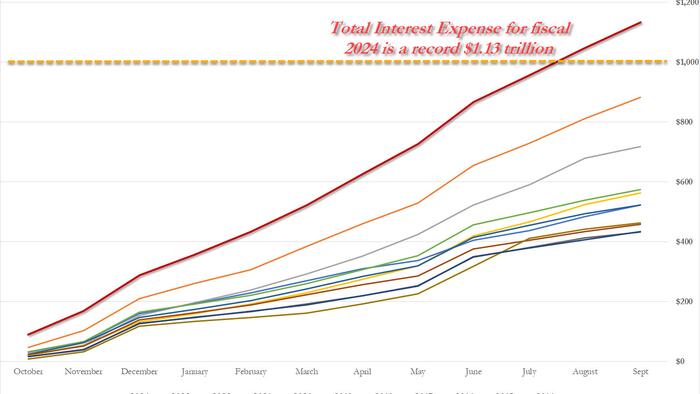

In 2024, the narrative surrounding the U.S. budget deficit was expected to shift towards moderation, following two tumultuous years characterized by unprecedented spending. The anticipation was that after a phase of fiscal extravagance, often likened to “drunken sailor” spending, there would be a period of gradually normalizing the budget deficit. The prior years had seen staggering levels of indebtedness, particularly in 2021 and 2022 when the deficit surged to an alarming 18% of GDP. As 2024 unfolded, initial signs indicated a glimmer of stability, but the situation continued to evolve in unexpected ways.

Early in 2024, the cumulative U.S. deficit appeared to surpass that of 2023, raising concerns about fiscal responsibility. The echoes of the previous two years loomed large, creating uncertainty in the economic landscape. It seemed as if the efforts to reel in spending might be falling short. However, as the year progressed into the middle months, there were indications of a gradual easing of the deficit, sparking cautious optimism among analysts and policymakers alike. This brief reprieve suggested that there might be a path forward toward a more sustainable fiscal future.

Despite the fleeting period of improvement, the U.S. budget deficit again took a turn, outpacing the figures from 2023 by August. Policymakers were faced with the challenge of addressing this reversal amid ongoing debates about necessary fiscal reforms and spending cuts. The August spike in the deficit illustrated the complex interplay of economic variables at work, including inflation, interest rates, and government spending priorities. This inconsistency in progress raised questions about the effectiveness of existing policies aimed at curbing the deficit and sparked renewed discussions about the need for comprehensive reforms.

As September approached, the situation saw a slight contraction in the deficit, allowing for a minor retreat from the fiscal cliff. This modest reduction in September provided a temporary sense of relief, yet left many economists skeptical about the sustainability of such trends. The pattern of oscillating deficits highlighted the underlying structural issues within the U.S. economy, underscoring the challenge of achieving lasting fiscal stability. The experts pointed out that short-term improvements could easily be undone if less favorable economic conditions arose or if spending practices did not change.

The dialogue surrounding fiscal policy throughout 2024 was marked by polarized views. Advocates for more aggressive spending pointed to the need for investment in critical infrastructure and social programs as a means to stimulate the economy and address systemic issues. Conversely, fiscal conservatives warned against continued deficit spending, arguing that it jeopardized long-term economic stability and burdened future generations with debt. This rift in perspectives further complicated the policy landscape, making it difficult to reach consensus on a viable path forward.

Ultimately, as the fiscal year concluded, the trends observed throughout 2024 illustrated the persistent difficulties associated with managing the U.S. budget deficit. While there were moments of reprieve, the overarching narrative remained one of uncertainty and complexity. The year brought attention to the necessity for lasting fiscal reforms that could address not only the symptoms of the deficit but also its root causes. As policymakers and economists prepared for the future, the lessons learned from 2024 served as a crucial reminder of the challenges faced in balancing economic growth with fiscal responsibility.