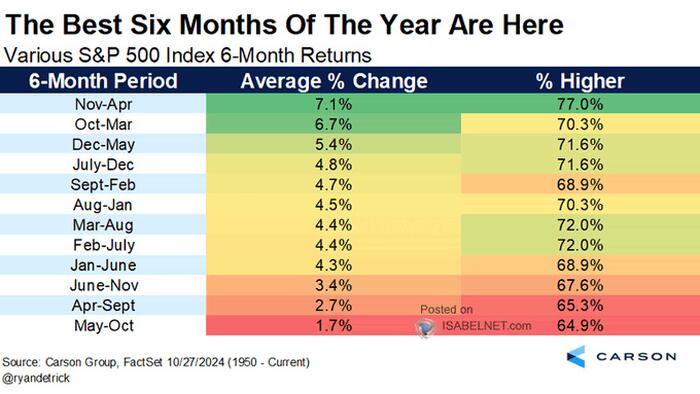

In November 2024, the market landscape presents a mixed but promising opportunity for traders and investors, shaped largely by the recent Federal Reserve rate cuts and prevailing global uncertainties. Historically, November marks a transitional period for the stock market, known for its strong seasonal trends leading into a year-end rally, often referred to as the “Santa Claus Rally.” Data shows that from November through April, stocks yield the highest percentage returns, bolstered by bullish signals from technical indicators like the weekly MACD. This seasonality is further supported by a resurgence of corporate share buybacks, injecting substantial capital into the market. While these trends forecast positive momentum, a short-term correction remains possible, highlighting the need for cautious strategy adjustments.

The cyclical sectors of technology and industrials are emerging as strong performers as interest rates decline. Large-cap tech stocks, especially the “Magnificent 7,” have remained resilient, and institutional interest in the technology sector suggests potential for a significant uptick in the Nasdaq index as hedge funds position themselves to catch up with performance. Simultaneously, the industrial and materials sectors are showing signs of upward movement, driven by anticipations surrounding a favorable presidential election that might lead to improved economic conditions and domestic growth. This environment could enhance employment rates and wage growth, motivating greater investments in technology and leading to increased loan demands, which together create a positive feedback loop in these sectors.

However, amid this optimism, the Volatility Index (VIX) has begun to rise, revealing underlying apprehension in the market. Typically, a decline in the VIX accompanies rising equity prices, but current disparities between the VIX and the S&P 500 suggest a degree of caution as investors hedge against potential volatility stemming from anticipated electoral outcomes. While this divergence isn’t immediately alarming, it prompts vigilance for possible market reversals or spikes in volatility as the election approaches. Should the electoral situation unfold as expected, the reversal of volatility hedges could inject further momentum into the equity markets toward the year-end.

Additional market indicators, including the Relative Strength Index (RSI) and MACD, present mixed signals. Although the market remains bullish and above key moving averages, negative divergences suggest that short to medium-term corrective actions could be on the horizon. Investors risk reacting prematurely to these indicators, either by fearing steep corrections or by making hasty, emotion-driven decisions. Typically, these corrections find support at moving averages like the 20 and 50-day DMAs, although deeper pullbacks could reach the longer-term 100 or 200-DMA levels, emphasizing the necessity to stay disciplined during periods of market uncertainty.

Navigating the complexities of the current market environment involves recognizing macroeconomic challenges alongside the external geopolitical landscape. With the Fed’s accommodating stance likely supporting equities, upcoming elections add layers of volatility that investors must prepare for. Strategies may include increasing exposure to sectors historically benefiting in this timeframe, such as large-cap equities, and reassessing portfolio risks in light of prevailing market conditions. Investors should contemplate rebalancing their allocations to manage potential downside risks while considering tactical stop-loss orders to safeguard against adverse shifts.

Ultimately, effective market navigation hinges on the principle of disciplined decision-making rather than attempting to time the market perfectly. Investors need to be comfortable with the notion that some stocks may have reached a point where taking profits is prudent, especially as earnings reports from major corporations roll in. Maintaining composure, following established risk management principles, and being strategically agile will equip investors to weather volatility, capitalize on opportunities, and secure long-term gains without succumbing to the pressures of short-term market fluctuations.